A recent survey of rental housing providers by the National Multifamily Housing Council found that rental application, financial and identity fraud are increasing throughout the nation, fueled by social media platforms that sell fraudulent rental application docs and/or post videos that demonstrate how to commit these crimes. Results from the survey have revealed staggering increases of fraud contributing to both the growth in rents and the number of evictions, said the NMHC.

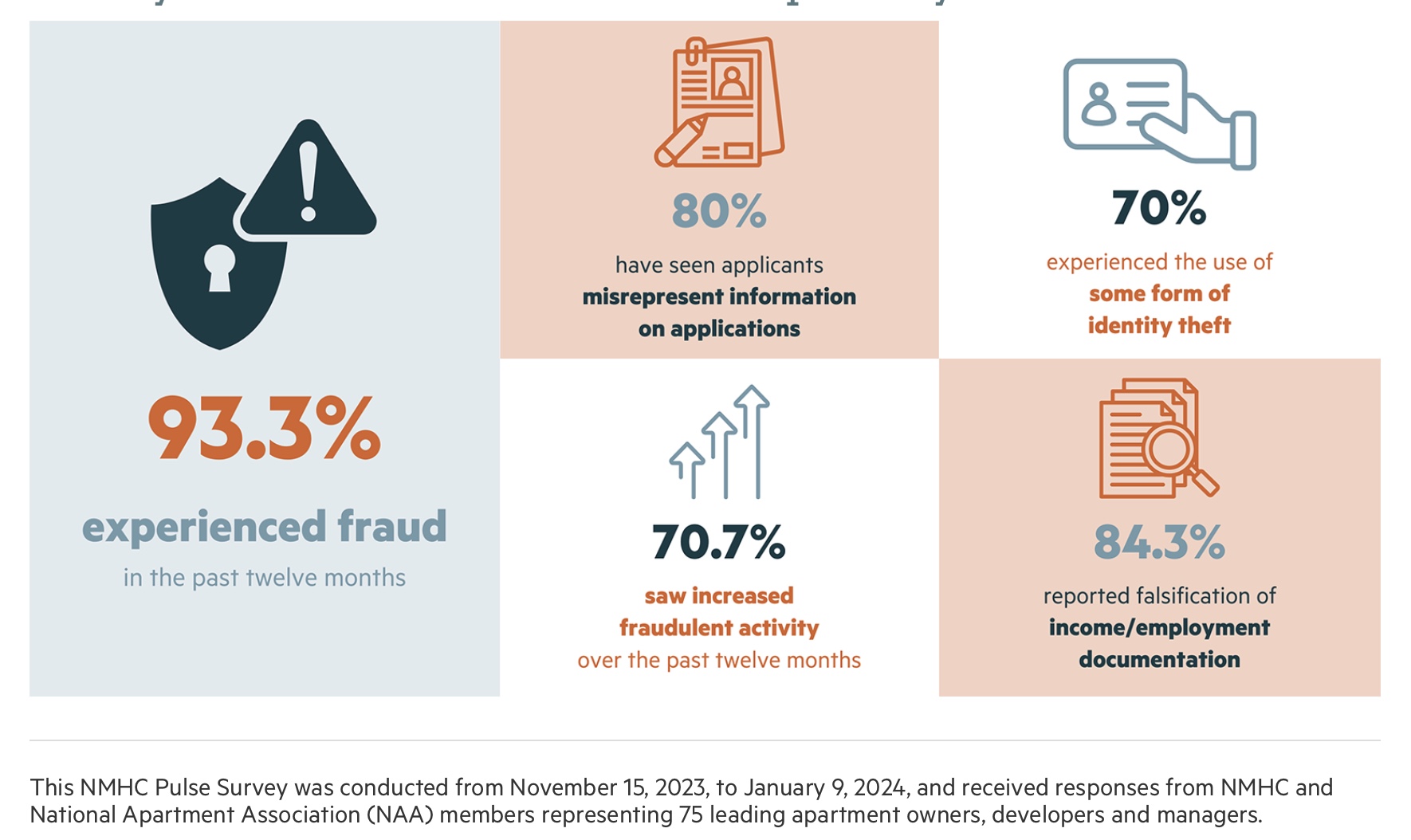

Nearly all survey respondents (93.3 percent) reported experiencing fraud in the past twelve months, while 70.7 percent reported an increase in fraudulent applications and payments, utilizing fraudulent documentation, financial statements and even identities over the same period.

Moreover, those who observed an increase in fraudulent applications and payments reported a 40.4 percent average increase year-over-year.

One of the survey’s most notable findings was the share of evictions tied to fraudulent applications. Nearly a quarter of respondents’ eviction filings were linked to fraudulent applications and related failure to pay rent over the past three years, leading to higher costs for rental housing providers and rent increases for those they house.

Seventy-three percent of respondents reported that at least some of the nonpayment of rent they recorded over the past three years could be attributed to the eviction moratorium during the pandemic.

The average respondent was required to write off nearly $4.2 million in bad debt over the past 12 months.

Of those who experienced fraud:

- 84.3% have seen applicants falsifying or fabricating pay stubs, employment references or other income documentation;

- 80.0% observed prospective renters misrepresenting information on applications;

- 70.0% reported identity theft, fraudulent ID documents or use of another individual’s personal information;

- 67.1% experienced unauthorized cohabitants, illegal subletting or other actions to evade application or the leasing process; and

- 62.9% of respondents reported the use of fraudulent checks or other payment methods.

Nearly half of respondents reported the greatest share of fraudulent rental activity is centered in Atlanta and markets in Texas and Florida.

While the FBI and the Federal Trade Commission have issued warnings to consumers of rental scam ads, landlords complain that lawmakers have done too little to combat the staggering rise in rental fraud.

“The NMHC calls on lawmakers and courts to take action that will address this problem,” said NMHC President Sharon Wilson Géno on behalf of constituents.

Last summer, it was reported that even Ric Campo, CEO of apartment REIT Camden Property Trust had his identity stolen and used to rent an apartment from a Camden competitor, destroying his credit score.

“While most renters are honest, those who are not are causing the cost of rental housing to increase for everyone. Additional delays in many jurisdictions in the lease enforcement process, even when there is clear fraud, incentivizes bad actors and means that this illegal behavior costs responsible renters even more,” Geno said.