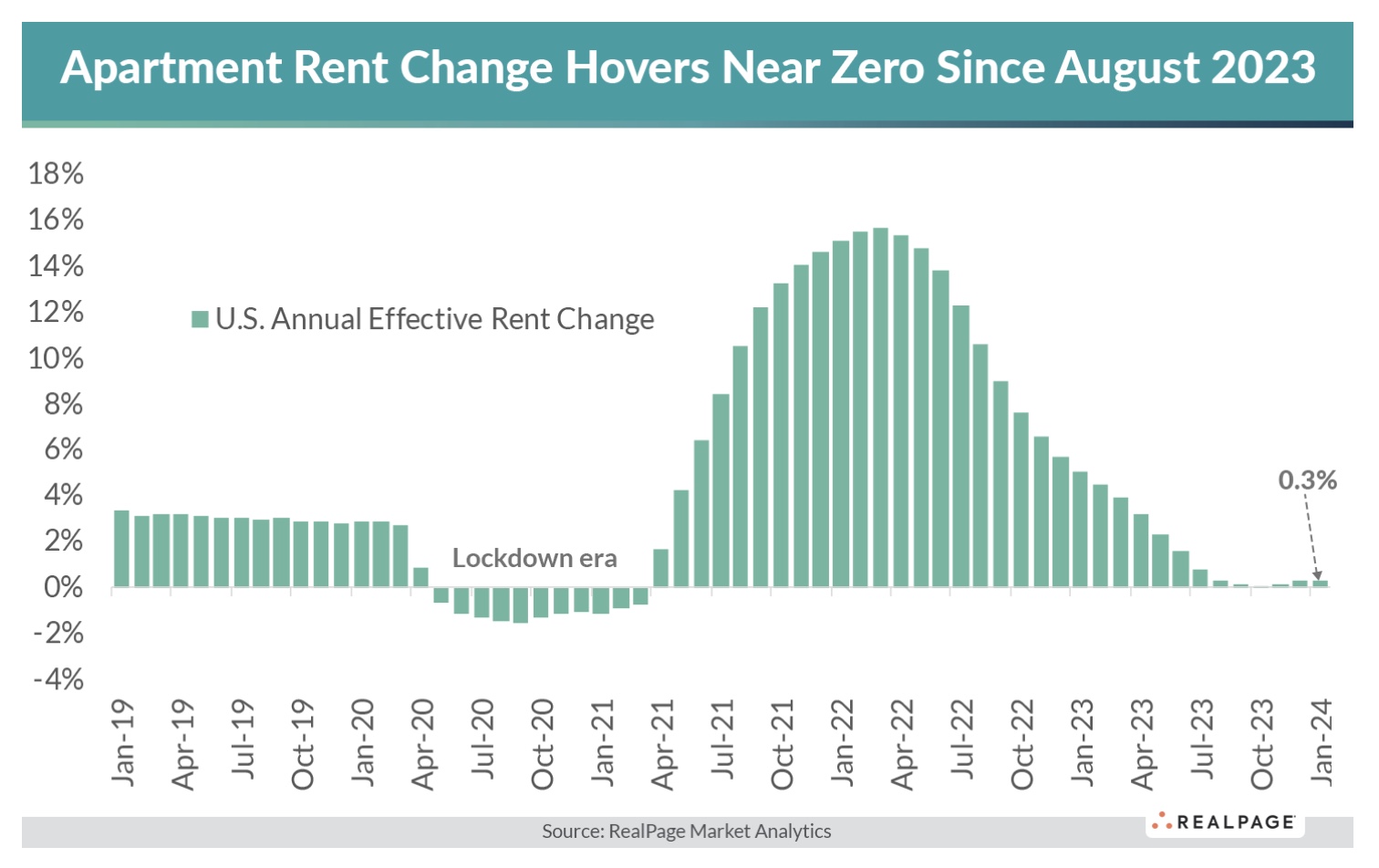

Apartment rent growth is expected to remain stagnant near zero this year, just as it has since August 2023, according to RealPage Analytics.

RealPage SVP and Chief Economist Jay Parsons explained that demand is helping to stabilize declining rent growth, while supply continues to grow.

In high-construction apartment markets across the Sun Belt and Mountain regions, rents through January 2024 continued to fall, but at a stabilizing rate due to continued robust demand, though still somewhat lacking supply. This, said Parsons, has kept the national average for year-over-year effective rent change near zero for a sixth consecutive month.

RealPage Analytics sees this as an indication that rent deceleration is leveling off, but re-acceleration is unlikely this year.

That things are not getting worse could be a silver lining for multifamily this year, said Parsons.

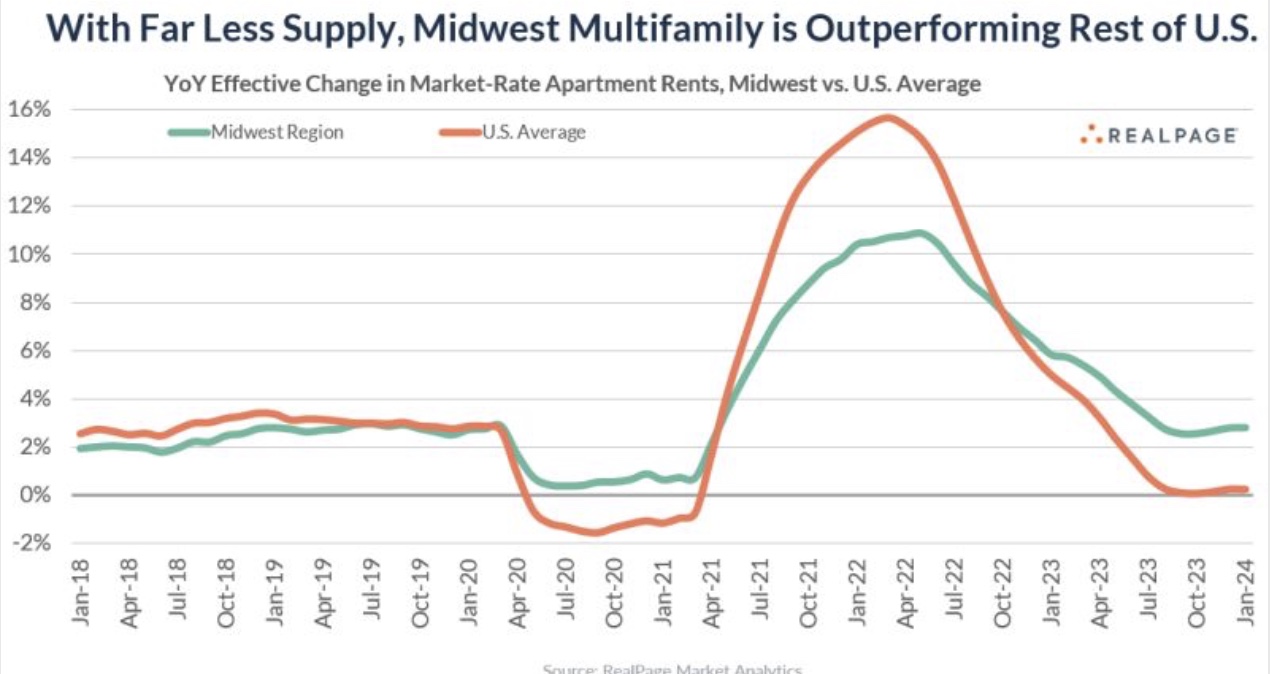

He also sees a tortoise and hare story unfolding. “National rents remain slightly positive only because of consistent strength in the low-supplied Midwest and Northeast regions, with rents rising two to five percent year over year across most of those markets,” he said.

This is the tortoise (the typically underperforming Midwest markets) beating out the hare (the typically higher performing coastal and Sunbelt markets), a surprising trend many expect to continue through 2024.

“The Midwest will rarely, if ever, outperform in a strong market. But in a period of volatility, there’s value in the ‘steady Eddie.’ While most of the country, including the West Coast, will wrestle with multi-decade highs in apartment supply, the Midwest is only seeing a blip,” said Parsons.

Here’s how the Midwest stacks up against the rest of the country right now:

Apartment occupancy: 50 basis points ABOVE the U.S. average.

Year-over-year rent growth: 280 basis points ABOVE the U.S. average.

Resident retention: 240 basis points ABOVE the U.S. average.

Apartment construction: 220 basis points BELOW the U.S. average.

Total apartment construction in 2023 in the Midwest amounted to just 2.8 percent inventory expansion, the lowest of all regions, compared to the national average of five percent, the highest since the 1980s.

Midwest diversification

Based on 2023/2024 trends, Parsons suggests it may be time for national multifamily investors to add Midwest acquisitions to their portfolios, for purposes of diversification.

While the Midwest may lag in terms of employment growth, when it comes to supply relative to demand, the market is beating out other regions that may have more net new demand, but a lot more supply.

While institutions may fault the Midwest because it is difficult to scale and less liquid than other markets, said Parsons, he thinks liquidity fears are overstated and scalability can be easily overcome.

“It wasn’t that long ago when some institutions worried about the Sun Belt liquidity, too.

Long term, the Midwest is unlikely to remain an outperformer, but it may be the safest bet for a low-beta multifamily investment. And that has value, too,” he said.