A new report from Yardi Matrix examines the changes in the number of multifamily starts and the sorts of developments started over the last 10 years. It takes a broad view of multifamily housing to include market rate, affordable, single-family rental, senior and student housing.

Market rate segment grows but loses share

The report cautions that there is a lag in collecting the starts data so the results for 2023 are not yet complete. When the final data are in, the falloff in multifamily starts for 2023 is likely to be less than the current data show. When compared to the number of starts in the first three quarters of 2022, the number of starts in the first three quarters of 2023 is off by 11.6 percent.

The new report differs from the Census Bureau’s monthly report on residential construction in that the Census Bureau does not separate out starts intended for single-family rentals from other single-family starts.

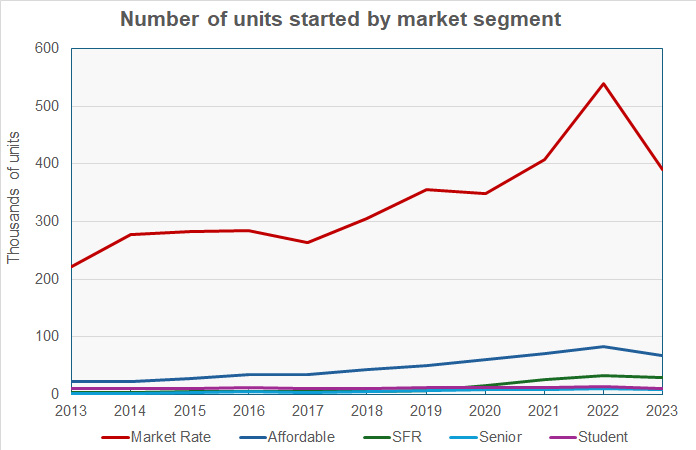

Yardi Matrix found that total number of multifamily units started rose from 258,591 in 2013 to a peak level of 539,263 in 2022. The current count for 2023 is 390,369 units, but this will likely be revised higher as additional data come in.

The first chart shows the history of the number of multifamily units started by year. In this view, market rate units dominate the market.

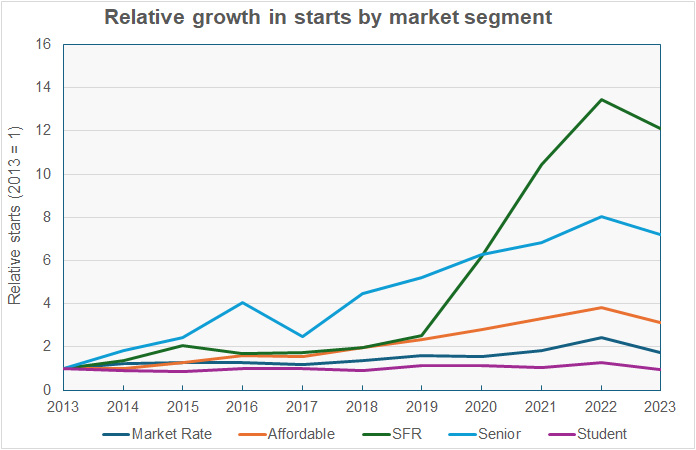

The next chart shows the relative growth in different segments of the market compared to their numbers of starts in 2013.

This chart makes clear that, while multifamily starts in the market rate segment more than doubled between 2013 and 2022, its relative growth has been eclipsed by that of other market segments. The standout on this basis is single-family rentals which started from a very low volume of starts in 2013 but grew to over 13 times that number by 2022 with most of the growth occurring after 2019. The number of senior housing starts has also seen high relative growth with starts in 2022 rising to 8 times the starts number in 2013.

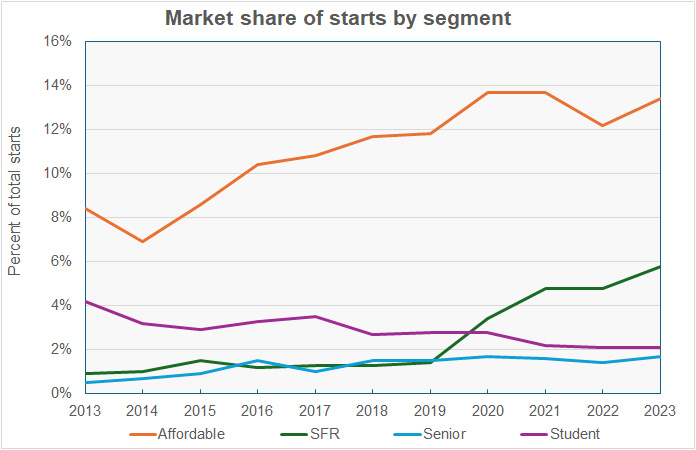

The next chart shows the share of unit starts for the different market segments over the last 10 years. The market rate segment was left off this chart since its share is what is left over after the shares of the market segments illustrated are added up. However, for the record, the share of multifamily starts for the market rate segment was 86 percent in 2013 and fell to 77 percent in 2023.

The chart shows that the share of starts in the affordable market segment has exhibited relatively steady growth since 2013. The single-family rental segment has gained significant market share, but its growth has largely occurred in the post-pandemic period after 2019. Senior housing has also gained market share while student housing has seen its share slide although the actual number of student housing units started per year has risen slightly.

Regional shifts in growth in starts

The report notes that many of the geographic markets that saw surges in multifamily starts post-pandemic saw sometimes dramatic drops in construction starts in 2023. Of the 22 markets that accounted for nearly half of 2022’s starts, only 4 did not see starts fall through Q3 2023. Remarkably, 3 of those markets saw starts rise by 48 percent or more. They were Dallas-North (up 48.3 percent), Raleigh-Durham (up 48.7 percent) and Tampa-St. Petersburg (up 62.5 percent).

Markets whose construction activity was at or below pre-pandemic levels through 2022 were better able to sustain their numbers of starts in 2023. Yardi Matrix identified 66 markets where starts rose in the first 3 quarters of 2023, some significantly. Examples are Boston, where starts rose 35.1 percent, and Kansas City, where starts rose 41.6 percent.

Looking ahead

Yardi Matrix expects that construction starts will continue to fall in 2024. However, the current robust construction pipeline will keep the level of completions high through early 2025. The report expects that the low point in completions will not arrive until 2026.

The full report from Yardi Matrix can be found here.