Yardi Matrix reports strong student housing preleasing in its most recent Yardi Matrix National Student Housing Report.

The off-campus student housing sector continues to post solid fundamentals, beating out last year’s preleasing rate in January, while rent growth in the sector has decelerated in recent months, according to the report.

Yardi Matrix reported in February that preleasing rates rose to all-time highs in January among the 200 markets the company tracks, while rent gains fell from last year’s autumnal preleasing season.

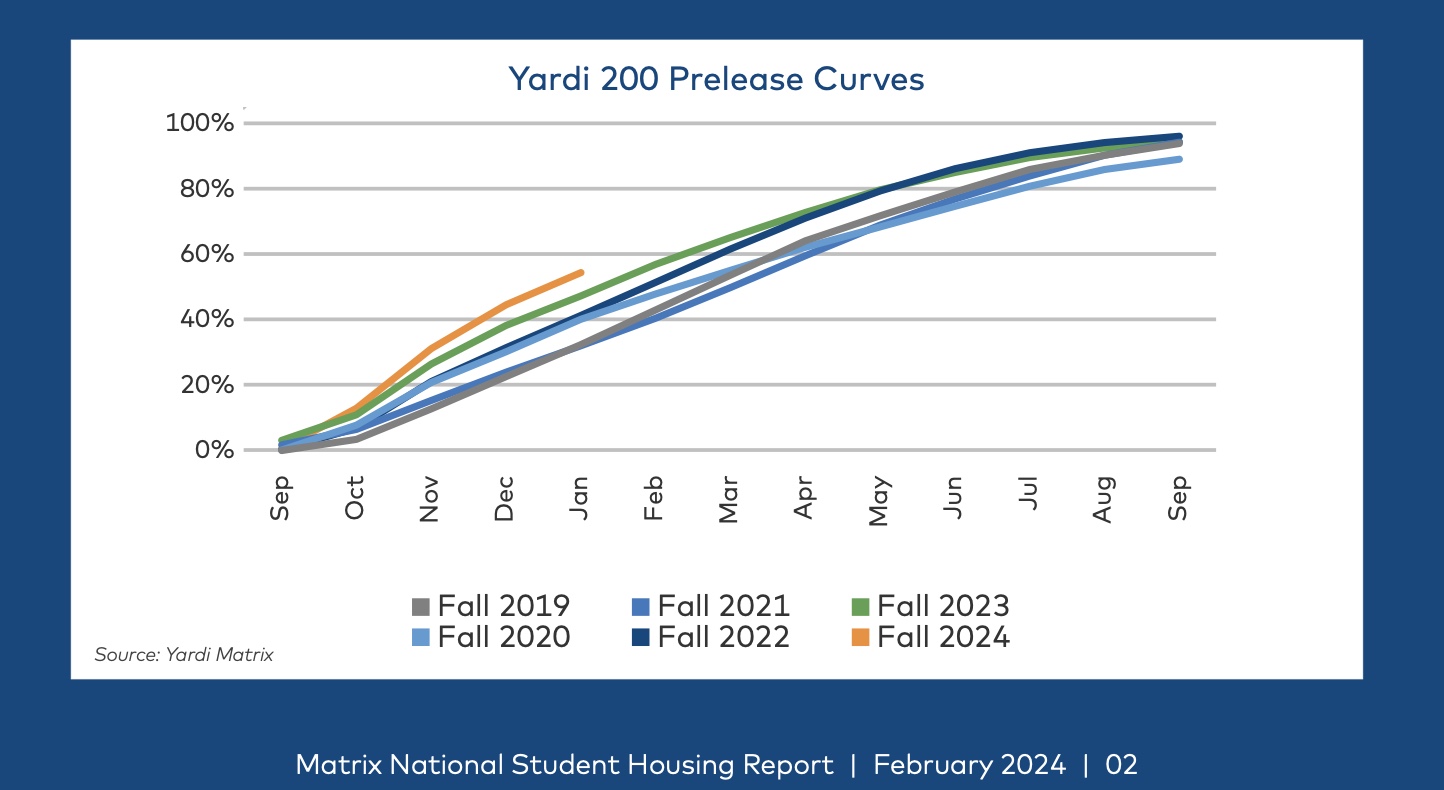

Preleasing of student housing beds for the 2023-2025 year hit 54.5 percent in January, 7.1 percent ahead of last year and more than 15 percent above the five-year average—marking a 710-basis-point increase year over year.

Operators have started preleasing earlier each year, as supply has failed to keep up with increased demand due to strong enrollment growth.

In January, four markets had surpassed the 90 percent preleased mark, while 22 markets were at least 75 percent pre-leased. Nineteen markets were at least 20 percent ahead of preleasing year over year.

Performance in the sector is being driven by a combination of strong enrollment growth and a decrease in new supply in many university markets, according to Yardi’s early data.

Asking rates at Yardi 200 schools reached $863 per bed in January 2024, while year-over-year rent growth fell to 4.4 percent, down from 6.3 percent a year ago and 6.5 percent at the beginning of the leasing season.

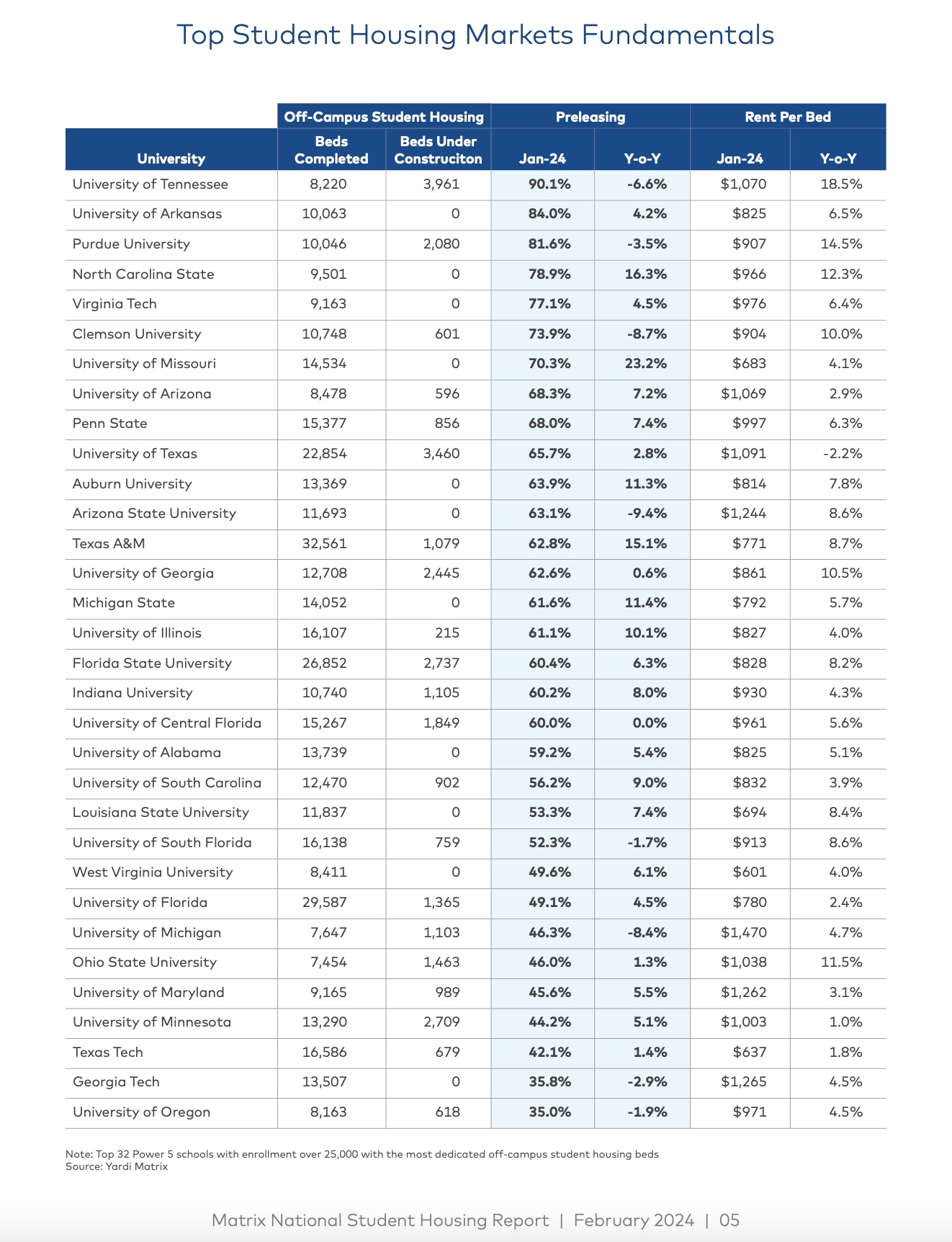

While rent growth varies by market, Yardi found that the student housing markets with above-trend recent increases in enrollment and preleasing rates also have the highest increases in rent growth. The best-performing schools for preleasing and rent growth include the University of Tennessee, University of Mississippi and University of Kentucky.

In January, 24 of Yardi’s markets saw double-digit rent growth, while 32 had negative rent growth of less than 0.5 percent.

Markets with slower preleasing activity have seen slower rent growth. Student housing rents also declined in markets that experienced an influx of deliveries and/or below-average enrollment growth over the past several years. But overall, Yardi Matrix analysts think the current strong preleasing activity indicates student housing owners can expect solid revenue growth for the 2024 school year.

The chart below shows the fundamentals of the top schools tracked by Yardi.

Yardi Matrix anticipates delivery of more than 46,000 new student housing beds in 2024, an increase from the 35,610 beds delivered last year, but expects supply will fall over the next five years to below the long-term average of 36,322 beds per year dating back to 2010.

Student housing investment activity was down last year, with only 76 student housing properties changing hands, compared to an average of 205 in 2021 and 2022. This resulted in a lower price per bed of $75,410 last year, compared with more than $80,000 per bed during the previous five years.