The multifamily arena is finally returning to pre-pandemic norms and so are renter preferences for unit types. Three-bedroom units, which saw the greatest increases in occupancy during COVID, have settled back to typical pre-crisis patterns as renter preferences change, according to RealPage Analytics

Rent increases returned to pre-2020 patterns late last year after skyrocketing during the pandemic and are expected to remain muted this year, thanks to downward pressure from supply.

Household formation also surged in mid-2020, only to moderate somewhat later that same year. And, since February 2020, the number of U.S. households has increased approximately six percent, according to the latest available data from Federal Reserve Economic Data (FRED) dated November 2023.

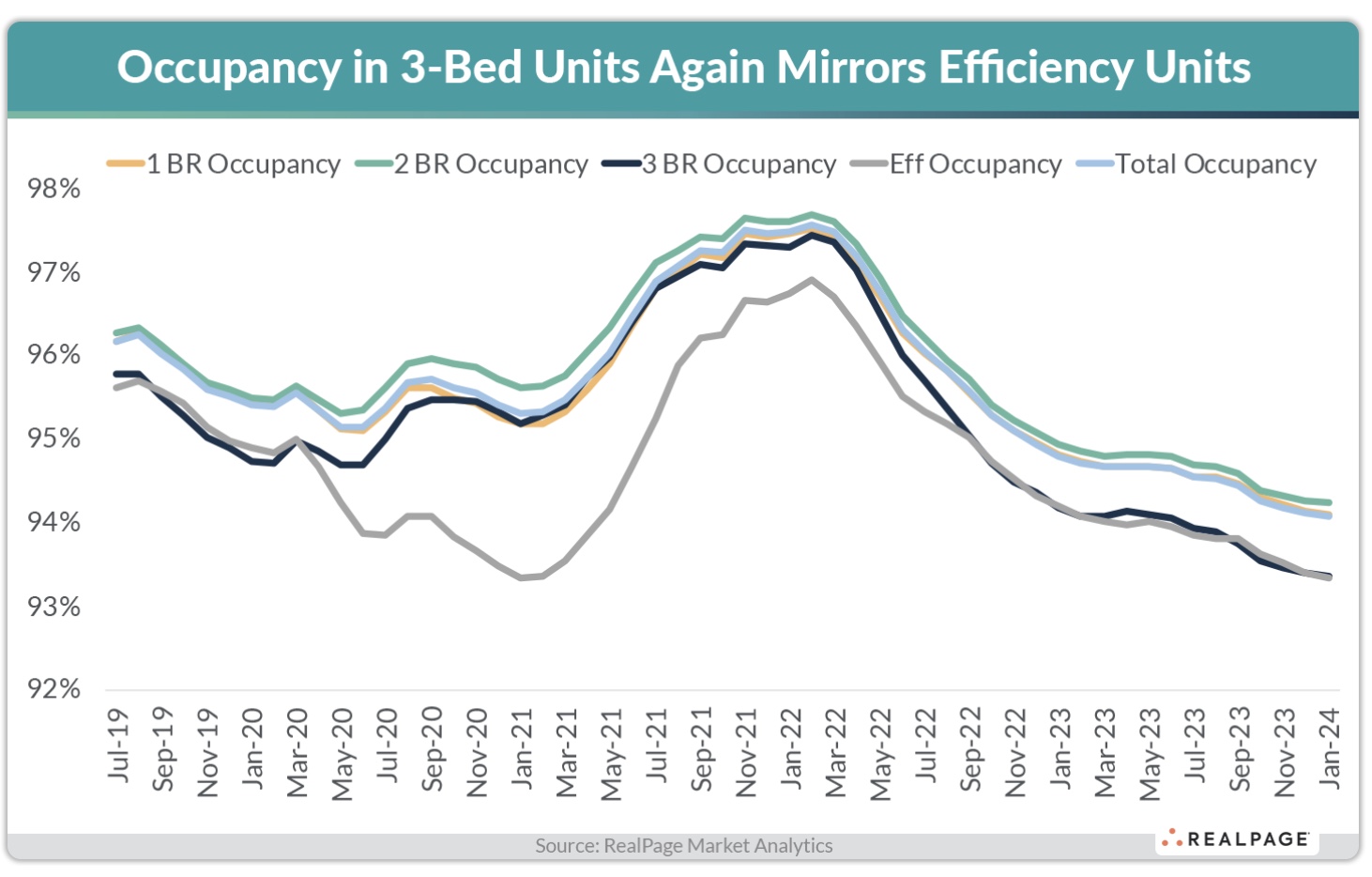

Apartment occupancy is another area returning to pre-pandemic patterns. National apartment occupancy across all unit types surged during COVID, but hit a ten-year low of 94.1 percent at the end of 2023, a year in which supply levels leapt to a 36-year high.

In January 2024, one-bedroom units posted 94.1 percent occupancy, followed by 94.2 percent for two-bedrooms, while three-bedroom and efficiency units underperformed at 93.4 percent and 93.3 percent, respectively.

Historically, one- and two-bedroom units have been the most popular among renters. They constitute the largest share of apartments nationwide, while three-bedroom and efficiency units comprise a smaller fraction of national apartment stock; hence three-bedroom units typically post occupancy rates lower than ones and twos.

All unit types got an occupancy boost in 2021 and 2022, when people worldwide were asked to stay in their homes. One- and two-bedroom units experienced increases between 210 and 220 basis points (bps). But three-bedroom units jumped 270 bps from pre-pandemic occupancy rates to register 97.4 percent in March 2022, one of the highest rates on record since RealPage began tracking this unit type.

Factors that contributed to the sudden popularity of larger units included renters’ need to double- and triple-up to help meet rising rental rates and/or find added space for a home office. Amid the shift to working from home, efficiency units were suddenly the least desirable and lost the most occupancy during the pandemic.

Efficiency renters tend to be younger and more price conscious and were the most likely to move back in with family temporarily during the pandemic.

Data from RealPage Analytics now suggests one- and two-bedroom unit occupancy is again registering in-line with normal pre-pandemic patterns, with three-bedroom and efficiency units posting occupancies 70 bps below national norms, marking a return to historic norms.