Insurance costs are leading the rise in multifamily expenses, which abated somewhat in the second half of 2023, but still remain high, while increases in property insurance premiums accelerated throughout the year, according to Yardi Matrix property expense bulletin released in March. Gross income rose more than expenses year over year in January 2024, but could soon turn downward.

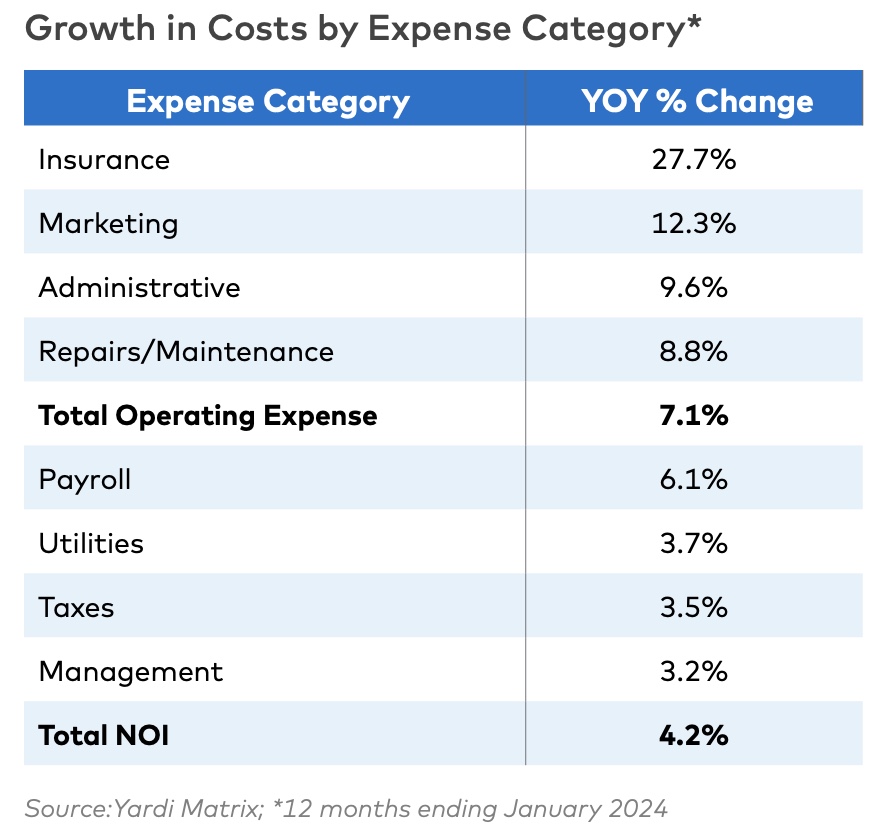

Overall expenses per multifamily units nationally rose by 7.1 percent year-over-year to $8,950 as of January 2024, according to an examination of more than 20,000 properties that use Yardi operating software.

Property insurance was the leader, rising 27.7 percent, while marketing rose 12.3 percent, administrative 9.6 percent and repairs and maintenance 8.8 percent, per expense growth data cited in the report in the 12 months ending in January. Expenses that grew the least included management fees (3.2%), real estate and other taxes (3.5%) and payroll (6.1%).

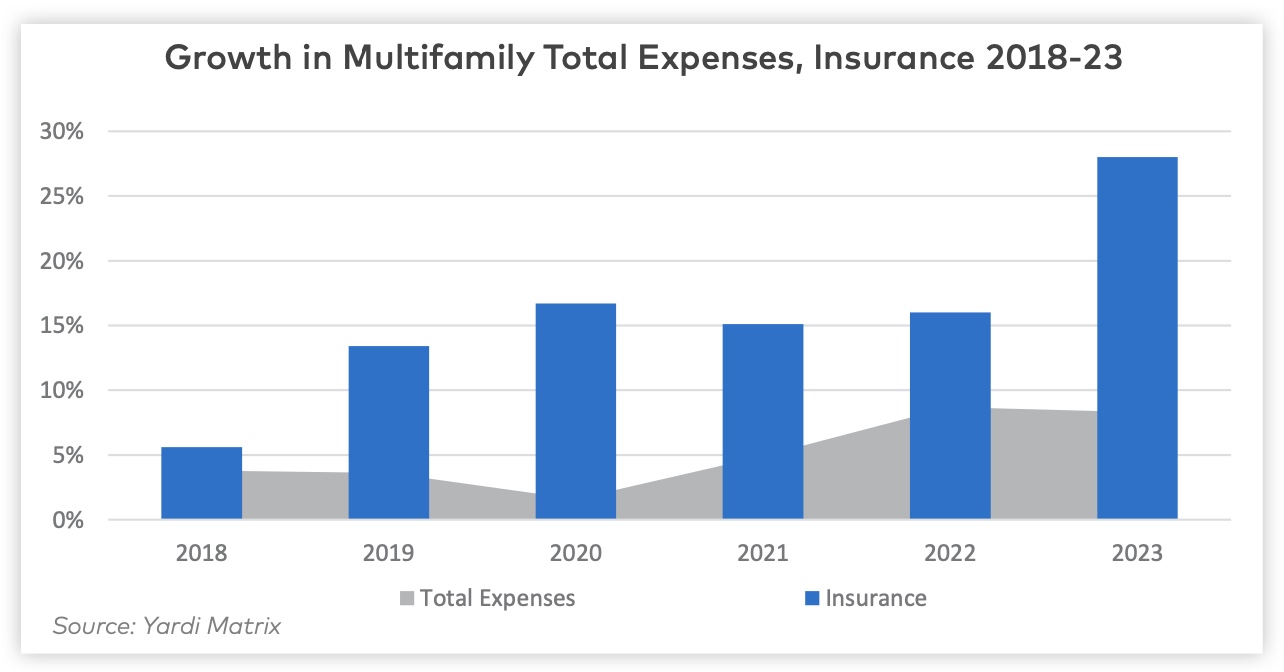

Total operating expenses at multifamily properties increased rapidly over the past two years, driven by inflationary pressures, peaking at 8.7 percent in 2022. In comparison, average annual expense growth rates were 4.9 percent in 2021, 1.6 percent in 2020, 3.6 percent in 2019 and 3.8 percent in 2018.

Total operating expenses at multifamily properties increased rapidly over the past two years, driven by inflationary pressures, peaking at 8.7 percent in 2022. In comparison, average annual expense growth rates were 4.9 percent in 2021, 1.6 percent in 2020, 3.6 percent in 2019 and 3.8 percent in 2018.

Expense growth increased the most in Florida and other markets where overall economic growth and inflation are high. Among Matrix’s top 30 metros by size, the top three markets for expense growth were Tampa (12.8%), Orlando (11.5%) and Miami (11.3%), and Florida metros that were hit with extraordinarily high increases in property insurance.

Although expense growth is still high, but moderating somewhat, property insurance costs spiked in 2023 and have risen 129 percent nationally since 2018 to an average of $636 per unit. Insurance costs rose rapidly in most parts of the country, but they particularly escalated in the Southeast and other areas experiencing weather-related damages. Property insurance is only seven percent of total expenses, but its share of overall costs is increasing. Moreover, insurance is becoming more difficult to obtain, especially in areas affected by hurricanes, floods and fires.

The news is not all bad, according to the report. Despite the growth in expenses, the Matrix study found that profitability at multifamily properties in the period studied was up in the 12 months ending January 2024 because gross income rose more than expenses.

But this good news might be short lived. Much of the income growth in 2023 came from higher rents on lease renewals, which lagged the growth in asking rents on new leases in recent years. Unfortunately, that avenue of growth is close to being tapped out because renewal lease rates have nearly caught up with asking rents, said the report.

Matrix forecasts asking rents will increase by only 1.8 percent this year and expects renewal rent growth will continue to decelerate. Matrix analysts caution property owners to carefully control expense growth, especially in light of weaker income growth forecast over the next 12 to 24 months.

Yardi full report available here.