Higher than average demand in the first half of 2024 failed to keep pace with the unprecedented supply that delivered during the same period, according to RealPage Analytics.

With national apartment supply expected to hit a 50-year high in the second half of this year, property managers are looking for ways to protect occupancy rates as they face the prospect of having empty units at the height of the delivery onslaught.

Vacant units can spell disaster for an apartment owner’s bottom line, so when they have difficulty attracting tenants or want to increase retention rates, rent concessions can help them achieve their goal.

A common best practice in periods of occupancy uncertainty, such as the 40-year-high in supply hitting the market today, is to incentivize renters to choose a longer-term lease, explained Jay Parsons, Madera Residential partner and head of investment strategy, in his LinkedIn blog.

“The renter typically pays less per month than they would otherwise. But the trade-off is a win/win, because property managers will have fewer expiring leases in the shorter term, which can be beneficial in a year like 2024, where record supply exceeds even robust demand in many markets,” he said.

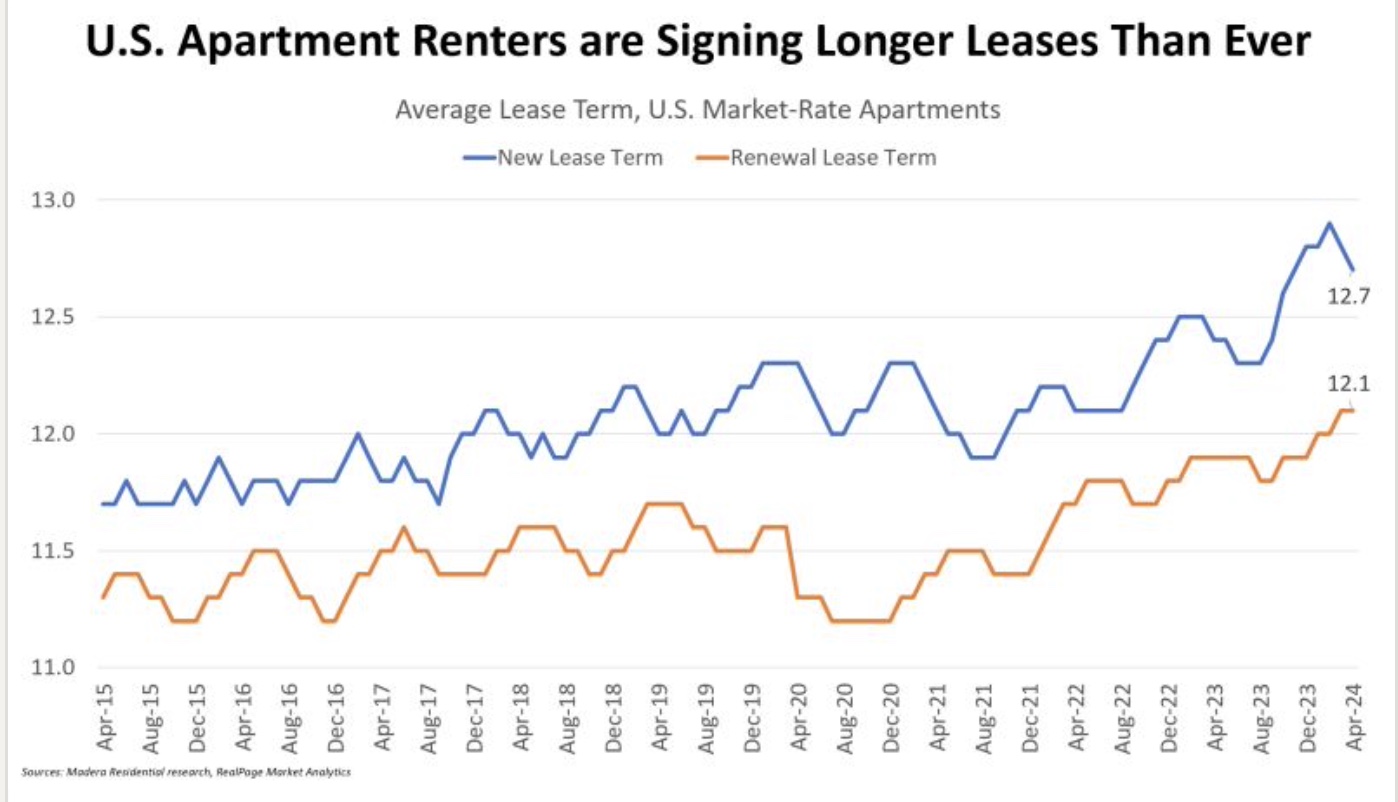

The strategy seems to be paying off. Apartment renters are signing longer leases, according to data from RealPage Analytics. (See chart below)

New leases signed in April reached 12.7 months, just below the high set in February of this year, while renewal lease terms peaked at 12.1 months. Historically, new leases have averaged 12 months and renewal leases have averaged 11.5 months.

Parsons reminds readers that contrary to social media conspiracy theories (and even some mainstream media stories), apartment owners make no revenue when their units sit vacant.

“Protecting occupancy and minimizing days on market are important strategies, especially in a high-supply environment,” said Parsons.

One LinkedIn reader noted that the incentives being offered are only on “luxury” units, as a means to fill maintained vacancy and cover losses stemming from monetary austerity. But Parsons replied, “the same trend is playing out in market-rate Class C units, which are ‘luxury’ only in comparison to public housing and most rent-controlled housing.”