A recent report by CBRE examines the state of commercial real estate finance in Q1. While the report considers investment in several commercial property types, this summary focuses on change in investment volumes for multifamily properties.

Investment volumes down

Overall investment in commercial property was down 19.4 percent in Q1 2024 from its level in Q1 2023.

Despite falling by 28.0 percent, investments in multifamily property continued to hold the largest investment share of any of the property types covered by the CBRE report. Investment in multifamily property in Q1 was $19.8 billion, down from $27.5 billion one year earlier. Of the $19.8 billion invested in multifamily property, $16.9 billion was in the form of single asset investment.

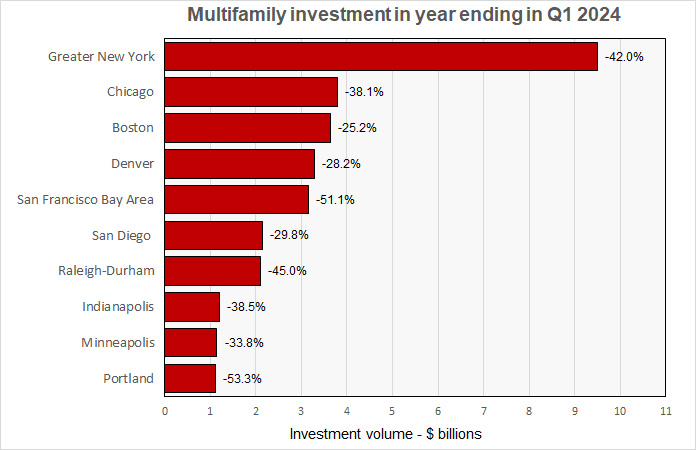

The first chart, below, shows the investment volumes for the 10 metros with the highest rates of volume growth or, in this case, the lowest rates of decline. The bars represent the volumes for the metros for the year ending in Q1 2024. The numbers at the ends of the bars represent the percentage growth in volume compared to the trailing 4 quarters.

The chart shows that the New York metro had by far the highest level of investment in multifamily property at $9.49 billion. Chicago was in second place at $3.80 billion with Boston coming in at $3.64 billion and Denver at $3.30 billion.

The metro with the lowest rate of decline in multifamily investment was Boston, where investment volume for the year ending in Q1 2024 fell 25.2 percent. This was followed by Denver, where volume fell 28.2 percent, San Diego with a fall of 29.8 percent and Minneapolis with a fall of 33.8 percent.

In New York, multifamily represented 20.0 percent of commercial property investment over the year ending in Q1 2024. The share was 31.1 percent in Chicago, 32.6 percent in Boston and 56.1 percent in Denver.

Who is active in the marketplace?

CBRE reports on the types of investors who are active in the marketplace. Unfortunately, this portion of the report does not break out investor activity by property type. However, it notes that private investors continued to generate the largest share of overall investment volume at 53.5 percent. Institutional investors became less active compared to Q1 2023 and represented 11.6 percent of volume in Q1 2024, down from 22.1 percent one year ago. REITs and public companies became more active, raising their share of investment volume to 20.5 percent from only 3.6 percent one year earlier.

The report also discusses property price movements based on the RCA commercial property price index. Yield Pro independently reports on that here.

The full report from CBRE covers more property types and is titled, ”Commercial real estate investment volume falls at a slower pace in Q1”. It is available here.