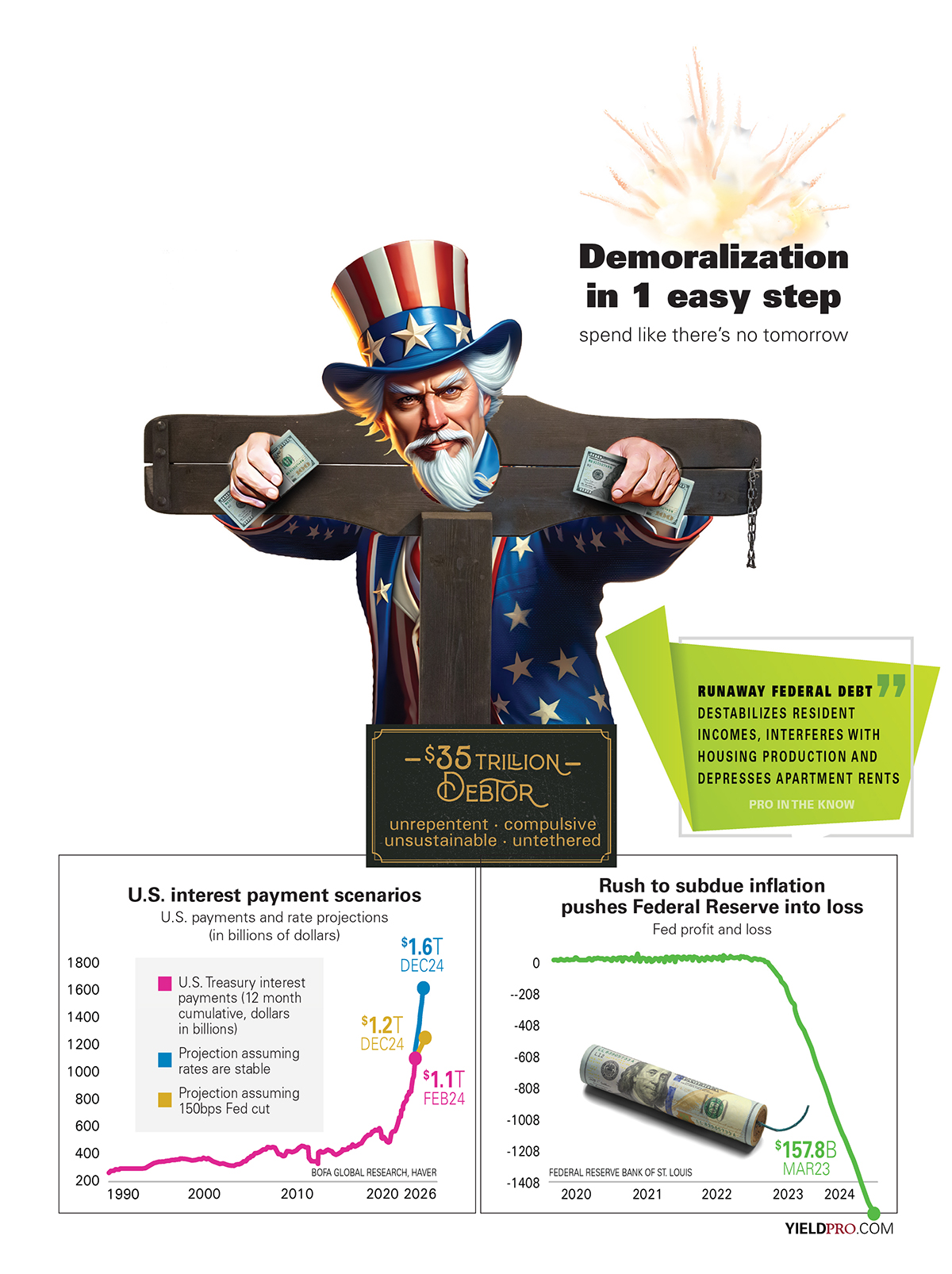

spend like there’s no tomorrow

Runaway federal debt destabilizes resident incomes, interferes with housing production and depresses apartment rents (PRO IN THE KNOW)

$35 trillion debtor

Unrepentant, compulsive, unsustainable, untethered

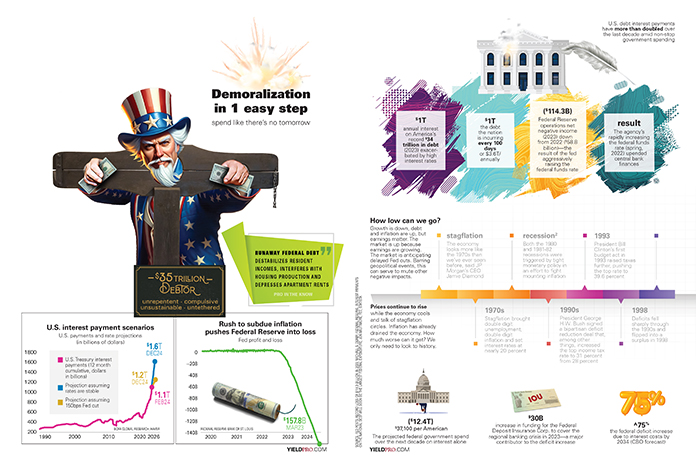

U.S. interest payment scenarios

U.S. payments and rate projections (in billions of dollars)

U.S. Treasury interest payments (12 month cumulative, dollars in billions) $1.1 trillion February 2024

Projection assuming rates are stable $1.6 trillion December 2024

Projection assuming 150bps Fed cut $1.2 trillion December 2024

Rush to subdue inflation pushes Federal Reserve into loss

Fed profit and loss

$157.8 billion, March 2023

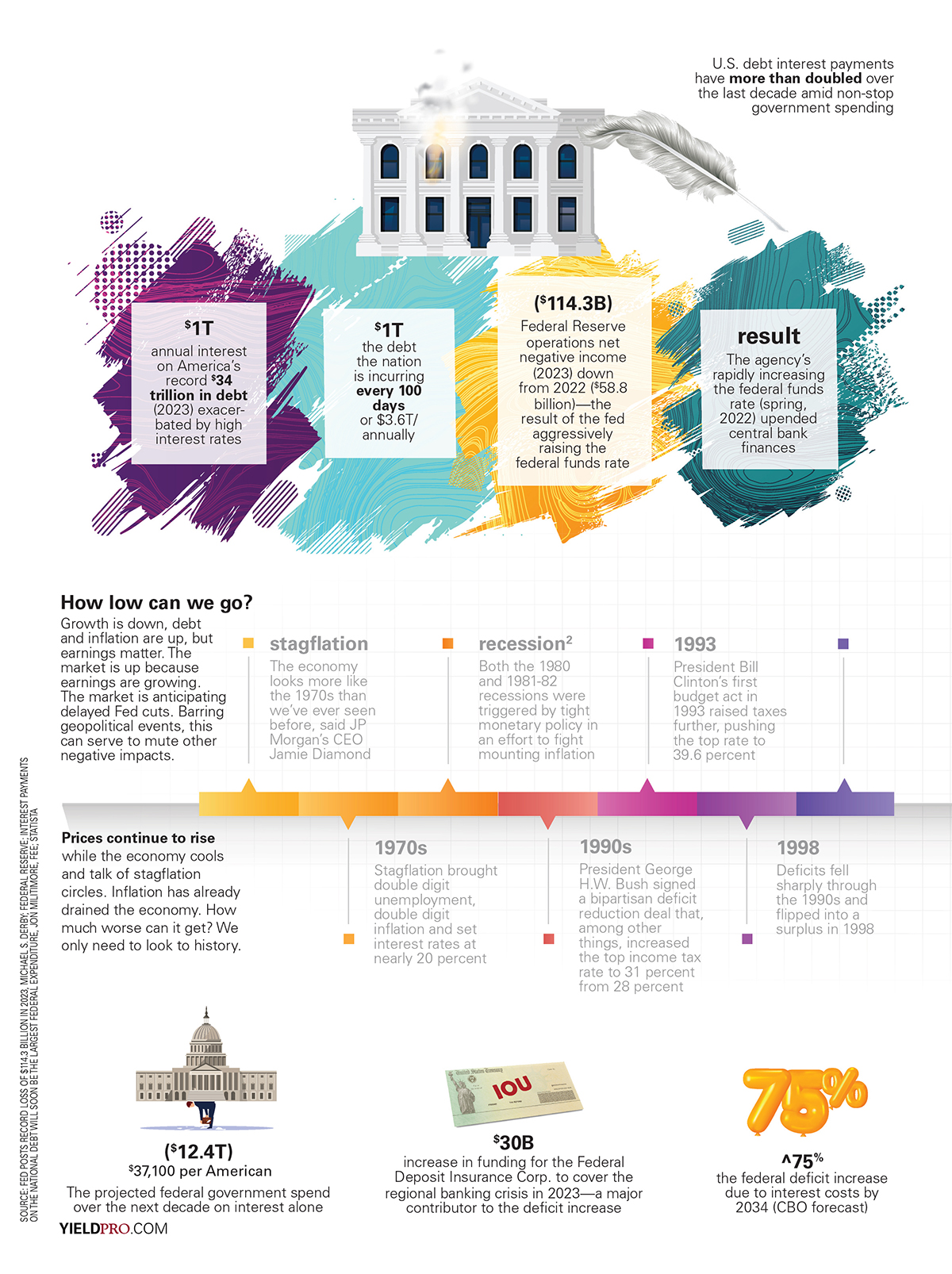

U.S. debt interest payments have more than doubled over the last decade amid non-stop government spending

$1T annual interest on America’s record $34 trillion in debt (2023) exacerbated by high interest rates

$1T the debt the nation is incurring every 100 days or $3.6T/annually

($114.3B) Federal Reserve operations net negative income (2023) down from 2022 ($58.8 billion)—the result of the fed aggressively raising the federal funds rate

Prices continue to rise while the economy cools and talk of stagflation circles. Inflation has already drained the economy. How much worse can it get? We only need to look to history.

stagflation • The economy looks more like the 1970s than we’ve ever seen before, said JP Morgan’s CEO Jamie Diamond

1970s • Stagflation brought double digit unemployment, double digit inflation and set interest rates at nearly 20 percent

recession2 • Both the 1980 and 1981-82 recessions were triggered by tight monetary policy in an effort to fight mounting inflation

1990s • President George H.W. Bush signed a bipartisan deficit reduction deal that, among other things, increased the top income tax rate to 31 percent from 28 percent

1993 • President Bill Clinton’s first budget act in 1993 raised taxes further, pushing the top rate to 39.6 percent

1998 • Deficits fell sharply through the 1990s and flipped into a surplus in 1998

($12.4T) $37,100 per American • The projected federal government spend over the next decade on interest alone

$30B • increase in funding for the Federal Deposit Insurance Corp. to cover the regional banking crisis in 2023—a major contributor to the deficit increase

^75% • the federal deficit increase due to interest costs by 2034 (CBO forecast)

How low can we go? Growth is down, debt and inflation are up, but earnings matter. The market is up because earnings are growing. The market is anticipating delayed Fed cuts. Barring geopolitical events, this can serve to mute other negative impacts.

Result The agency’s rapidly increasing the federal funds rate (spring, 2022) upended central bank finances

Data sources: Fed posts record loss of $114.3 billion in 2023, Michael S. Derby; Federal Reserve; Interest payments on the national debt will soon be the largest federal expenditure, Jon Militimore, FEE; Statista