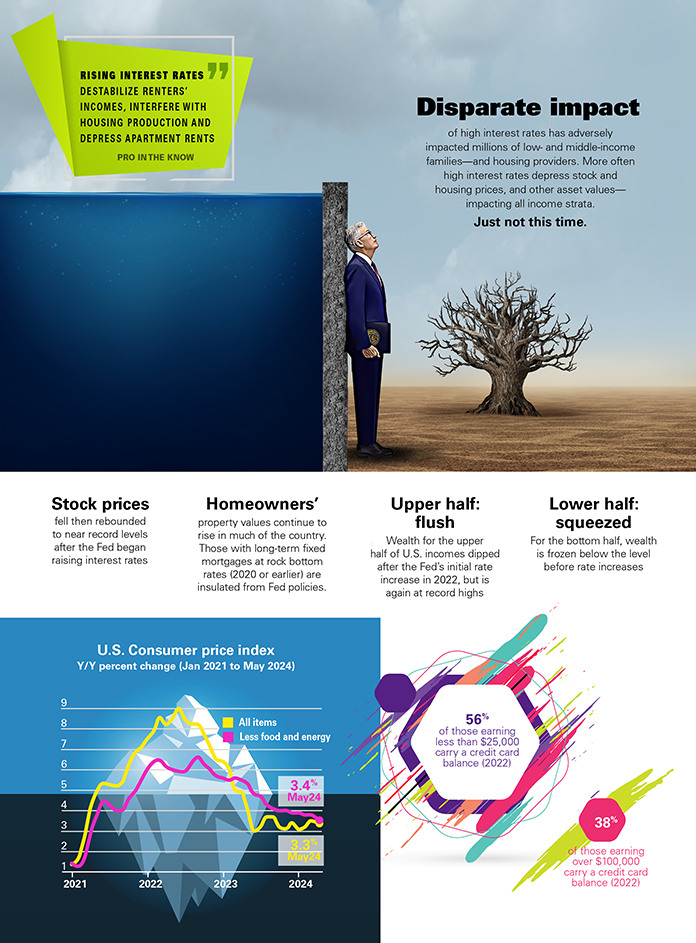

Disparate impact of high interest rates has adversely impacted millions of low- and middle-income families—and housing providers. More often high interest rates depress stock and housing prices, and other asset values— impacting all income strata. Just not this time.

Rising interest rates destabilize renters’ incomes, interfere with housing production and depress apartment rents

Stock prices fell then rebounded to near record levels after the Fed began raising interest rates

Homeowners’ property values continue to rise in much of the country. Those with long-term fixed mortgages at rock bottom rates (2020 or earlier) are insulated from Fed policies.

Upper half: flush Wealth for the upper half of U.S. incomes dipped after the Fed’s initial rate increase in 2022, but is again at record highs

Lower half: squeezed For the bottom half, wealth is frozen below the level before rate increases

U.S. Consumer price index, Y/Y percent change (Jan 2021 to May 2024)

Less food and energy 3.4 percent May 2024

All items 3.3 percent May 2024

56% of those earning less than $25,000 carry a credit card balance (2022)

38% of those earning over $100,000 carry a credit card balance (2022)

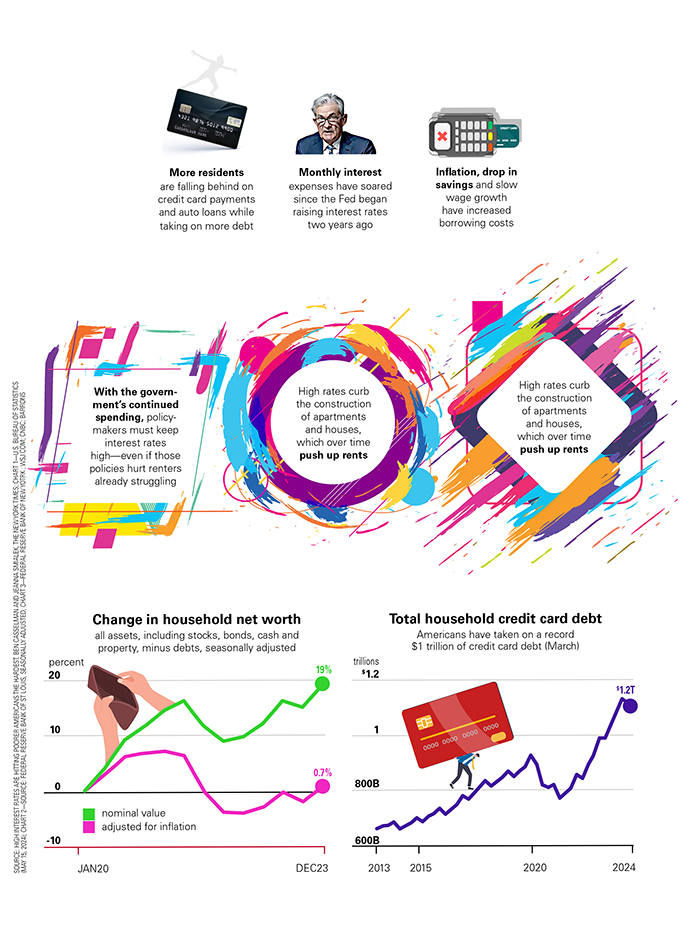

More residents are falling behind on credit card payments and auto loans while taking on more debt

Monthly interest expenses have soared since the Fed began raising interest rates two years ago

Inflation, drop in savings and slow wage growth have increased borrowing costs

With the government’s continued spending, policy-makers must keep interest rates high—even if those policies hurt renters already struggling

High rates curb the construction of apartments and houses, which over time push up rents

Rate hikes have slowed the housing market. Home sales have dropped sharply and prices remain near record levels.

Change in household net worth (all assets, including stocks, bonds, cash and property, minus debts, seasonally adjusted)

nominal value 19%

adjusted for inflation 0.7%

Total household credit card debt Americans have taken on a record $1 trillion of credit card debt (March) $1.2 trillion

Source: High interest rates are hitting poorer Americans the hardest, Ben Casselman and Jeanna Smialek, the New York Times; chart 1—U.S. Bureau of Statistics (May 15, 2024); chart 2—Source: Federal Reserve Bank of St Louis, seasonally adjusted; chart 3—Federal Reserve Bank of New York ; wsj.com; CNBC; Barrons