While asking rents for new leases nationally are running nearly flat over the past 12 months, those figures are heavily influenced by the Sunbelt, where record-high supply has turned rent growth negative in some cities, according to most property data and brokerage companies that track them.

The least affordable home-sales market in decades is compelling more renters to stay put. Large apartment owners say fewer renters are moving out to buy homes than ever before, put off by record home prices, limited inventory and higher mortgage rates.

“Rental demand is definitely rebounding,” said Igor Popov, chief economist at the listings website Apartment List. “We’re past the bottom.”

Strong job growth has also opened the door for landlords to raise rents. “That gives them pricing power,” said Linda Tsai, a real-estate equities analyst at Jefferies.

Rising rents complicate the inflation picture and could make it challenging for the Federal Reserve to ease interest rates. Labor Department data showed that inflation was cooler than expected last month, but the prospect of more apartment owners raising rents could offset lower prices in other areas.

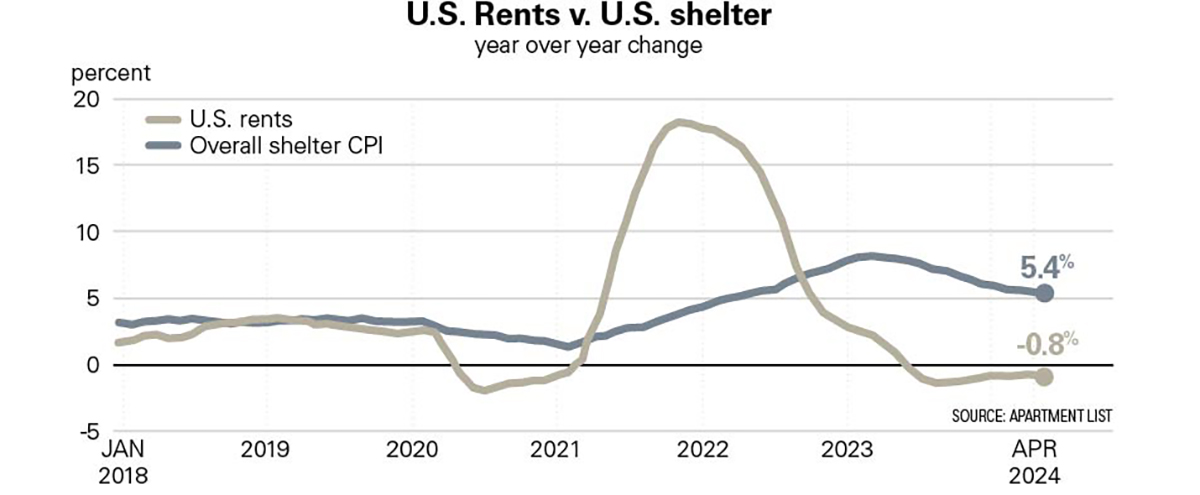

Shelter inflation, mostly a measure of rents that lags behind real market conditions by many months, was still running hot in May, with an annual rate of 5.4 percent, according to the Bureau of Labor Statistics.

“The housing situation is a complicated one,” Fed Chairman Jerome Powell said at a June press conference. “The best thing we can do for the housing market is to bring inflation down so that we can bring rates down.”

While most analysts say the pace of shelter inflation should decline further this year, some apartment landlords are signaling that the worst of the rent slowdown is already behind them.

While most analysts say the pace of shelter inflation should decline further this year, some apartment landlords are signaling that the worst of the rent slowdown is already behind them.

“We believe we have likely already seen the maximum impact to new lease pricing,” said Tim Argo, an executive at the publicly traded building owner Mid-America Apartment Communities, on a May earnings call.

The Sunbelt landlord has been cutting prices for new leases. But the company said apartment absorption in the first quarter was at its highest for that quarter in two decades.

For more than a year, rents have been held back by a historic crush of new apartment supply. Vacancy rates rose last year. The drop in demand pushed building owners, especially those with newer buildings, to rein in rent increases following two years of record gains.

In recent months, apartment buildings aren’t losing as many residents as they once were, market reports show, and available units are leasing fast.

Only 7 percent of residents at properties owned by AvalonBay Communities left to purchase a home in the first quarter, Chief Operating Officer Sean Breslin said on an earnings call. That compares with the long-term average of 16 percent to 17 percent, he said.

Big landlords are increasing rents on renewed leases by about 4 percent or more, according to their recent earnings statements. That is in line with recent historical averages and higher than general inflation.

Equity Residential, a landlord focused on wealthier renters in coastal markets, said at the end of April that it was asking current tenants to pay increases closer to 7 percent.

Investment firms are eager to cash in and are buying large apartment portfolios again. Blackstone recently agreed to pay $10 billion for Apartment Income REIT, which has buildings in high-end coastal markets.

Other investors are more focused on middle-market housing, where they are undeterred by the glut of construction mostly concentrated in the higher end of the market.

“We are not directly competing with the new supply,” said Swarup Katuri, managing partner in the real-estate group at investment giant Brookfield.

In May, Brookfield paid more than $1.5 billion for 7,300 units in the Sunbelt, mostly in 30-year-old garden apartment complexes. The average rent for those units is about $1,700.

Over the next five years, Brookfield plans to make renovations, raise rents and increase its cash profits at these properties by more than 34 percent, according to a bond offering detailing the business plan.

The difference in monthly rent between a middle-tier apartment and newer luxury-tier units is about $570 on average, according to real-estate data firm CoStar. Rents in the middle segment have also risen faster than rents in lower- and higher-tier properties since 2019, CoStar said.

Despite the bounce off the bottom, most analysts don’t think big rent increases will return nationally this year. Commercial-property brokerage Newmark forecasts asking rents for new leases to rise 2 percent nationwide in 2024, well below the double-digit rates of the pandemic years.

In only four metros of at least one million people—Louisville, Ky., Hartford, Conn., Providence, R.I., and Honolulu—have new lease rents risen 5 percent or more on average this year, according to Apartment List.

High supply, meanwhile, is expected to continue to weigh on rents in Sunbelt cities such as Austin, Texas, Phoenix and Nashville, Tenn., where rents for new leases are still declining on average.

Excerpt Will Parker, wsj.com