Fannie Mae’s May economic forecast calls for multifamily housing starts to reach their low point in Q2 2024 and then to rise, if unevenly, through the end of 2025. Single-family housing starts are expected to pull back slightly through Q3 2024 and then to resume their recent rise.

Fannie Mae’s forecasters are predicting that the Federal Reserve will cut the Fed Funds rate only once in 2024, with that cut coming in December. However, they leave open the possibility that an additional cut could come in September if the moderation in inflation that was seen in May’s Consumer Price Index report continues.

The forecasters are now expecting the Fed Funds rate to fall to 4.5 percent by the end of 2025. Last month’s forecast predicted that the rate would drop to only 4.8 percent by then, so they are now factoring in a rate cut in mid-2025.

The 10-year Treasury is predicted to rise to 4.5 percent in Q2 2024 and drop slightly to 4.4 percent in Q1 2025. This is marginally lower than last month’s outlook.

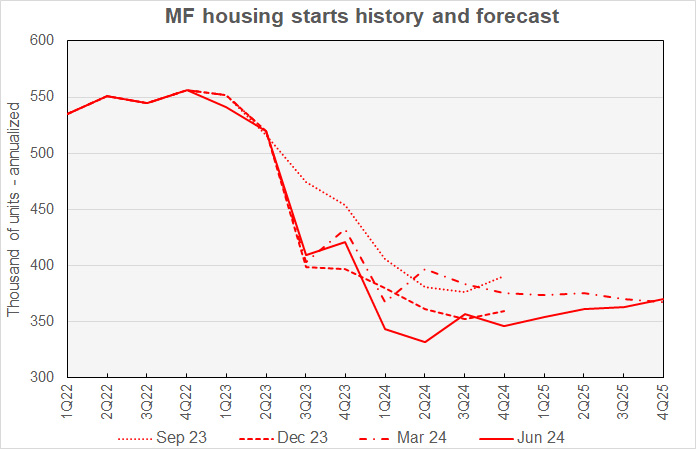

Fewer multifamily starts expected

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

After being revised lower in the last two monthly forecasts, the multifamily starts forecast was revised higher this month on a slightly more favorable interest rate forecast. While the number of starts forecasted for Q1 and Q2 2024 were lowered, the number of multifamily starts forecasted for Q3 2024 through Q4 2025 were all raised by between 14,000 and 28,000 annualized units.

The current forecast calls for multifamily starts to reach a low of 332,000 annualized units in Q2 and then rise slowly through the end of 2025, finishing that year at a rate of 370,000 annualized units.

For reference, the most recent new residential construction report from the Census Bureau has multifamily starts running at an annualized rate of 306,000 units through the first two months of Q2 2024.

Looking at yearly forecasts, the predicted number of multifamily starts for 2024 was revised higher by 8,000 units to 344,000 units. The forecast for multifamily starts in 2025 was revised higher by 16,000 units to 362,000 units.

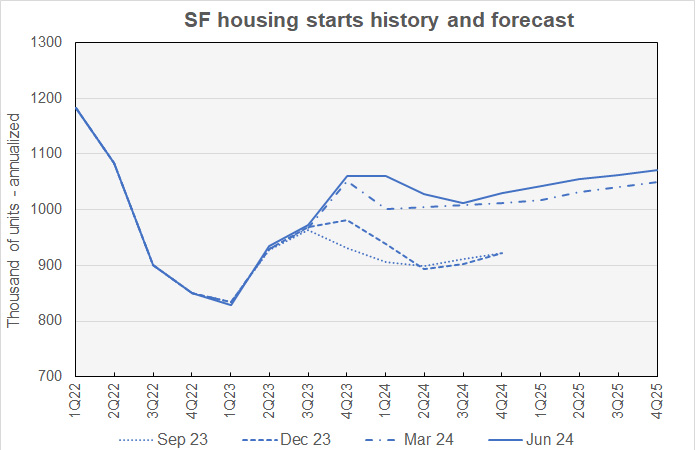

Single-family starts forecast revised lower

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

With the exception of the Q2 2024 forecast, the revisions to each quarter of the single-family starts forecast call for fewer starts than did last month’s forecast. The Q2 2024 forecast was revised higher by 2,000 annualized units. The forecasts for the following quarters were revised lower by 2,000 to 12,000 annualized units.

The number of single-family starts is forecast to fall from 1,060,000 annualized units in Q1 2024 to a low of 1,012,000 annualized units in Q3 2024. Single-family starts are then forecast to rise gradually, reaching 1,071,000 annualized units in Q4 2025.

Looking at their full-year predictions, Fannie Mae now expects single-family starts to be 1,033,000 units in 2024, down 5,000 units from the level forecast last month. Single-family starts in 2025 are forecast to be 1,058,000 units, also down 5,000 units from the level forecast last month.

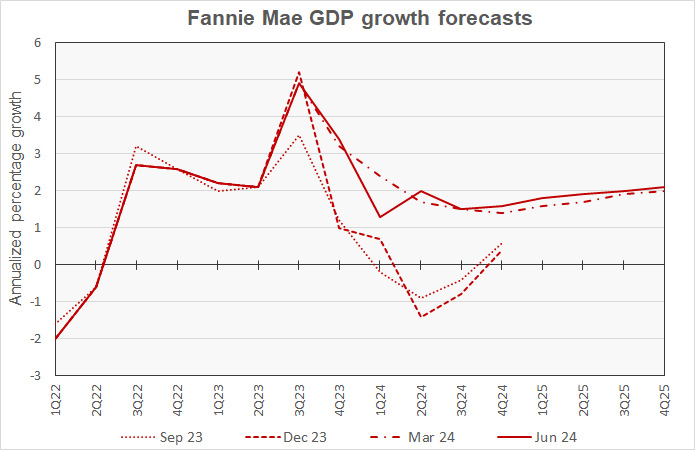

GDP growth outlook revised lower

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

Fannie Mae’s forecasters revised their estimate for Q1 2024 GDP growth lower from 1.6 percent to 1.3 percent, matching the Bureau of Economic Analysis’ second estimate. Fannie Mae also revised their forecasts for Q2 and Q3 2024 GDP lower by 0.4 and 0.3 percentage points respectively. They now expect a GDP growth rate of 2.0 percent in Q2 and of 1.5 percent in Q3. GDP growth forecasts for Q4 2024 and Q1 2025 were both revised higher by 0.1 percentage point while that for Q3 2025 was revised lower by the same amount.

The full year forecast for GDP growth for 2024 was revised lower to 1.6 percent while the full-year forecast for 2025 was left unchanged at 1.9 percent.

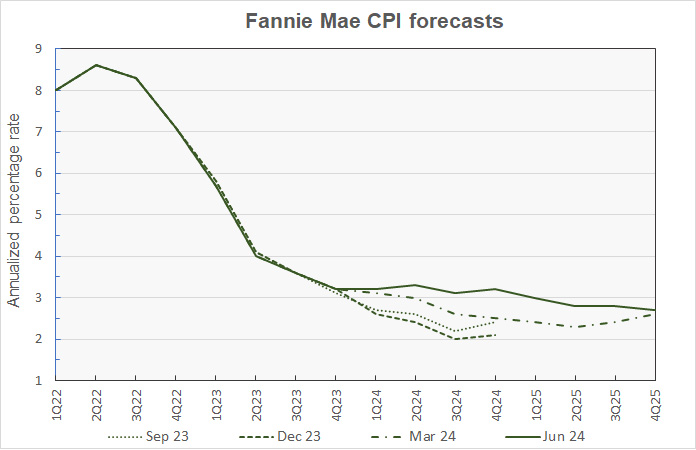

Higher CPI Inflation predicted

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

This month, all revisions to Fannie Mae’s CPI inflation quarterly forecasts were to the upside. Inflation was predicted to be 0.1 percentage point higher in Q3 2024 and Q3 2025. It was predicted to be 0.2 percentage points higher in Q4 2024 and Q2 2025 and it was predicted to be 0.3 percentage points higher in Q1 2025.

Looking at whole-year forecasts, the forecast for year-over-year CPI inflation in Q4 2024 was raised 0.2 percentage points to 3.2 percent. The Q4 2025 year-over-year inflation forecast was unchanged at 2.7 percent.

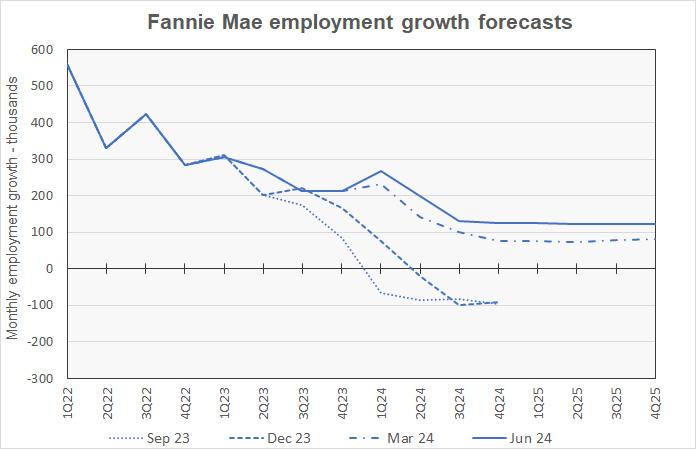

Employment growth forecast slightly lower

The next chart, below, shows Fannie Mae’s current forecast for employment growth, along with three earlier forecasts. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth. By contrast, the unemployment rate depends on employment but also on the labor force participation rate. Either rising employment or falling labor force participation can drive the unemployment rate lower, but only the former would contribute to economic growth.

Revisions to this month’s employment growth quarterly forecasts are all to the downside with the exception of that for Q2 2024. That forecast now anticipates monthly job growth of 198,000 jobs, a rise of 19,000 jobs from the last forecast. Monthly job growth is forecast to fall from Q2’s level, reaching 126,000 per month by Q4 2024 and 121,000 per month by Q4 2025.

For reference, the Employment Situation Report from the Bureau of Labor Statistics indicates that the economy added an average of 219,000 jobs per month in the first two months of Q2 2024.

Compared to last month’s forecast, the expected full year forecast for employment growth in both 2024 and 2025 were unchanged. Employment growth in 2024 is expected to be 2,200,000 jobs. Employment growth in 2025 is expected to be 1,500,000 jobs.

The Fannie Mae May forecast can be found here. There are links on that page to the detailed forecasts and to the monthly commentary.