Professionally managed apartments report lower vacancies than the broader market, according to data from RealPage and the U.S. Census Bureau.

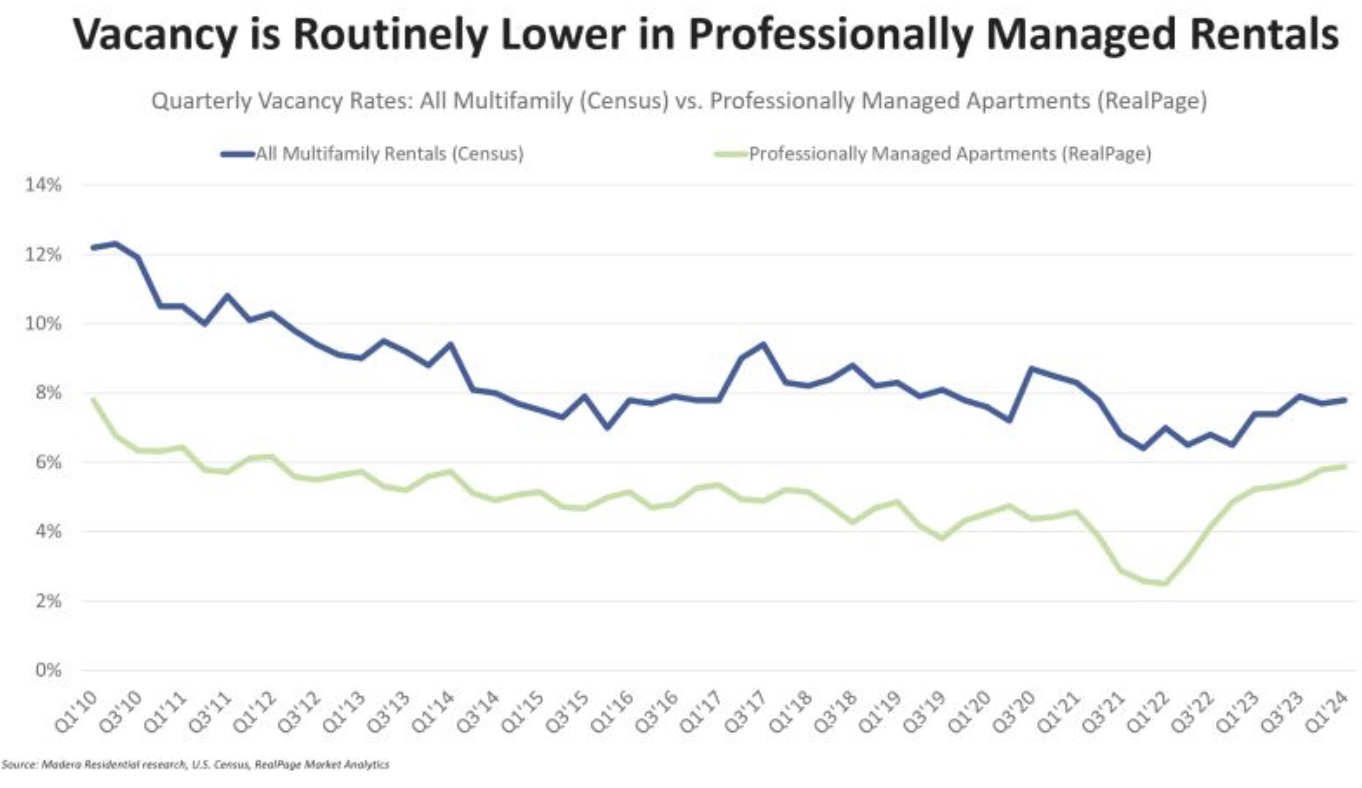

Since 2010, the professionally managed segment of the multifamily industry has averaged five percent vacancy compared with 8.5 percent average vacancy in the broader multifamily rental market, representing a premium of 350 basis points.

Jay Parsons, head of investment strategy and research for Madera Residential, shared this finding on his LinkedIn page, prompting a discussion with readers speculating why this large and consistent vacancy gap exists.

“Professionally managed” is defined by RealPage and other competing multifamily analysts as the properties they track with at least 50 units and on-site management teams.

“This includes property owners and managers of all sizes. So, while you could call these properties institutional grade, it does not mean ownership is institutional. In fact, most are likely owned by small local investment groups,” said Parsons.

By comparison, the Census reporting would likely cover every possible type of multifamily building, including small walk-up apartments, public housing, and other niches, he said.

The data in the graph below was derived by comparing quarterly vacancy rates over time between all U.S. multifamily rentals tracked by the U.S. Census and the niche of professionally managed rental properties tracked by RealPage.

U.S. Census vacancy data is also shared by the Federal Reserve Bank of St. Louis.

According to this data, professionally managed apartment properties consistently report lower vacancy rates than the broader population of multifamily rentals.

Parsons calls this finding a narrative buster, likely referring to accusations that the revenue management software like RealPage’s Yieldstar and LRO that are used primarily by larger professionally managed apartments recommend landlords, in some cases, accept a lower occupancy rate in order to raise rents and make more money

But Parsons reminds readers that “despite the conspiracy theories on social media, vacant units generate zero revenue, so there is an incentive to fill them, if feasible.”

He speculates that a partial explanation for the consistent vacancy gap in the comparison data may trace to professionally managed assets being newer and having more units, which may attract more renters. They also may have more capital to maintain properties and avoid obsolescence, which could force long-term vacancy, he said.

Chris Yeagle, founder and managing partner at EastGate Multifamily, agreed with Parson’s size premise.

“In my experience, smaller properties can have wild fluctuations in occupancy simply due to losing a few occupied units,” he said.

Investment manager Mitch Bollinger surmised that the differential in vacancy may be because larger owners are more technologically and economically sophisticated and more likely to use revenue management software.

“Larger owners have realized that to maximize the value of their assets in the long term, the best strategy is to keep them fully leased at 95 percent to 96 percent, which accounts for the time it takes to turn units and make them ready for new tenants. Less sophisticated investors are more susceptible to poor decision making, including holding out for underwritten rents the market may not support or not raising rents quickly enough when they are achieving underwritten rents,” he said

As evidence of this, Bollinger points to occupancy across apartment REIT Mid America Apartments’ (MAA) markets, which is locked in at around 95.5 percent.

Even when most markets the REIT operates in saw a material uptick in vacancy, MAA was not affected because, “they understand that price is the plug to get to their targeted occupancy. They own around 100,000 units, so I would posit that they are onto something,” he said.

RealPage’s comparison data chart and MAA’s occupancy as projected by NASDAQ debunk a poorly thought-out conspiracy theory that revenue management software providers and their clients will trade occupancy in order to keep rents high.

Also of interest, RealPage reported that most markets across the country are seeing month-over-month apartment occupancy improvements. April and May combined registered a 0.1 percent increase in occupancy, compared with a negligible drop of 0.02 percent last year. Although small, the increase is significant in light of the deluge of deliveries still occurring in many markets.