Yardi Matrix reported that national average apartment rent was up $6 in May compared to the revised level of the month before at $1,733 per month. The national average year-over-year apartment asking rent growth was 0.6 percent in May, down 0.1 percent from the rate reported last month.

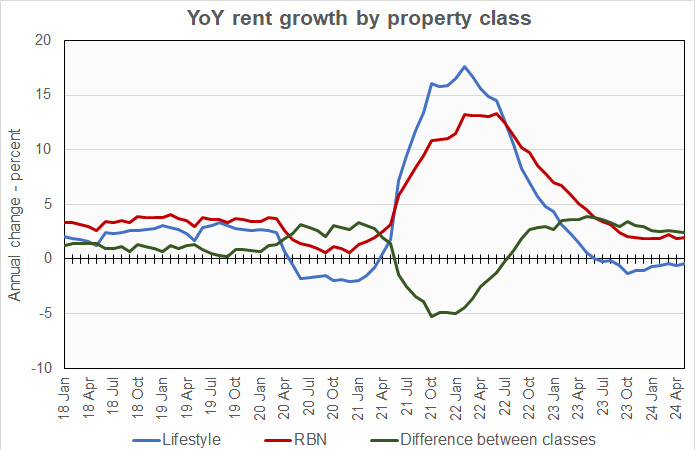

Rents in the “lifestyle” asset class, usually Class A properties, were down 0.4 percent year-over-year, while rents in “renter by necessity” (RBN) properties increased by 2.0 percent year-over-year. The chart, below, shows the history of the year-over-year rent growth rates for these two asset classes along with the difference between these rates.

The chart shows that the year-over-year rent growth rate for lifestyle properties was negative again this month, bring its string of negative rent growth reports to 11. The rent growth rate for RBN properties remains positive but at a lower level than in the years before 2020.

For the at least the past 5 months, the year-over-year rent growth rates for both lifestyle and RBN properties have been varying in narrow ranges with a difference in rent growth rates that is significantly higher than the pre-pandemic norm. The data show little sign that a return to the pre-pandemic pattern of rent growth is imminent.

Starting in September 2022, Yardi Matrix reported data on lease renewal rates and rent-to-income ratios in their monthly multifamily report. However, that data is missing from this month’s report.

Yardi Matrix reported that U.S. average occupancy rate in April was unchanged from the level in the last two month’s reports at 94.5 percent. None of the top 30 metros on which Yardi Matrix reports saw occupancy rise during the month and 29 of them saw occupancy decline. Atlanta had the lowest occupancy at 92.4 percent, but Houston, Austin and Dallas also had occupancy below 93 percent. What these metros have in common is high level of new product coming to market.

Tabulating the data

Yardi Matrix reports on other key rental market metrics in addition to rent growth. These include the year-over-year job growth rate based on 6 month moving averages and the completions over the prior 12 months as a percentage of existing stock. The 10 metros with the largest annual apartment rent increases are listed in the table below, along with the other data.

| City | YoY rent | YoY jobs (6 mo moving avg) |

Completions as % of stock |

| New York | 4.8 | 1.1 | 1.1 |

| Columbus | 3.6 | 1.1 | 3.1 |

| Kansas City | 3.4 | 1.2 | 2.0 |

| New Jersey | 3.4 | 1.2 | 2.9 |

| Washington DC | 3.0 | 1.1 | 2.1 |

| Chicago | 2.8 | 0.4 | 1.8 |

| Boston | 2.6 | 0.6 | 2.3 |

| Detroit | 2.4 | 0.1 | 1.0 |

| Philadelphia | 2.4 | 1.5 | 1.8 |

| Indianapolis | 1.9 | 2.2 | 2.4 |

The major metros with the smallest year-over-year apartment rent growth as determined by Yardi Matrix are listed in the next table, below, along with the other data as in the table above.

| City | YoY rent | YoY jobs (6 mo moving avg) |

Completions as % of stock |

| Austin | (5.8) | 2.8 | 5.6 |

| Atlanta | (3.2) | 1.1 | 3.3 |

| Raleigh | (2.4) | 2.6 | 5.2 |

| Orlando | (2.3) | 2.4 | 4.8 |

| Phoenix | (2.2) | 2.5 | 3.3 |

| Charlotte | (2.0) | 1.7 | 5.8 |

| Tampa | (1.8) | 2.3 | 2.7 |

| Nashville | (1.7) | 1.1 | 5.3 |

| Dallas | (1.5) | 2.0 | 2.9 |

| Portland | (0.9) | (0.7) | 3.4 |

The top metros for month-over month rent growth in May were Denver, New York, Raleigh and Boston. Only Boston was in the top 4 in last month’s report. The trailing metros were Twin Cities, Phoenix, Charlotte and Tampa. Only Tampa was in the bottom 4 in last month’s report.

SFR markets outperform

Yardi Matrix also reported that single-family rental (SFR) rents rose $6 in May from the revised level of the month before to $2,166 per month. The year-over-year SFR rent growth rate edged up from the level reported last month to 1.4 percent. Of the 34 metros tracked in the report, 25 saw rents rise year-over-year.

Yardi Matrix reported on the top 34 metros for built-to-rent single family rentals, 26 of which saw rents grow year-over-year in May. The leading metro for year-over-year rent growth was Boston, with rent growth of over 20 percent. It was followed by Raleigh, Orange County and Lansing, each of which had rent growth of 10 percent or more. The metros with the lowest year-over-year rent growth were Tampa, Austin, Phoenix and Atlanta, which all saw rents fall year-over-year.

The national occupancy rate for single-family rentals in April fell 0.1 percentage point from the revised level of the month before to 95.3 percent.

This month, 12 of the metros saw year-over-year occupancy increases. The metros with the largest year-over-year occupancy increases were Washington D.C., Lansing, Tampa and Las Vegas. The metros with the greatest occupancy declines were Orlando, Atlanta, Los Angeles and Nashville.

The complete Yardi Matrix report provides information on some of the smaller multifamily housing markets and more information on the differences in results between lifestyle and RBN properties. It can be found here.