Renter nation? Not yet! says data from U.S. Census Bureau that reveals homeownership in America remains resilient. Again, Jay Parsons, head of investment strategy at Madera Residential, punctures narratives with facts, this time dispelling the idea that the U.S. is giving up the American dream of homeownership and becoming a renter nation, thanks to large institutional investors buying up swaths of single-family homes to rent.

Other culprits targeted in this narrative are rising home prices and interest rates, stagnant wages, transient youth and the lack of supply.

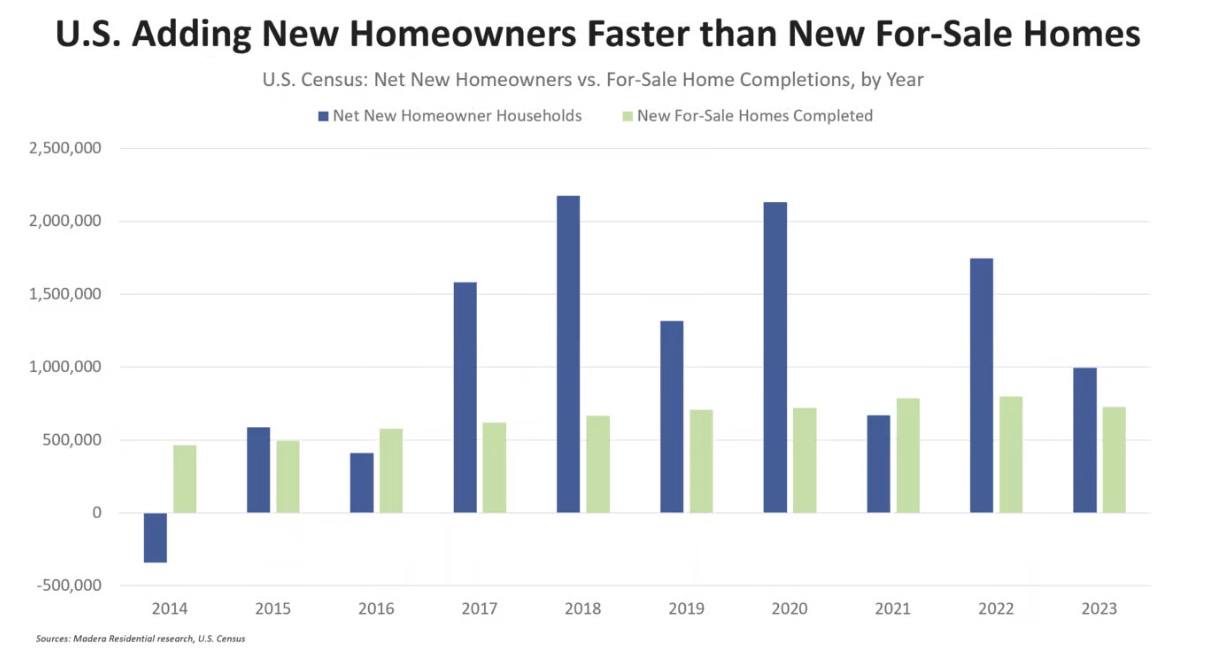

The fact is that over the past nine years, the nation added more homeowners than new for-sale homes, meaning millions of single-family rentals were sold to individual owner occupants, said Parsons on his LinkedIn page.

He expanded on the subject with a piece in his newsletter Rental Housing Economics with Jay Parsons called Three Charts to Combat Common SFR Myths.

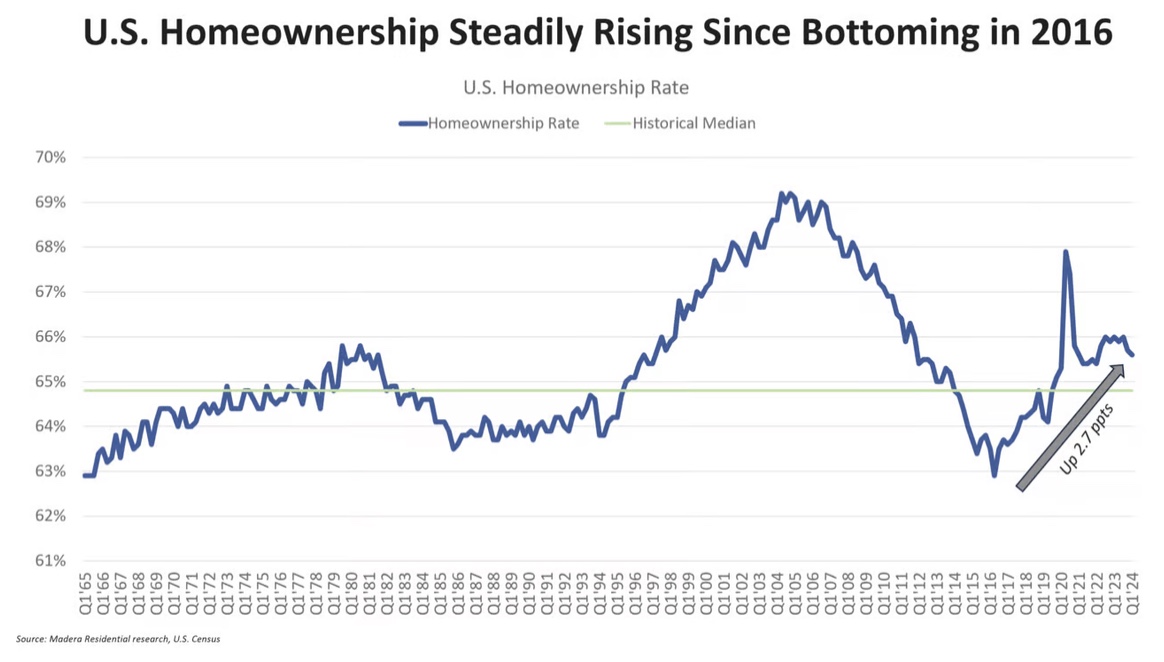

The first chart shows that after bottoming out in 2016, the homeownership rate increased 270 basis points to 65 percent as of Q1 2024, according to Census data. While this is below the all-time highs of the housing bubble era, the homeownership rate is still above the historical medium.

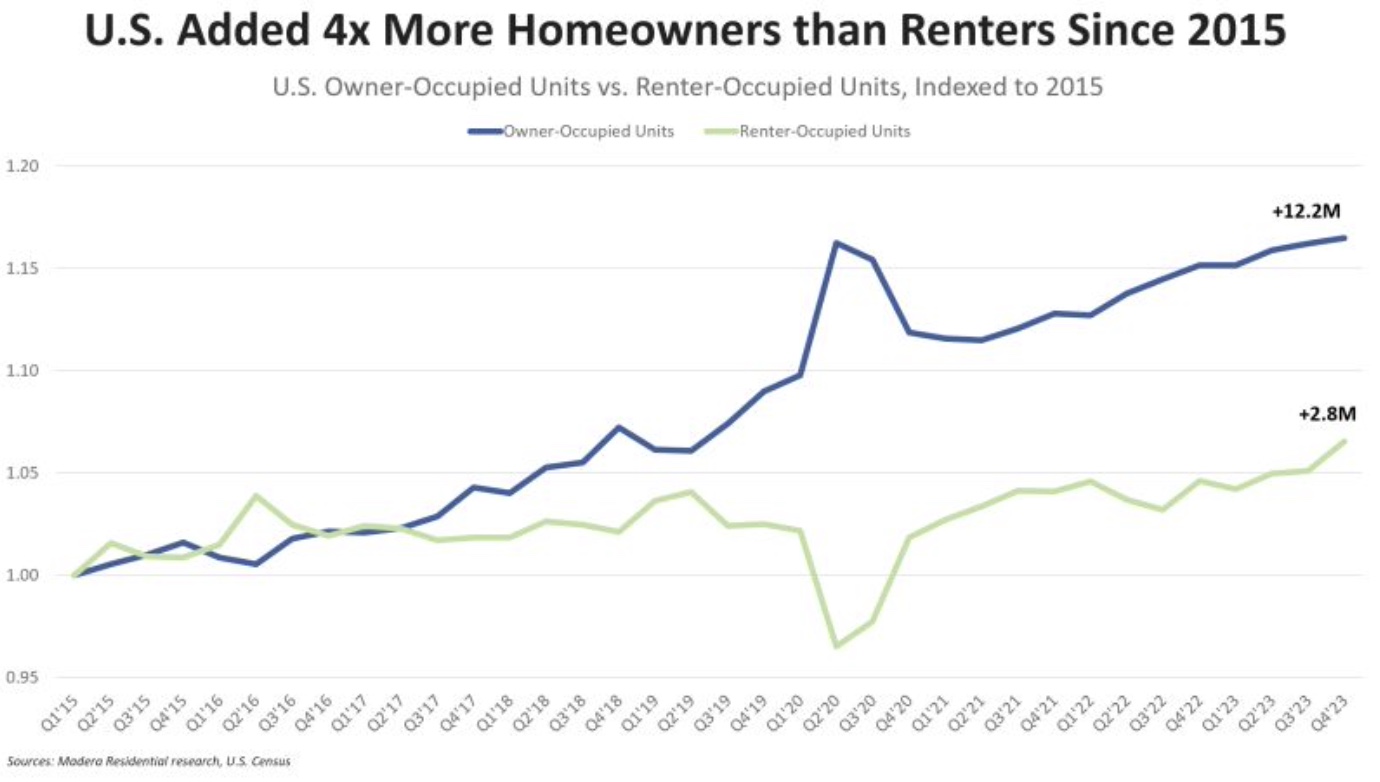

The next chart reveals that between 2015 to 2023, the U.S. added more than four times more new homeowner households than renter households, an important data point that Parsons points out has been largely ignored by policymakers and fearmongering headlines.

The third chart shows that the U.S. is adding homeowners far faster that it is building for-sale homes, building only six million for-sale homes between 2015 and 2023 while adding nearly 12 million new homeowners during the same period.

Parsons quoted an article published last year by the Harvard Joint Center for Housing Studies that came to the same conclusion. “The number of single-family rentals then fell in more recent years as the for-sale market strengthened, and many of these homes converted back to owner occupancy.”

Although the media skews the narrative by only reporting investor acquisitions and not dispositions, Parsons points out that according to John Burns Research & Consulting, institutional investors in SRF comprise only three percent of all single-family rentals and less than one percent of all single-family homes.

The growth in institutional single-family rentals has not been at the expense of individual owners. “As a group, investors sold more than they bought over this time period. The real shift has been from mom-and-pop investor exists over the past decade to take advantage of high sale prices and escape the ever-increasing headaches of property management, which has offset growth among larger national SFR firms,” said Parsons.

He explains that barriers to homeownership are real and that the upward trend over the past decade could be in jeopardy from high home prices and interest rates. But, he posits, instead of fearmongering about investors, the focus should be on supply—adding more housing of all types—and affordability, which is directly related to supply.