The latest commercial property price report from MSCI Real Capital Analytics said that multifamily property prices fell 0.5 percent from their level of the month before in June. While still negative, this is less than last month’s reported decline of 1.0 percent. Prices were down 7.5 percent from their level of one year ago.

Defining CPPI

MSCI tracks an index called the Commercial Property Price Index (CPPI). The index is computed based on the resale prices of properties whose earlier sales prices and sales dates are known. The index represents the relative change in the price of property over time rather than its absolute price. Note that, as new properties are added to the MSCI dataset each month, they recalculate the CPPI all the way back to the beginning of the data series.

Apartment price declines moderate

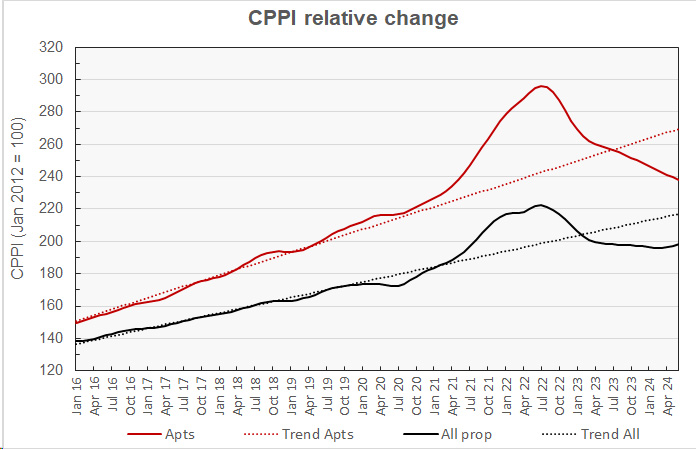

The first chart, below, shows how the CPPI’s for all commercial property as a single asset class and for apartments have changed since January 2016. To simplify the comparison, both CPPI’s have been normalized to values of 100 in January 2012. The chart also contains trend lines showing the straight-line average rates of price appreciation for the two asset classes based on their performances from January 2012 to December 2019.

The chart shows that multifamily property prices have been falling steadily since early 2023. Multifamily property prices are now down 19.6 percent from their peak but are still 12.2 percent above their level in January 2020. They are 11.7 percent below their pre-pandemic trend.

Prices for all commercial property as a single asset class are down 10.8 percent from their peak but are 14.2 percent above their level in January 2020. They are 8.7 percent below their pre-pandemic trend.

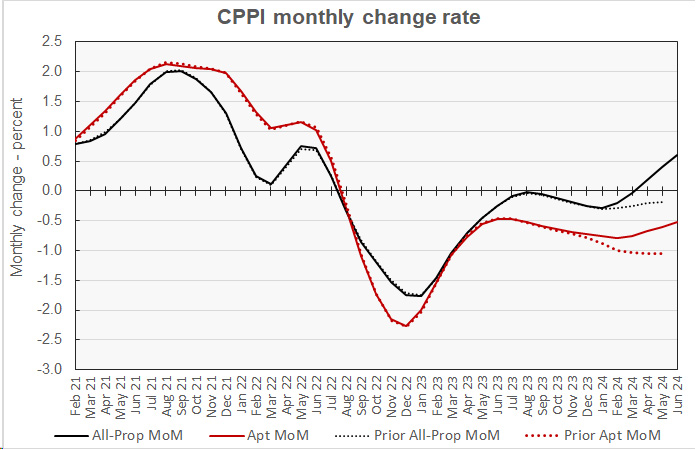

The next chart plots the month-over-month changes in the values of the CPPIs since January 2021 for all commercial property as a single asset class and for apartments. It also includes the same values based on the data included in last month’s report.

The chart shows that updates to last month’s data were positive for both multifamily property and commercial property price trends. While multifamily property prices are still declining, the rate of decline over the last several months is now seen to be lower than indicated by last month’s data.

Overall commercial property prices are now seen to have been rising over the last 3 months, while last month’s data indicated that they were continuing to fall.

Multifamily lags other property types

June’s data indicate that multifamily property was the only asset class to see its price level fall month-over-month. Even prices for offices in central business districts (CBDs), the long-term laggard, managed to break-even month-over-month in June. Industrial property continued to lead in price growth with a rise of 0.7 percent for the month. Prices for retail property rose 0.5 percent for the month while prices for suburban offices rose 0.3 percent.

Industrial property continued to be the best performing property type on a year-over-year basis, with prices rising 8.0 percent. Prices for offices within CBDs were down 24.7 percent while prices for suburban offices fell 7.5 percent. Prices for retail property were up 0.7 percent year-over-year.

Major metro commercial property prices have suffered

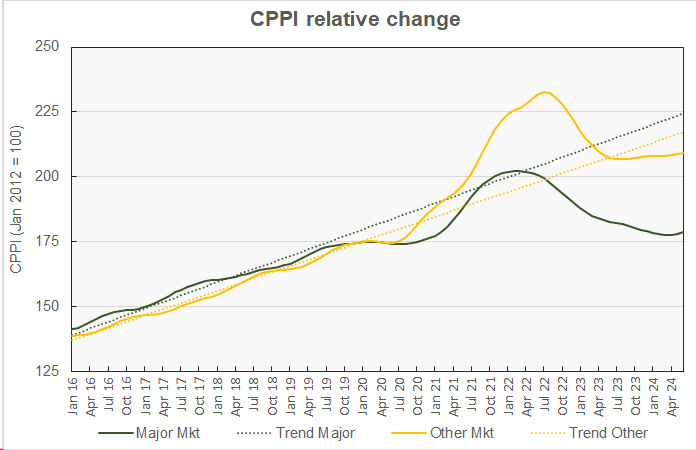

The MSCI report provides data comparing the price changes of commercial property in 6 major metro* areas against those in the rest of the country, although it does not separate out apartments from other commercial property types in this comparison. The next chart, below, plots the history of the relative price indexes since January 2016 for both market segments, along with trend lines based on straight-line fits to the changes in these indexes between January 2012 and December 2019. For purposes of this chart, both price indexes were set to values of 100 for January 2012.

The chart shows that the CPPI for major metro commercial property has fallen 11.7 percent from its peak but is now 2.2 percent above its level in January 2020. It is 20.5 percent below its long-term trend. The non-major markets CPPI has now fallen 10.2 percent from its peak but is 19.5 percent above its level in January 2020. The non-major metro CPPI is 3.7 percent below its pre-pandemic trend.

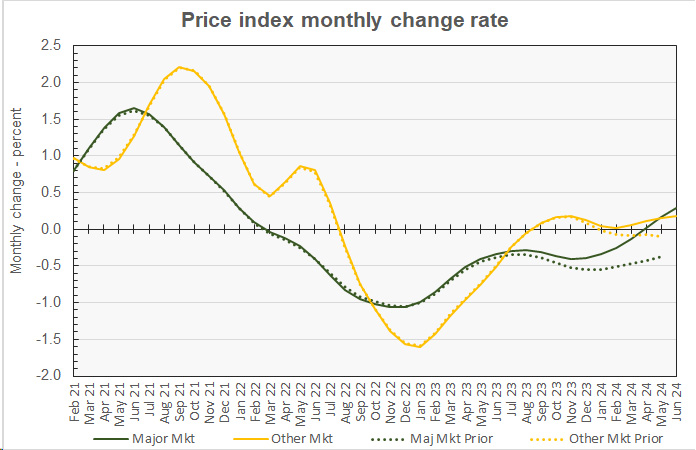

The final chart plots the history of the month-over-month changes in the price indexes for the two property markets since January 2021 along with last month’s monthly price change data.

This month’s updates to the data sets painted more positive pictures of the recent price growth for both market segments. Month-over-month price changes for properties in major metros, which had been seen to be negative since March 2022, are shown to be positive for the last 3 months based on the new data. Month-over-month price changes for properties in non-major markets, which had been seen to have experienced 5 months of decline in last month’s data set, are shown to have had 10 months of positive, if limited, growth based on this month’s updated data.

By the numbers, price appreciation for commercial property in major metros was reported to be 0.3 percent for the month but -2.3 percent for the year. Prices for commercial property in non-major markets were reported to be up 0.2 percent for the month and up 0.8 percent year-over-year.

The full report provides more detail on other commercial property types. Access to the MSCI report can be obtained here.

*The major metros are Boston, Chicago, Los Angeles, New York, San Francisco and Washington DC.