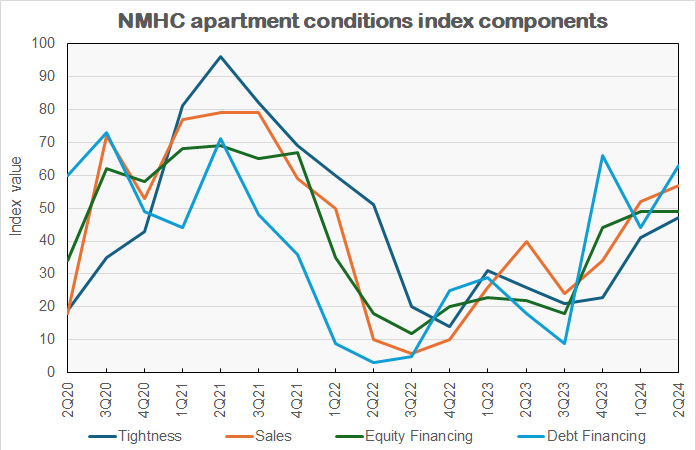

Apartment market conditions came in mixed in the National Multifamily Housing Council’s (NMHC’s) Quarterly Survey of Apartment Market Conditions for July 2024. While the Debt Financing (63) and Sales Volume (57) indexes indicated more favorable conditions this quarter, Equity Financing (49) and Market Tightness (47) came in below the breakeven level (50).

“Concessions have become commonplace in markets with elevated levels of deliveries, as survey respondents reported overall looser market conditions for the eighth consecutive quarter,” noted NMHC Economist and Senior Director of Research, Chris Bruen. “Yet, this has not been for a lack of demand, which is helping to absorb this new supply at a healthy pace.”

“The 10-Year Treasury yield fell 25 basis points (bps) over the past three months as inflation edged closer to the Federal Reserve’s 2% target and the labor market began to show some signs of cooling. This has led to more favorable conditions for debt financing and a second straight quarter of increasing sales volume, even while a plurality of respondents report unchanged conditions.”

• The Market Tightness Index came in at 47 this quarter – below the breakeven level of 50 – indicating looser market conditions for the eighth consecutive quarter. Half of respondents, though, thought market conditions were unchanged compared to three months ago while 27% thought markets have become looser, down from 37% in April. Twenty-two percent of respondents reported tighter markets than three months ago.

• The Sales Volume Index reflected a second straight quarter of increasing deal flow – after seven consecutive quarters of decline – with a reading of 57. The plurality of respondents (46%) reported sales volume to be unchanged from three months ago. Thirty-two percent of respondents reported higher sales volume this quarter, increasing from 6% of respondents in January and 21% in April, while 18% thought volume was lower.

• The Equity Financing Index again came in at 49 – just under the breakeven level (50) – marking the tenth consecutive quarter in which equity financing became less available than three months prior. Sixty percent of respondents this round reported availability of equity financing to be unchanged from three months ago, while 13% thought it more available and 16% thought it less available.

• The Debt Financing Index reading of 63 indicated more favorable conditions for debt financing compared to three months ago. A plurality of respondents (44%) felt debt financing conditions were unchanged, down from 59% in April, while 37% reported now was a better time to borrow than three months ago. Eleven percent of respondents believed borrowing conditions were worse than three months ago.

While equity financing continues to be less available than quarters prior, and a tight monetary policy environment persists, deal flow and opportunities to transact are showing signs of a rebound. Although a plurality of Quarterly Survey respondents (45%) thought opportunities for apartment transaction were about the same as three months ago, 28% believed there were more properties that would fit their transaction criteria compared to three months ago. Conversely, 19% believed there were fewer properties that would fit their transaction criteria.

The history of the survey results is shown in the chart, below. They can also be viewed here.

About the Survey

The July 2024 Quarterly Survey of Apartment Market Conditions was conducted from June 26 – July 16, 2024. 174 CEOs and other senior executives of apartment-related firms nationwide responded.