Surging demand in Q2 2024 helps stabilize occupancy and rent growth and narrow the gap between supply and demand, according to RealPage Market Analytics. RealPage market analyst Carl Whittaker thinks this is a sign the market has turned a corner.

Occupancy remained at 94.2% in June, holding steady for three consecutive months, but only increasing 0.1 percent through the month.

While short of the standard, this increase represents a great testament to the depth of rental housing demand across the country and a sign that the occupancy freefall of 2022 and 2023 is finally stabilizing, said Whittaker on his LinkedIn page.

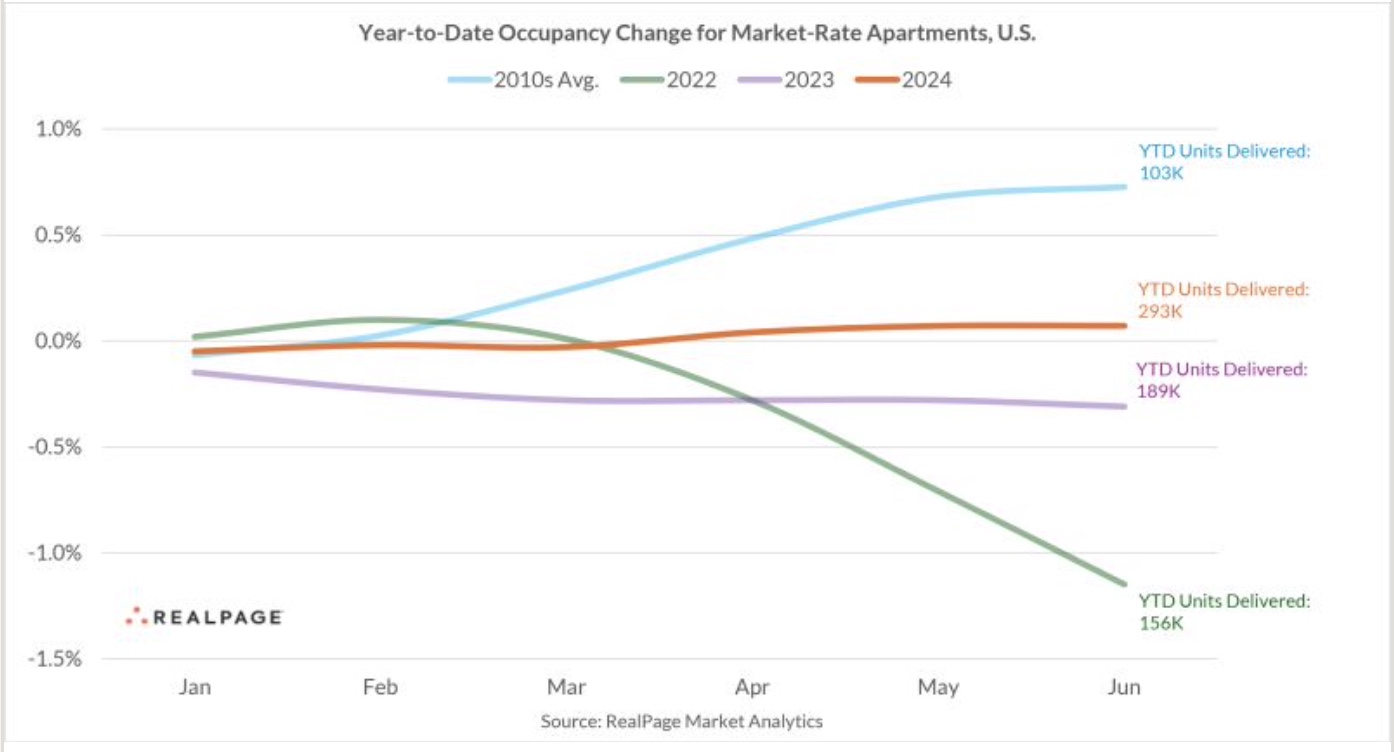

Rates fell by 1.2 percent between January 2022 and June 2022 and ultimately by a whopping 2.5 percent for the full calendar year 2022. Although by comparison things were better in 2023, they were still disappointing as year-to-date occupancy contraction through June was about 0.3 percent, as evidenced by the chart below.

Occupancy fell another half a percentage point through the following six months resulting in calendar year occupancy loss of 0.8 percent.

Occupancy fell another half a percentage point through the following six months resulting in calendar year occupancy loss of 0.8 percent.

“The single most impressive part of this chart though is today’s occupancy improvement within the context of generationally high supply. Year-to-date, an incredible 293,000 apartment units have delivered to market (basically a full year’s worth of supply in the 2010s). Despite massive supply headwinds though, apartment demand is doing quite an impressive job of maintaining momentum,” said Whittaker.

He notes that challenges are likely to persist through the end of this year with another 0.3 percent occupancy drop expected by year’s end, assuming the second half of the year is “normal” based on 2010’s cycle.

“Still, it’s hard to complain considering the past two years saw much larger drops,” Whittaker said.

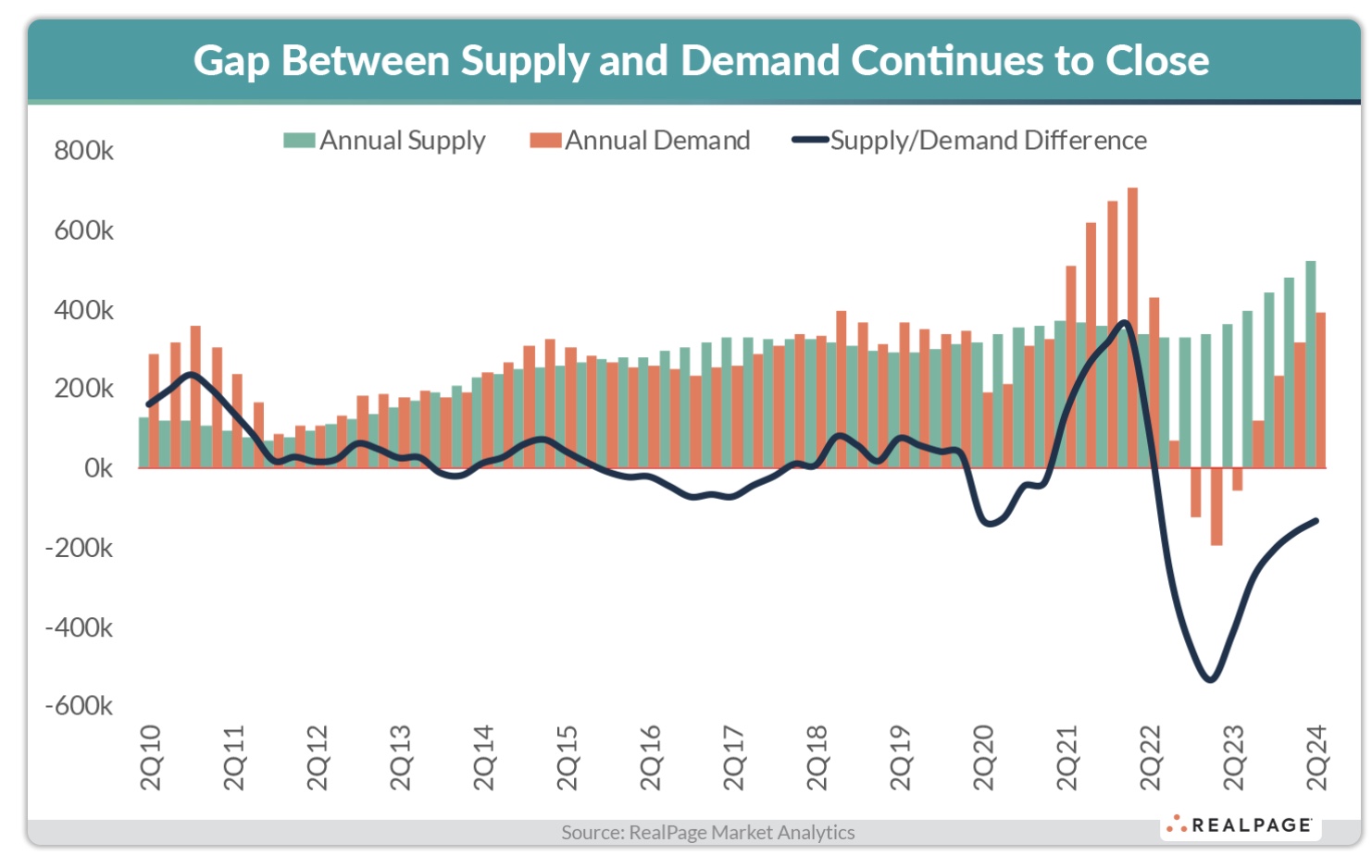

While supply has been the focus of media headlines, RealPage Market Analytics sees a remarkable surge in demand brewing. The impressive demand reading in the year-ending Q2 2024 is difficult to overstate, RealPage analysts write in a recent blog post.

Data reveals that some 390,000 apartment units were absorbed on net over the past 12 months, representing the eighth largest figure on record dating back to the start of the millennium. Only the figures from the pandemic-era boom from mid-2021 to mid-2022, the year-ending third quarter 2018 and the year-ending fourth quarter 2000 outpaced that of the past 12 months. More impressive in the context of the pandemic boom is how many units have been absorbed year-to-date, said RealPage.

During the first two quarters of the year, some 257,000 units have been absorbed—essentially in line with the all-time high set during the pandemic when about 270,000 units were absorbed in the first half of 2021.

While the gap is closing, record supply still outpaces demand. More than half a million new market-rate apartment units delivered in the past 12 months, representing not only a 45 percent increase from the same time horizon in the previous 12-month period, but the highest total number of apartment units delivered since 1986, said RealPage.

Though demand is arguably exceptional by historic norms, rent growth has yet to respond in a congruent manner. This ultimately points back to the interplay between supply and demand, whereby a four-decade peak in new deliveries is keeping rent expansion modest.

While rents grew 0.2 percent in the year-ending June, analysts think it unlikely that rent growth will accelerate considerably this calendar year.

“Still, stabilization of rental rates considering the background of a two-generation supply wave supports the idea of incredible demand capacity in the market today,” said RealPage.