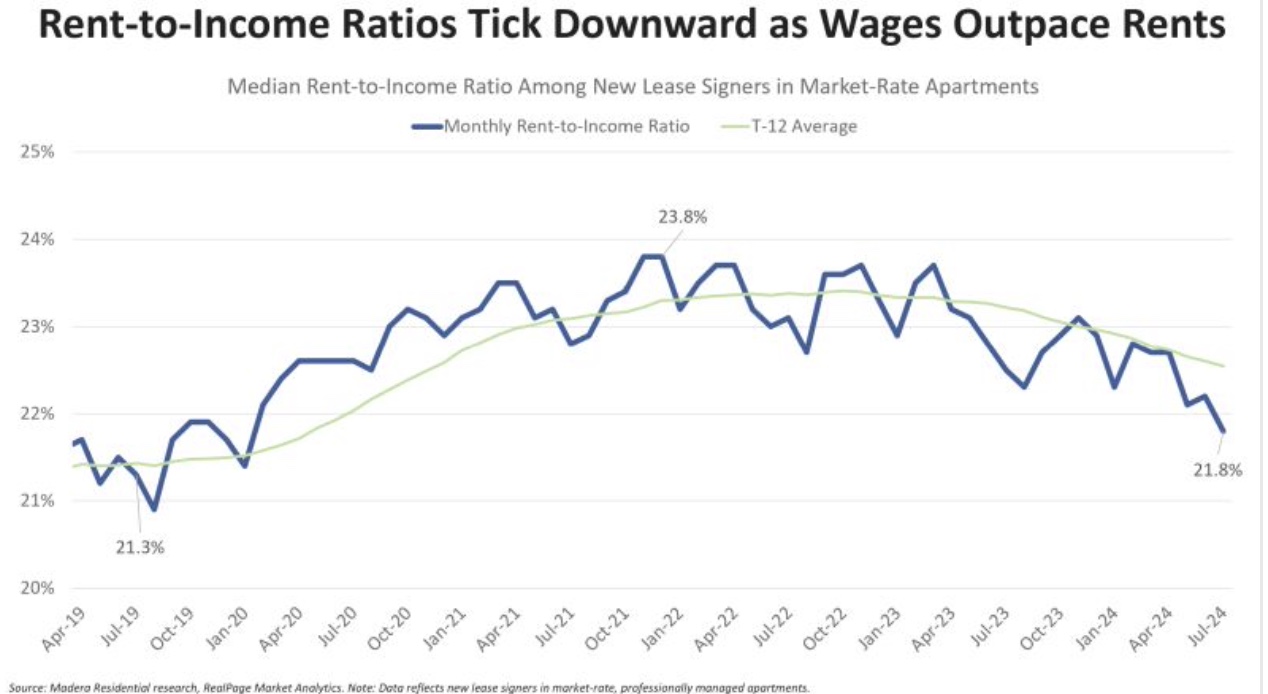

Affordability is re-emerging as a tailwind for market-rate apartments. One takeaway from data discussed on a RealPage podcast this week is that rent-to-income ratios have returned to pre-pandemic levels, suggesting affordability issues are easing. Some analysts expect the ratio will decrease further due to continued wage growth outpacing rent growth.

RealPage looked at eight different types of renter households that make up the nation’s renter cohort and examined product selection behaviors, all of which can be useful to landlords.

RealPage chief economist Carl Whittaker joined market analyst Adam Good to devise a renter segmentation analysis using census data that highlights individual years of age and data from the Pew Research Center, which defines generations by birth year. The National Association of Realtors contributed the median first-time homebuyer age and RealPage Analytics contributed and the median renter age.

RealPage chief economist Carl Whittaker joined market analyst Adam Good to devise a renter segmentation analysis using census data that highlights individual years of age and data from the Pew Research Center, which defines generations by birth year. The National Association of Realtors contributed the median first-time homebuyer age and RealPage Analytics contributed and the median renter age.

Since 2018, the median renter age has held static at around 31 and 32, with a growth rate of 39 percent. According to data from the Federal Reserve Bank of St. Louis, the working adult age population is 15 to 64 years of age.

The RealPage podcast shared detailed segmentation analysis based on more than five million signed lease transactions, revealing that 50 percent of renters start out as first-time renting singles (27 percent) and roommates-by-necessity (24 percent). These renters are typically aged 31, earn $73,000 annually, live in a 900 sq. ft unit and spend 22 percent of income on rent

Single renters typically opt for Class B or C properties in lower-priced metros and are found in high concentration in Midwest and Sunbelt metros. This cohort is sensitive to pricing increases and tends to struggle during economic downturns

Renters-by-necessity are nearly identical to starting-out singles, but live in roommate situations, have a median age of 28 and a combined income of $90,000 annually. They typically choose two-bedroom units in high-cost markets like California, Boston, Miami and Seattle and tend to relocate often for job opportunities, meaning renewals among this group are rare.

Affluent singles, a cohort that has grown due to the increasing median age of marriage, and observed to be older than expected, have a median age of 36 and median income of $75,000 to $100,000 per year. Affluent singles tend to live in urban cores once known as live, work, play neighborhoods, or high-end suburbs, and are less sensitive to economic downturns.

Young couples are a demographic with a median age of 31 and combined income of $81,000. They often have pets and prefer two-bedroom units, spending 21 percent of their income on rent. Meanwhile, established married couples are typically in their mid- to late 30s with six figure incomes and a 17 percent rent-to-income ratio. They typically opt for luxury units.

Roommates-by-choice typically have combined incomes between $40,000 and $50,000 and prefer middle-tier suburban apartments.

Families with children are typically in their mid-30s and choose more affordable suburban areas rather than faster growth or high rent, high-cost-of-living markets. They have relatively low earnings of about $75,000 and therefore spend a bit more of their income on rent. Only six percent of the national renter base falls into this category.

Independent seniors, the oldest cohort with a median age of 59, is the easiest to keep happy, data reveals. They are empty nesters or recently divorced, many on social security, who have no desire for home maintenance. They prefer Class B and C assets, mostly in the suburbs. They tend to pay rent on time and rarely move, good news for landlords who choose to market to this group.

Jay Persons, Madera Residential multifamily housing analyst, dove into the data on his LinkedIn page, pointing out that rental affordability is a bifurcated issue.

“Two things can be true,” he said, adding that today’s debates around affordability are lacking two nuances.

One, there’s been plenty of demand for market-rate apartments at todays and yesterday’s levels, and, two, there is a severe shortage of affordable and attainable housing among those who cannot afford market-rate rentals, a problem that existed long before COVID, he said.

The chart below shows that renters signing new leases for market rate rentals in July were paying 21 percent of their income toward rent, down from a peak of 23.8 percent in 2022, said Parsons.

“Wage growth has outpaced new lease rent growth by a wide margin for more than 18 months and continues even as rent growth has evaporated in most markets due to an apartment supply wave at 50-year highs,” Parsons said. He feels optimistic the trend will continue.

“Median rent-to-income ratios are on track to be back within the realm of pre-COVID norms of 21 to 22 percent by the end of this year. The July numbers suggest we’re already there, but we’ll give it a few months to make sure it sticks,” he said.

Contrarian headlines claiming the opposite are caused by analysts using apples-versus-oranges data, he said.

“They’re mix-matching datasets covering different sets of people and different renting situations,” he said.

And instead of being narrowly focused on renters signing a new lease in a market-rate apartment and using reported income from lease applications, they use the actual rent renters are paying. The blind spot is renewals, he said, but thinks with a typical stay of two to three years, most analysts are unlikely to see a meaningful upward shift in their ratio.

“We’ve added 1.3 mm market-rate apartment households, on net, over the last four years and they’ve come in with median rent-to-income ratios of 22-24 percent, well below the affordability ceilings widely believed to be 30 to 33 percent,” he said.

Parsons points out that millions still cannot afford a market-rate unit. Inflationary pressures have affected lower income household’s ability to pay rent, while higher income households have not been so impacted. This is why the nation needs more affordable and attainable housing, he said.

The podcast is available here.