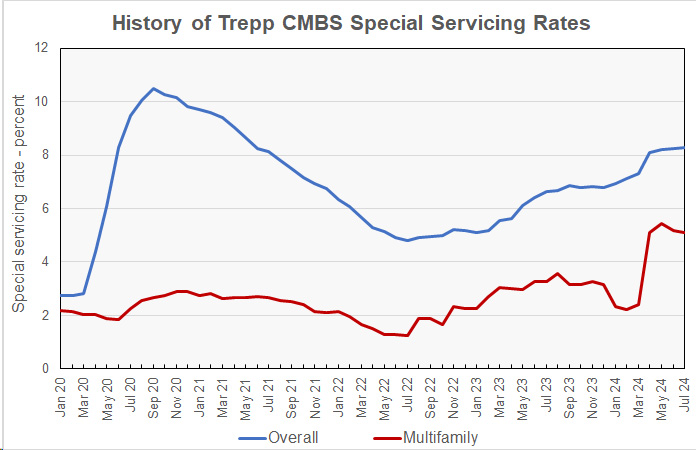

Trepp reported that special servicing rate for multifamily commercial mortgage-backed securities (CMBS) loans moderated slightly in July, falling 6 basis points. However, the overall CMBS special servicing rate on commercial property rose driven by a rise in the rate for loans on offices.

Multifamily CMBS special servicing rates lower

In July, the special servicing rate on CMBS loans on multifamily property declined for the second straight month. However, it remained at an elevated level after jumping higher in April. While the July rate is down 6 percent from its recent high, it is over 4 times the low it reached in July 2022.

The report found that the overall CMBS special servicing rate rose to 8.30 percent, up from 8.23 percent the month before. The rate is still well below the level of 10.48 percent it reached in September 2020.

The special servicing rate on CMBS loans on industrial properties continues to be the lowest of any commercial property type covered. This month, it ticked down 3 basis points to 0.40 percent. The rate on lodging property loans rose 5 basis points to 7.33 percent. The special servicing rate on office property loans was the big mover for the month, climbing 46 basis points to 11.25 percent. The rates on retail properties moved marginally higher, rising 7 basis points higher to 10.89 percent.

The history of the overall and multifamily CMBS special servicing rates as reported by Trepp since January 2020 is illustrated in the chart, below.

The full Trepp special servicing rate report can be found here.

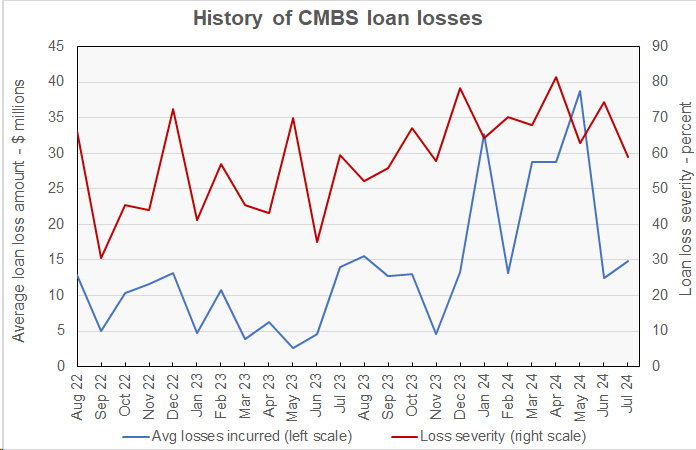

Loan loss severity plateaus

Trepp also recently reported on the volume and severity of loan losses on CMBS loans which were resolved in July, although it does not break down the data by the type of property covered by the loans. The history of this data since August 2022 is shown in the next chart. The chart shows the average loss incurred per resolved loan along with the average percentage of a resolved loan’s value that was lost during resolution.

The chart shows that the severity of CMBS loan losses dropped to 58.9 percent in July, with an average loss per loan of $14.9 million. The number of loans resolving in the July fell to 8 from 12 in June. However, the total dollar value of the loans that resolved rose slightly to $201.8 million from $200.1 million in June.

Since monthly loan loss data can be volatile, Trepp also reports on the 12-month trailing average loss severity. This figure had been steadily climbing for the last year but it edged lower this month, falling to 63.98 percent from a level of 64.21 percent last month. It had been 50.95 percent in August 2023.

The July loan loss severity report can be found here.