Multifamily concession offerings are on the rise nationally as rent growth slows. According to Fannie Mae, almost 21 percent of multifamily units were offering concessions averaging five percent as of Q2 2024.

The return of freebies as a lease-signing incentive has been expected, due to elevated new supply that has entered many larger metros.

Zillow puts the number of units offering concessions even higher, reporting that the share of rental listings on its site offering free weeks of rent or free parking climbed to 33.2 percent in July, up from 33 percent in June and 25.4 percent a year earlier. More new multifamily units were completed in June than in any month in the past 50 years.

Rent increases slowed in July for the second month in a row, Zillow said. Multifamily rents are up historically 5.1 percent since July 2022, which is a normal trajectory compared with increases of 22.3 percent that occurred at the outset of the pandemic.

Rent concessions are higher from a year ago in 45 of the 50 largest metros on Zillow’s site, with the annual increase in the share of listings with a concession being highest in the Sunbelt markets of Jacksonville, Charlotte, Raleigh Altanta and Austin.

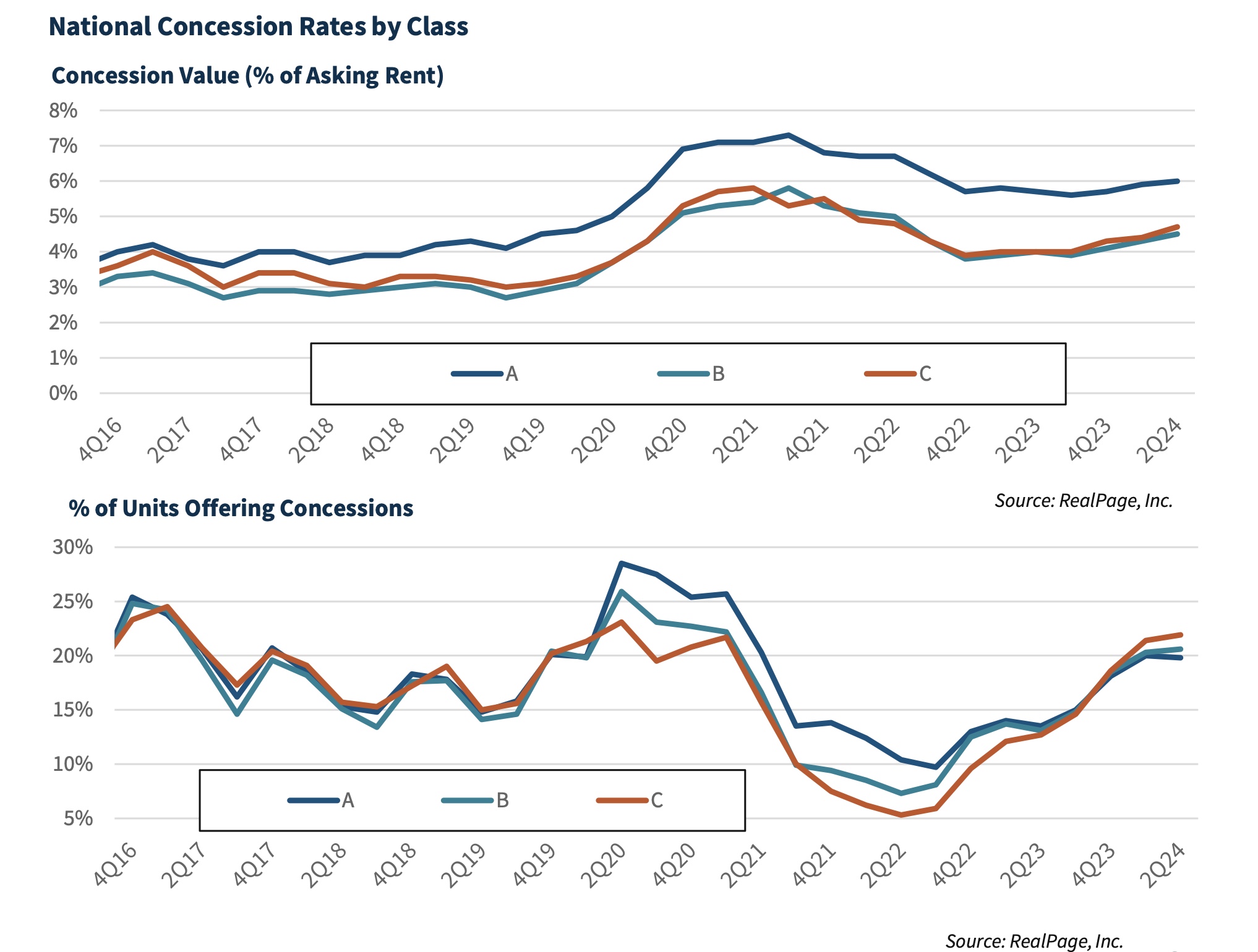

Fannie Mae noted that the level of apartment concessions differ between unit classifications, while the trajectory is the same.

The highest number of concessions offered is for Class C units, followed by Class B and then Class A. As of Q2 2024, an estimated nearly 20 percent of Class A units were offering concessions, up from 13.5% a year ago. While Class B units offering concessions were 20.6 percent in Q2, compared with 13.1 percent a year ago. The percentage of Class C units offering concessions increased to 21.9 percent, up from just 12.7 percent during the same quarter in 2023.

See chart below.

Fannie Mae predicts managers of Class C properties will need to continue offering concessions in the near term, since, “many tenants are dealing with higher debt levels and above-average inflation,” said Fannie Mae.

Fannie Mae predicts managers of Class C properties will need to continue offering concessions in the near term, since, “many tenants are dealing with higher debt levels and above-average inflation,” said Fannie Mae.

“It is important to note that, for units offering concessions, concession levels remain below one month’s free rent, or 8.3 percent. Still, we expect that both the value of concessions and the number of units offering them will keep increasing in 2024, primarily in oversupplied metros,” wrote Fannie Mae.

The return of apartment rental concessions has caught the attention of mainstream media. The Wall Street Journal (WSJ) printed a piece this month entitled, “Pay your rent, get 2 % cash back: Landlords join the craze for rewards.”

While traditional concessions include a month or two free rent or a discount on utilities at lease signing, landlords are embracing monthly reward formats, said the WSJ story. Rental reward companies discussed include Stake, which offers renters cash back for paying rent on time, and Piñata, a program that enables renters to accrue and cash in points for home goods, gift cards and other merchant products.

According to calculations, the benefits of these programs are much less than that of traditional concession offerings.

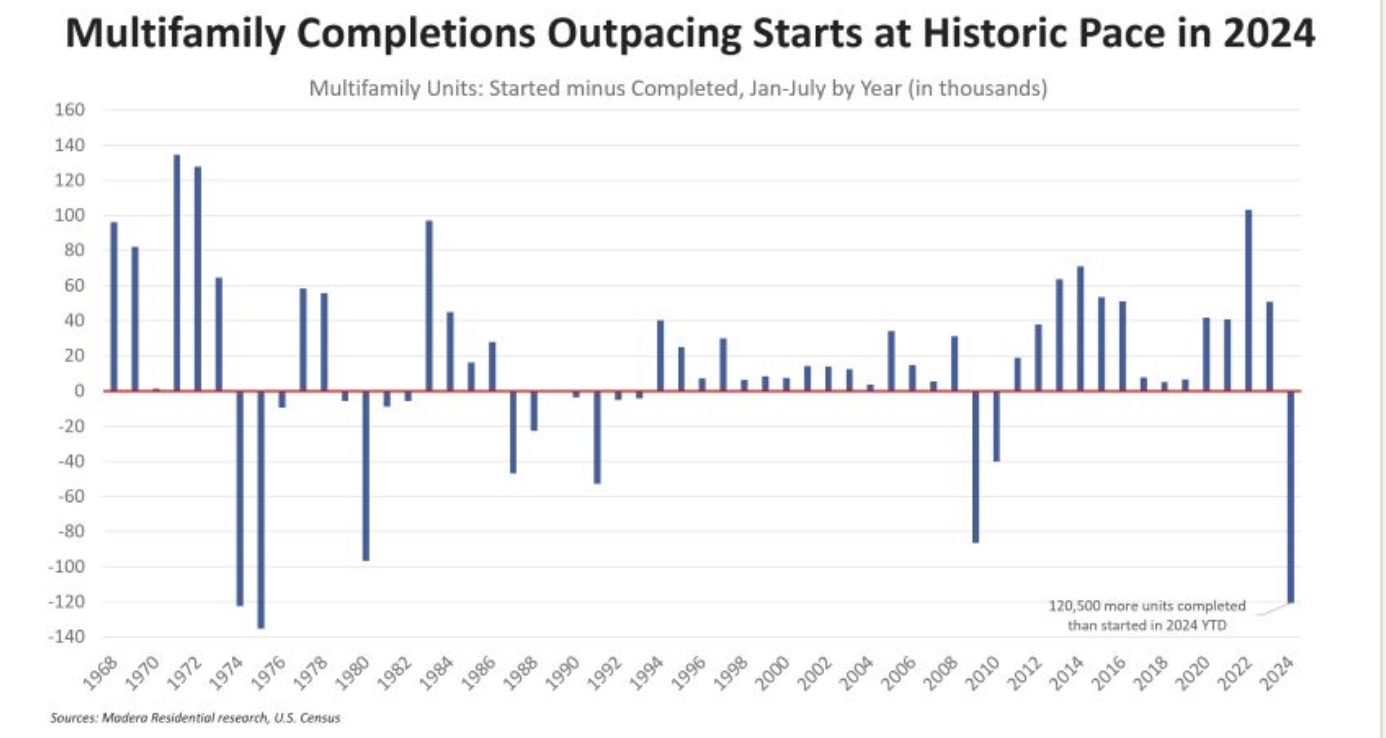

Meanwhile, the supply boom may have hit its peak, said Zillow. The number of units under construction has fallen in each of the past eight months.

According to Madera Residential Head of Investment Strategy & Research Jay Parsons on his LinkedIn page, apartment starts are at 11-year lows with multifamily completions outpacing starts by the widest margin (less than 120,000 units) since 1975. Through July 2024, 314,000 units have been completed while only 193,000 units have started, according to Census data.

“Supply is the biggest headwind for apartment investors today, while it’s an enormous tailwind for renters … but those dynamics appear likely to shift again,” said Parsons. He thinks today’s completion levels mark a generational high akin to the mid-1970s and likely are a once-in-a-career occurrence.