A report from the Mortgage Bankers’ Association (MBA) says that originations of multifamily mortgages in Q2 2024 were down 14 percent year-over-year. This is larger than last quarter’s 7 percent decline. Originations of all commercial mortgages as a single asset class rose 3 percent year-over-year.

Multifamily mortgage originations up from Q1

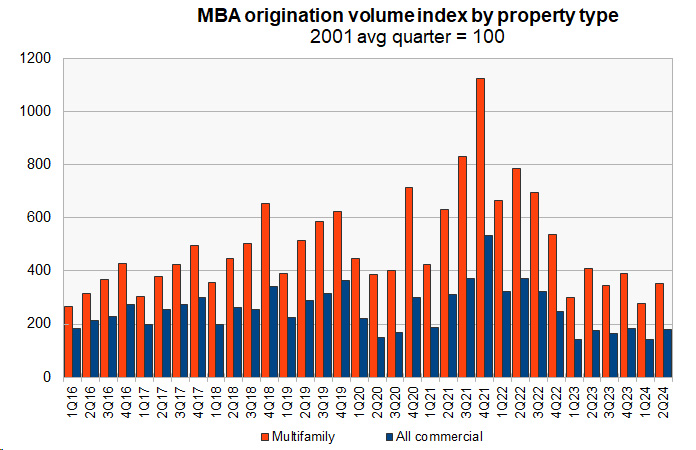

The first chart, below, shows the MBA’s quarterly origination volume indexes since Q1 2016 both for all commercial mortgages as a single asset class and for multifamily mortgages. The indexes are reported relative to the year 2001, with the average quarterly volume in that year defined as a value of 100.

The usual pre-pandemic pattern of mortgage origination volume was for origination volume to increase quarter-by-quarter through the year with Q1 mortgage origination volume declining from the level in Q4 of the previous year. The origination volume each quarter would be higher than that of the same quarter of the previous year.

So far in 2024, the pattern of quarter-by-quarter growth in multifamily mortgage originations is being maintained but the pattern of year-over-year growth is not. The volume of multifamily mortgage originations in Q2 is not only lower than that in 2023, it is the lowest since 2016. However, multifamily mortgage originations were up 27 percent in Q2 from their level in Q1.

The report covers originations for 5 other commercial property categories. They are office, retail, industrial, hotel and health care. Mortgage originations for industrial, hotel and health care properties all rose year-over-year. Industrial mortgage originations rose 77 percent year-over-year and 29 percent quarter-over-quarter. Hotel originations rose 172 percent year-over-year and 84 percent quarter-over-quarter. Health care originations rose 50 percent year-over-year and 178 percent quarter-over-quarter.

Mortgage originations for office property fell 29 percent year-over-year but rose 4 percent quarter-over-quarter. Retail property originations fell 7 percent year-over-year but rose 18 percent quarter-over-quarter.

Who’s lending

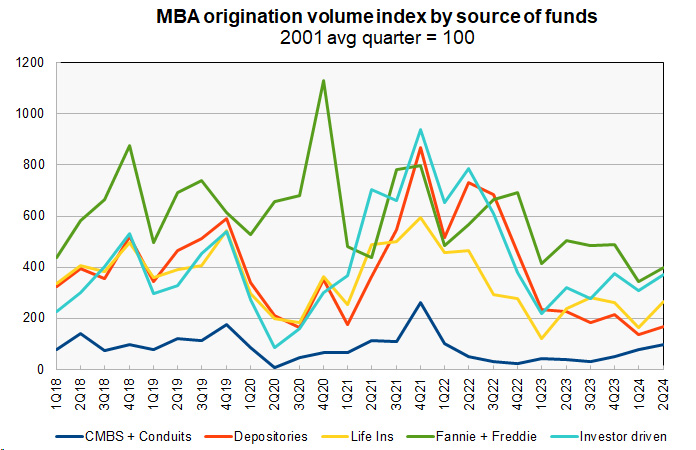

The MBA report also includes data on the sources of the commercial mortgages being originated. However, this section of the report does not break out multifamily mortgages from lending on other types of commercial real estate.

The report provides data on five categories of lenders: commercial mortgage-backed securities (CMBS) and conduits, depositories (aka commercial banks and savings and loans), life insurance companies, the government sponsored entities (GSEs), Fannie Mae and Freddie Mac, and investor-driven lenders such as REITs and specialty finance companies. The index values are quoted relative to the average quarterly origination volumes in the year 2001. The index values of different originators cannot be used to compare their absolute levels of mortgage originations since their origination levels in the baseline year of 2001 were different.

To gain insight into the absolute levels of funding provided by the different classes of originators, readers should look to the MBA’s report on mortgage debt outstanding. However, the origination index values can be compared to see which classes of originators are growing their business and which are not.

The final chart shows the history of commercial mortgage origination volume indexes since Q1 2018 by class of lender. It shows that all classes of lenders raised their commercial mortgage origination volume quarter-over-quarter in Q2.

The GSEs, who hold 48 percent of multifamily mortgages, saw their originations grow by 16 percent compared to Q1 2024. Depositories, who hold 30 percent of multifamily mortgages, grew their originations 21 percent quarter-over-quarter. Life insurers, who hold 11 percent of multifamily mortgages, raised their originations by 60 percent compared to Q1 2024. CMBS and conduits originations rose 21 percent quarter-over-quarter while invertor-driven lenders grew their originations by 20 percent.

On a year-over-year basis, commercial mortgage originations were down for the two largest classes of lenders. Originations fell 20 percent for the GSEs and 26 percent for depositories. However, commercial mortgage originations increased for the other classes of lenders, rising 11 percent for life insurers, 154 percent for CMBS and conduits and 17 percent for investor-driven lenders.

The full report from the MBA includes additional information on lending for other commercial property types. It can be found here.