In a mid-year look at the multifamily market, Berkadia reports that record levels of new supply are arriving but strong absorption is causing most of that new supply to be occupied.

Deliveries surge

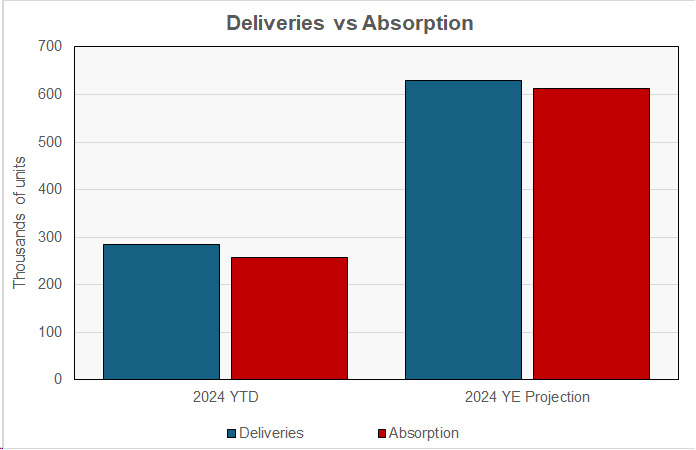

Berkadia anticipates that 2024 will have the highest number of deliveries in this cycle with 283,653 units already delivered in the first half of the year. By year-end, 629,153 new units are expected to hit the market. Berkadia expects net absorption of 612,115 units by year-end, equivalent to 97.3 percent of the new supply. This will result in the current occupancy rate of 94.2 percent rising slightly by the end of the year.

Rent growth is positive

Berkadia reported that rent growth on new leases at stabilized properties averaged 0.9 percent year-over-year in Q2 2024. However, 20 percent of new leases offered concessions, with concessions averaging 5 percent of rent at stabilized properties.

Berkadia reports that average apartment rent in Q2 reached $1,828 per month, significantly higher than the $1,743 estimated by Yardi Matrix.

Lease renewals performed better with average rent growth of 4.1 percent in Q2, with 54.3 percent of renters choosing to renew their leases. This renewal rate is up from the pre-pandemic average of 51.7 percent.

Sales lag as cap rate rises

The following table gives the mid-year sales statistics for the last 3 years as reported by Berkadia.

| Statistic | 2022 | 2023 | 2024 |

| Volume – billions | $59.3 | $14.6 | $18.4 |

| Transactions | 738 | 184 | 239 |

| Average rent | $1,736 | $1,809 | $1,828 |

| Price per unit | $359,762 | $316,565 | $327,204 |

| Cap rate | 4.0 | 5.2 | 5.6 |

| Units/property | 303 | 318 | 304 |

| Acres/property | 46.3 | 14.3 | 12.4 |

The data in the table show that the volume of transactions in 2024 is up slightly from last year’s level but is down significantly from the level in 2022. This is true whether measured by transaction count or by dollar volume. The price per unit is down 9 percent from 2022’s level and the average cap rate is up significantly over the last two years.

The full Berkadia report contains more information on individual markets. It is available here.