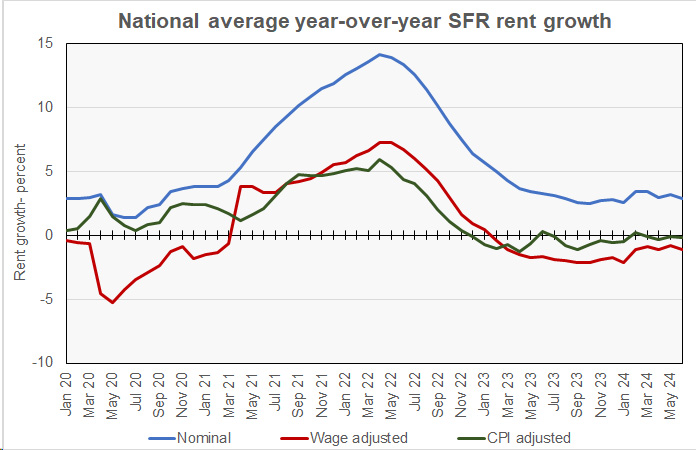

CoreLogic reported that their single-family rent index (SFRI) for June rose 2.9 percent from its year-earlier level. This is down 0.3 percentage points from last month’s reported year-over-year single-family rent growth rate and is down from the 3.3 percent annual rent growth rate reported in June 2023.

Nominal rents rise

The history of the overall SFRI growth rate since January 2020 is shown in the first chart, below. The chart shows both the nominal year-over-year single-family rent growth rate and also the wage-adjusted and CPI-adjusted rates. The wage-adjusted rate is the year-over-year nominal rate less the year-over-year rate of wage growth as measured by the seasonally-adjusted average hourly earnings of production and non-supervisory employees. The CPI-adjusted rate is the year-over-year nominal rate less the year-over-year rate of growth in the unadjusted consumer price index (CPI).

The chart shows a drop in wage-adjusted rent growth in 2020. This is due to many low wage workers being on temporary layoff during the pandemic lockdowns, artificially driving up average hourly earnings. When the lockdowns ended, most of these people went back to work, reducing average hourly earnings and retuning the wage-adjusted rent growth curve to its underlying trend.

The chart also shows that average wage growth has outpaced rent growth since February 2023.

For reference, Yardi Matrix found that single-family rent growth in June was 1.1 percent year-over-year as rents fell $3 for the month. However, Yardi Matrix focuses on properties of 50 or more units while CoreLogic takes a broader look at the single-family rental market, since small holdings represent a majority of the market.

Ranking the metros

CoreLogic reports the year-over-year rate of growth in the SFRI for a select group of metropolitan areas. Washington D.C., which was not included in last month’s report, came in at the top spot for year-over-year rent growth at 6.5 percent. Seattle and New York remained in second place and third places with growth rates of 6.1 percent and 5.4 percent respectively. St. Louis, the recent rent growth leader, fell to fourth place with single-family rent growth of 5.3 percent. Chicago rounded out the top 5 metros with rent growth of 4.9 percent.

Austin and Phoenix both saw rents decline again year-over-year in June. Phoenix saw rents fall by 0.8 percent year-over-year while Austin saw rents fall by 0.6 percent. Miami (+0.6 percent), Orlando (+1.0 percent) and Dallas (+1.6 percent) filled out the five metros with the lowest rent growth rates, just as they did last month.

CoreLogic is a data and analytics company. It calculates the SFRI using “a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service.” The CoreLogic report is available here.