Despite inflation cooling to the lowest level in more than three years in July, there’s no way around the fact that consumer prices in the United States have risen sharply over the past three years, as several factors came together to form a perfect storm of inflationary pressures.

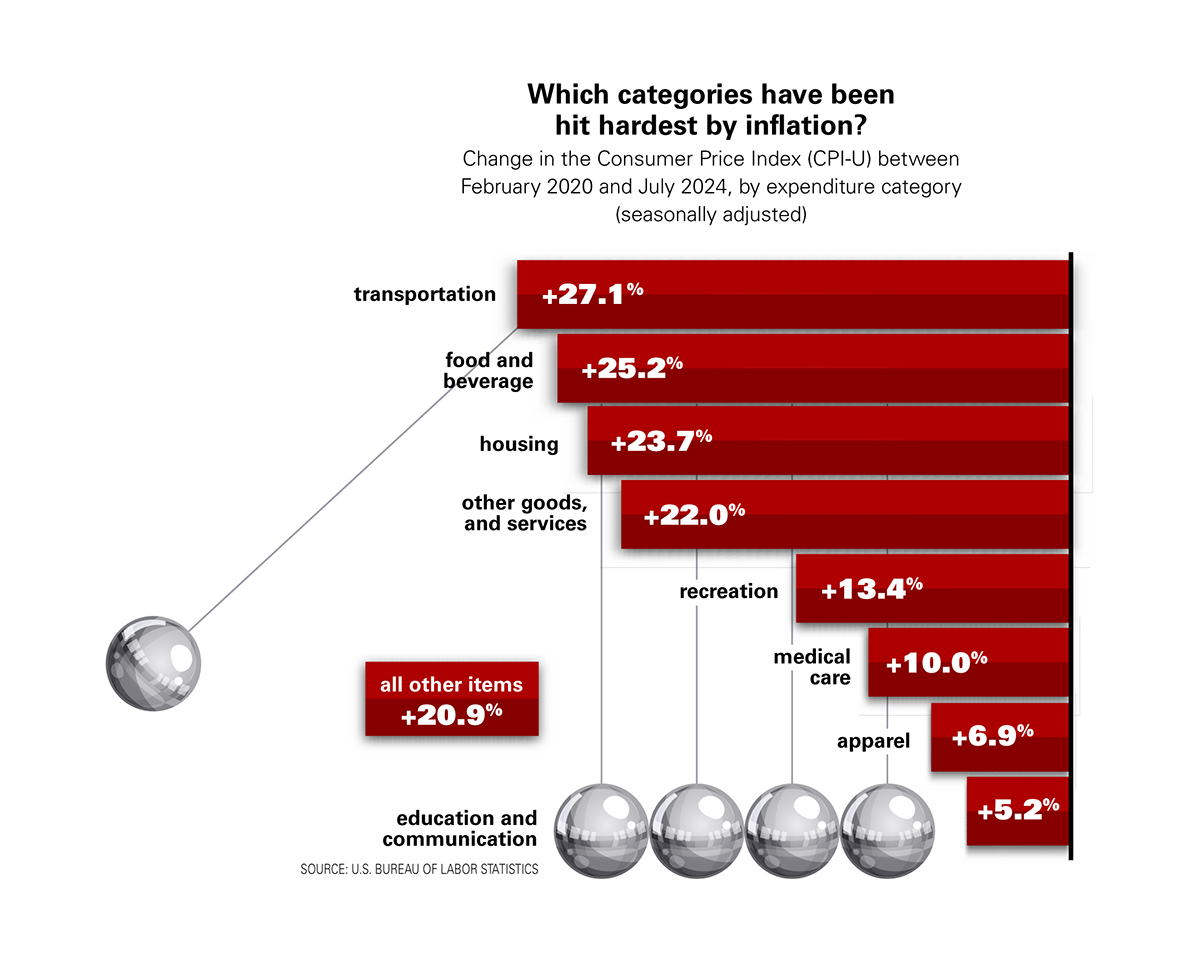

Since February 2020, the last month before the Covid-19 pandemic disrupted the global economy, the Consumer Price Index for All Urban Consumers (CPI-U) has increased 20.9 percent. Assuming the Fed’s targeted 2-percent inflation rate, prices would only have increased by 9.1 percent during that period, illustrating how severe the recent inflation surge has been.

Historic precedent

More importantly though, prices are going to remain elevated even if inflation returns to its target level of 2 percent, meaning that the effects of the inflation crisis will linger.

Not all prices are created equal, however, and while some expenditure categories have seen prices rise even more steeply than 20.9 percent since February 2020, others have barely budged.

The Consumer Price Index for Transportation, which includes new and used vehicles, airline fares, gasoline and others transportation- related goods and services, has risen most quickly since February 2020. At the other end of the scale, prices for education and communication, including for example tuition, postage and telephone services, increased by just 5.2 percent over the same period.

As energy goes…

Other expenditure categories with above-average price increases since the start of the pandemic are food and beverages as well as housing, which are up 25.2 and 23.7 percent since February 2020, respectively. Prices in recreation, apparel and medical care have seen more modest increases over the past four and a half years.

Data for the above chart follows the Bureau of Labor Statistics’ definition of eight major expenditure groups for this analysis, meaning that energy prices aren’t a category of their own, but are instead included in other categories according to their purpose.

For example, gasoline prices are included in the transportation category while household energy is included in housing.

When looked at separately, energy prices have seen the biggest increase of all, rising 30.4 percent since February 2020.