Recently, the Midwest has shown surprising growth and economic resilience, making this region an attractive candidate for multifamily development, investment and general interest.

Often considered the slowest growing region in the U.S., the Midwest has recently shown surprising improvements, both in the performance of its multifamily markets and in the resilience of the region’s economy. The outperformance comes amid a volatile economic backdrop—the Midwest’s relative stability is one of the region’s defining features and highlights its importance in any multifamily portfolio.

Attractive economic drivers

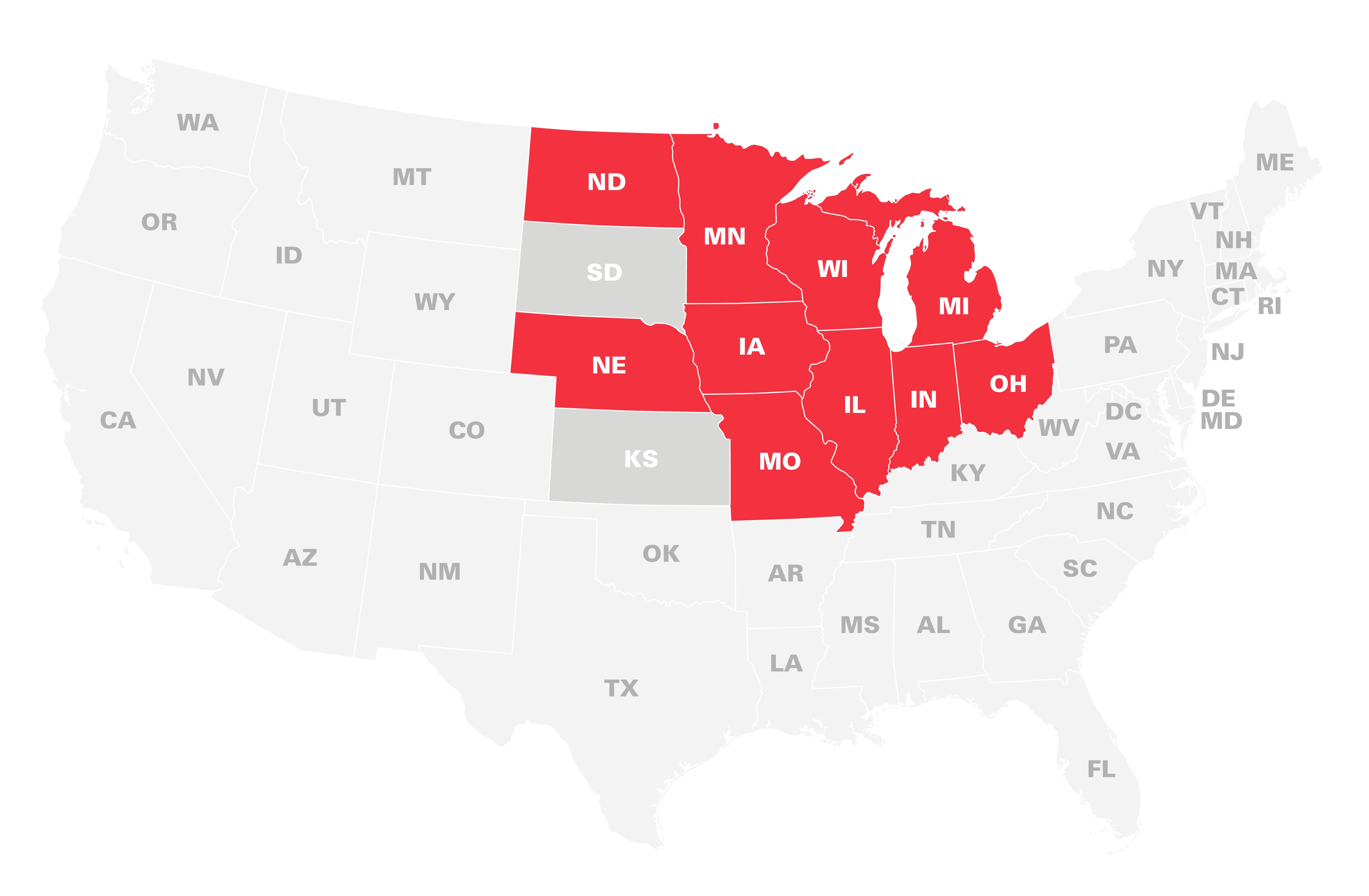

Highlighted states define the Midwest. Interest rates are the highest they’ve been in decades. The influx of jobs, population growth AND NEW HOUSING supply in several Sunbelt markets has slowed. this has led to multifamily building owners seeING flat or lower y/Y rent growth in the Sunbelt markets. As a result, we’re seeing markets that took a back seat in the last decade, begin to STEP INTO THE LEAD IN GROWTH. Several Midwest markets have led the nation in rent growth over the last year.

Most of the Midwest offers significant diversification in economic drivers. Eight of the top 10 Midwest markets rank among the most diverse markets in the country, according to the diversity index from Moody’s Analytics, which measures how closely a metro’s economy resembles the broader U.S. economy.

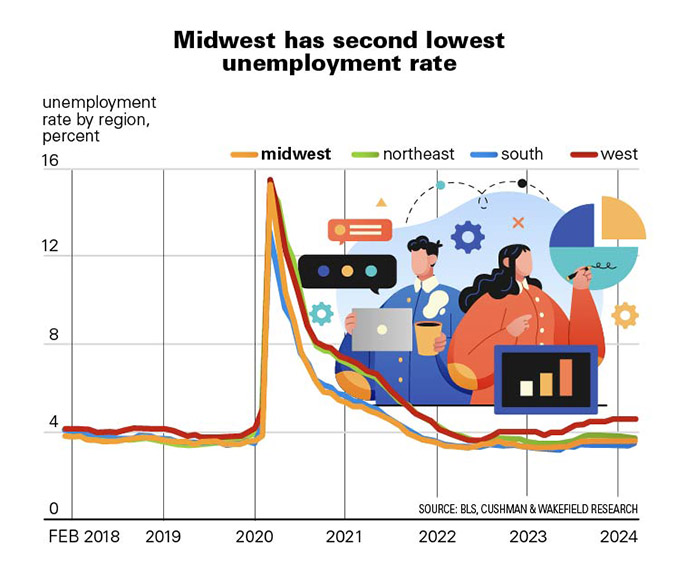

Diverse economies often grow slowly. As one economic driver accelerates, it is offset by a slower-growing sector that may not expand or contract as quickly. The Midwest had the second-fastest recovery from the pandemic of any region in the country, trailing only the Sun Belt. Since February of 2020, markets like Indianapolis and Kansas City have vastly outperformed, growing by 8.4 percent and 4.9 percent respectively, compared to the overall U.S. growth rate of 3.9 percent.

The region also has the second-lowest unemployment rate—only 10 basis points (bps) behind the Sun Belt. Over 80 percent of Midwest metros have unemployment rates below the national average, with Minneapolis posting the lowest among major metros, at 2.7 percent in April.

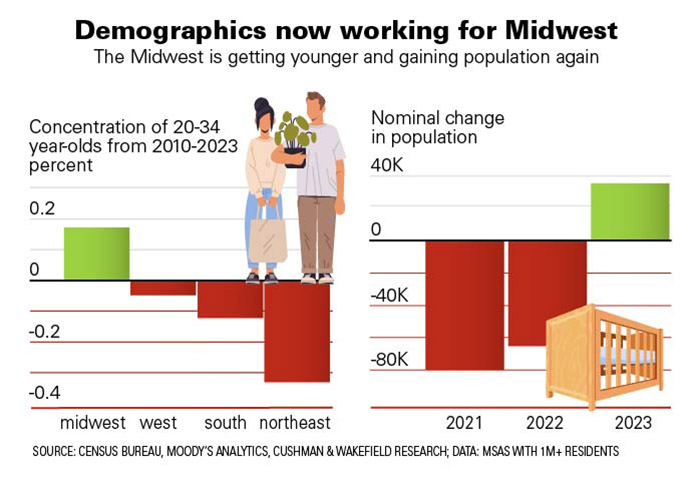

With the economic turnaround, the Midwest is starting to have its demographic fortunes reverse, especially regarding metrics associated with strong multifamily demand. Over the past 13 years, only the Midwest has added to its population concentration of 20-34-year-olds, the age cohort most likely to rent. Also, for the first time since the pandemic, the Midwest is adding population again. With a growing population that is getting younger, the multifamily market is poised for growth as these trends continue.

It’s not just economic growth that has helped foster positive demographic trends. The region is the most affordable of any in the U.S. Multifamily rents average $1,405, less than the national average of $1,823, and more than 10 percent less than the Sun Belt average. According to Lightcast, all but five metros have a cost of living below the U.S. average.

With the rise of remote work and a strong labor market, there is less impetus to move to larger cities for better job prospects, growth or more affordability.

High multifamily market demand

The post-pandemic euphoria in the multifamily space largely bypassed the Midwest’s multifamily markets, which now sets the region up for outperformance. The Midwest boasts low vacancies, a limited construction pipeline, and consequently some of the strongest rent growth in the nation. As a result of the economic and demographic rebound, demand has rebounded quickly, setting the region up for solid performance.

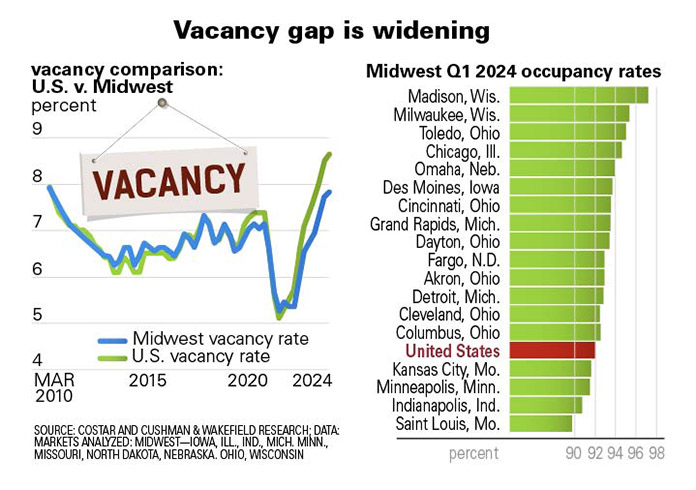

In the first quarter of 2024, the Midwest region recorded a vacancy rate of 7.8 percent, 90 bps below the national average of 8.7 percent, marking the largest delta in vacancy rates recorded since 2010.

The Midwest is currently outperforming the U.S. in fundamentals to a degree not seen since the Great Financial Crisis. While vacancy rates have risen nationwide, the Midwest has stabilized. Vacancy increased by only 10 bps, half the national rate. In the first quarter of 2024, the U.S. national occupancy rate was lower than that of Midwest markets, with 78 percent falling above it.

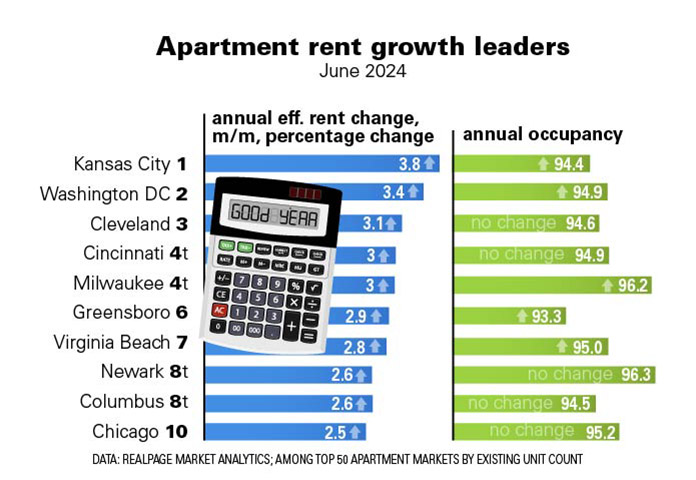

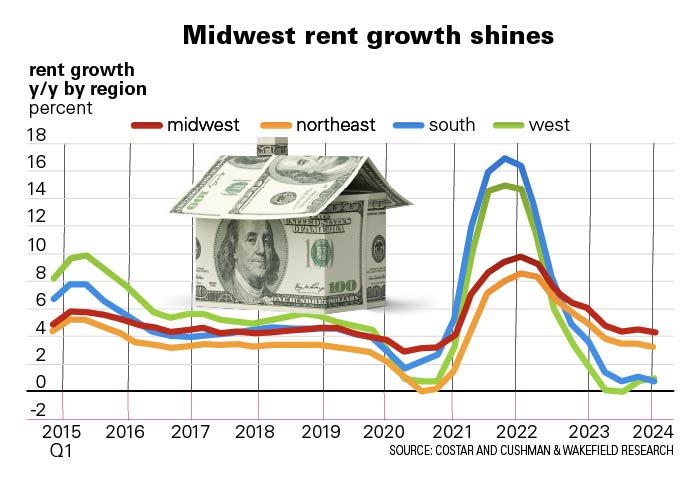

As the market normalized after the pandemic, the Midwest emerged as a leader for rent growth since the final quarter of 2022, outshining growth in the West and the Sun Belt.

During this period, the region averaged 4.9 percent year-over-year (y/y) rent growth, outpacing all other regions, which averaged 2.3 percent. It follows a consistent theme: During periods of economic volatility, the Midwest routinely outperforms.

During the depths of the pandemic in 2020, rent growth in the Midwest also outperformed all other regions. In the most recent quarter, all Midwest markets recorded positive rent growth well over the national average of 1.5 percent y/y. The strongest Midwestern markets included Grand Rapids, Michigan (+6.0 percent y/y), Dayton, Ohio (+5.7 percent y/y), Cleveland, Ohio (+5.4 percent y/y), Madison, Wisconsin (+4.8 percent y/y), and Milwaukee, Wisconsin (+4.6 percent y/y). Even Omaha, which recorded the least amount of rent growth in the Midwest was still 180 bps above the national average.

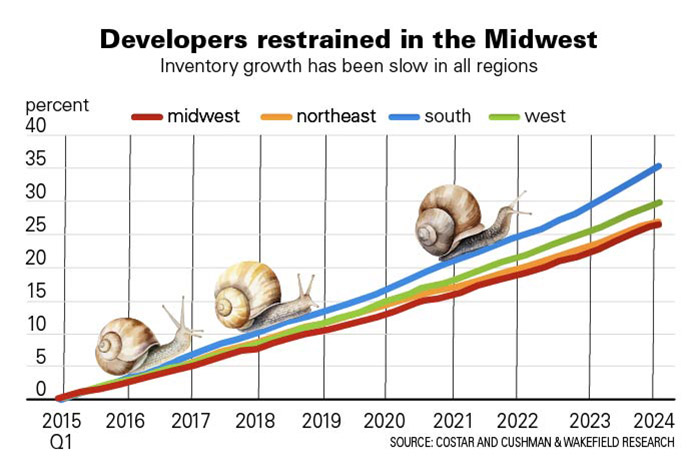

Looking toward the future, the easiest variable to forecast is new supply. Ramifications of the pandemic’s “bullwhip” effect are depicted in the graph: Capital migrated to the Sun Belt rather than being geographically distributed. As a result, the Midwest has had constrained pipelines. The region’s inventory has grown at a slower rate compared to other regions. Since the first quarter of 2015, inventory grew by 26.6 percent, 470 bps less than the 31.3 percent growth recorded nationally.

Meanwhile, demand remains strong across the region. In 2023, absorption increased by 65.5 percent y/y and posted a 24 percent increase in the first quarter of 2024 compared to one year prior.

The Midwest also has a significantly smaller pipeline moving forward, with a total of 3.4 percent of inventory currently under construction. Every other region in the country has more than 6.0 percent of inventory underway, nearly double the Midwest’s share.

Nationally, construction starts have slowed significantly, positioning the broader multifamily market for a rebound in 2025-2026 External Link. However, the Midwest is already ahead of the pack and will feel those effects sooner than other regions.

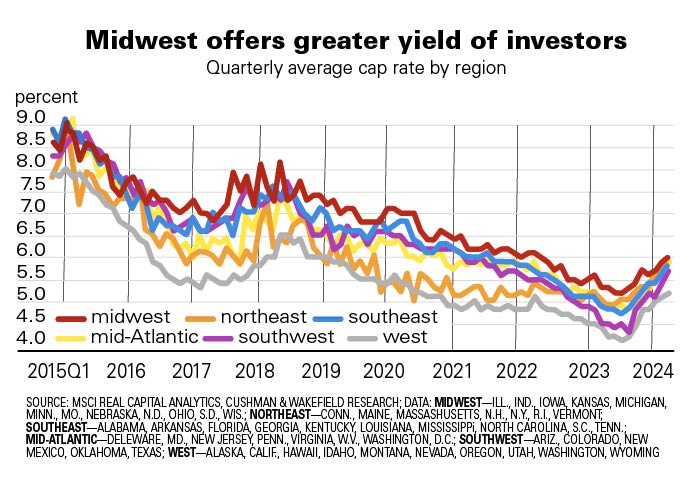

On top of the outperformance in fundamentals, the Midwest also generates more yield than other regions. In the 2024 Q1, the Midwest boasted an average cap rate of 6.0 percent, the highest among all U.S. regions, according to MSCI Real Capital Analytics. The next closest region is the Southeast, which averaged 5.7 percent.

Outsized yield is particularly compelling in a “higher-for-longer” era, meaning that higher yields are likely to drive returns if cap rate compression remains limited. The combination of strong fundamentals, a resurgent economy and high yields make a compelling case for including Midwest multifamily assets in any CRE portfolio.

The Midwest also has a significantly smaller pipeline moving forward, with a total of 3.4 percent of inventory currently under construction. Every other region in the country has more than 6.0 percent of inventory underway, nearly double the Midwest’s share.

The Midwest also has a significantly smaller pipeline moving forward, with a total of 3.4 percent of inventory currently under construction. Every other region in the country has more than 6.0 percent of inventory underway, nearly double the Midwest’s share.

Nationally, construction starts have slowed significantly, positioning the broader multifamily market for a rebound in 2025-2026. However, the Midwest is already ahead of the pack and will feel those effects sooner than other regions.

On top of the outperformance in fundamentals, the Midwest also generates more yield than other regions. In the 2024 Q1, the Midwest boasted an average cap rate of 6.0 percent, the highest among all U.S. regions, according to MSCI Real Capital Analytics. The next closest region is the Southeast, which averaged 5.7 percent.

Outsized yield is particularly compelling in a “higher-for-longer” era, meaning that higher yields are likely to drive returns if cap rate compression remains limited. The combination of strong fundamentals, a resurgent economy and high yields make a compelling case for including Midwest multifamily assets in any CRE portfolio.