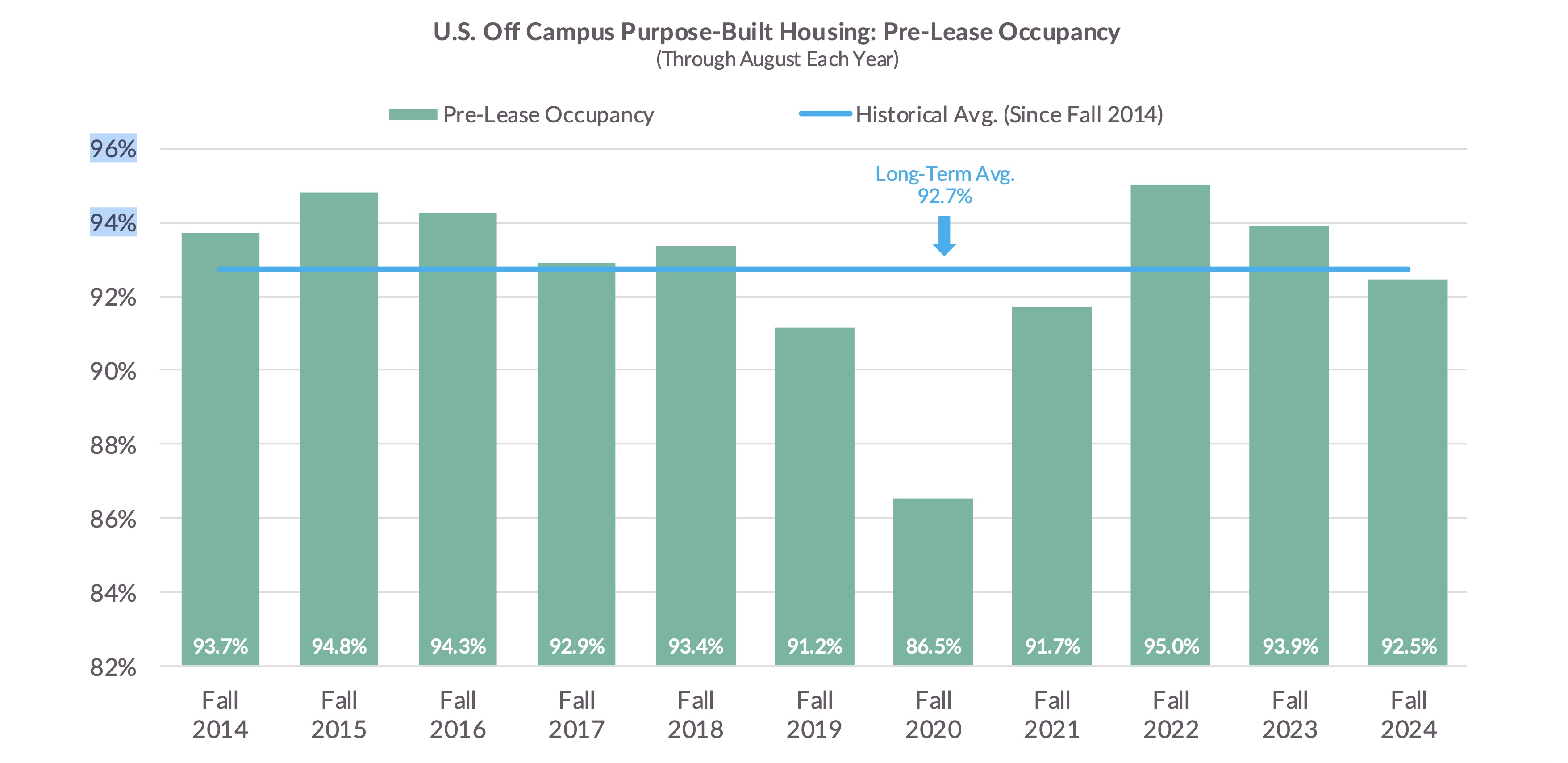

Student housing demand appears to be normalizing to a more sustainable trend after record occupancy rates in Fall 2022 and 2023. This is one of the take-aways from the student housing market update presented by RealPage’s chief economist Carl Whittaker and content manager Julia Bunch on September 25.

Bunch breaks the year into two halves, showing that Fall 2024’s first half was the all-star performer of pre-leasing velocity, but lagged in the second because of three key factors.

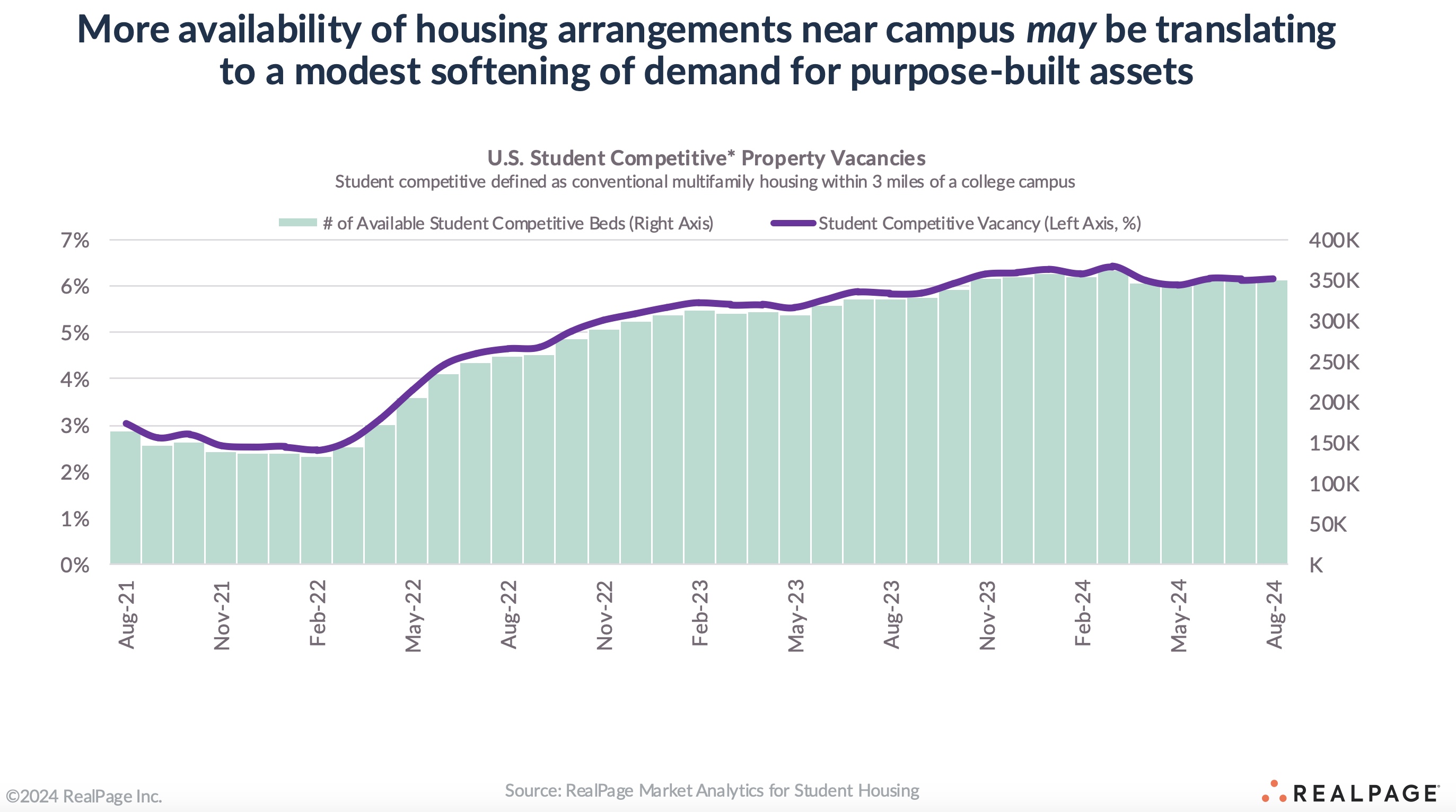

One is the availability of student competitive housing near campuses, two is a steadily declining enrollment trend even before 2024 and three is a widening divide between geographies of growth and decline, said the presenters.

Bunch said that the financial aid application system in place may be holding back some enrollment growth, but off-campus competitive housing, or what is called a shadow market, is the main driver.

“There’s just a lot more available housing units near college campuses today than there were two to three years ago,” said Bunch.

RealPage defines student competitive housing as any conventional market-rate property within three miles of a college campus.

“As of August 2024, that supply totaled about 350,000 student competitive beds that sat vacant, up a bit from last year, but way above the levels in 2021 and 2022 when it was hard to find any housing at all due to the post- pandemic rubber band effect on the demand side of things,” said Whittaker.

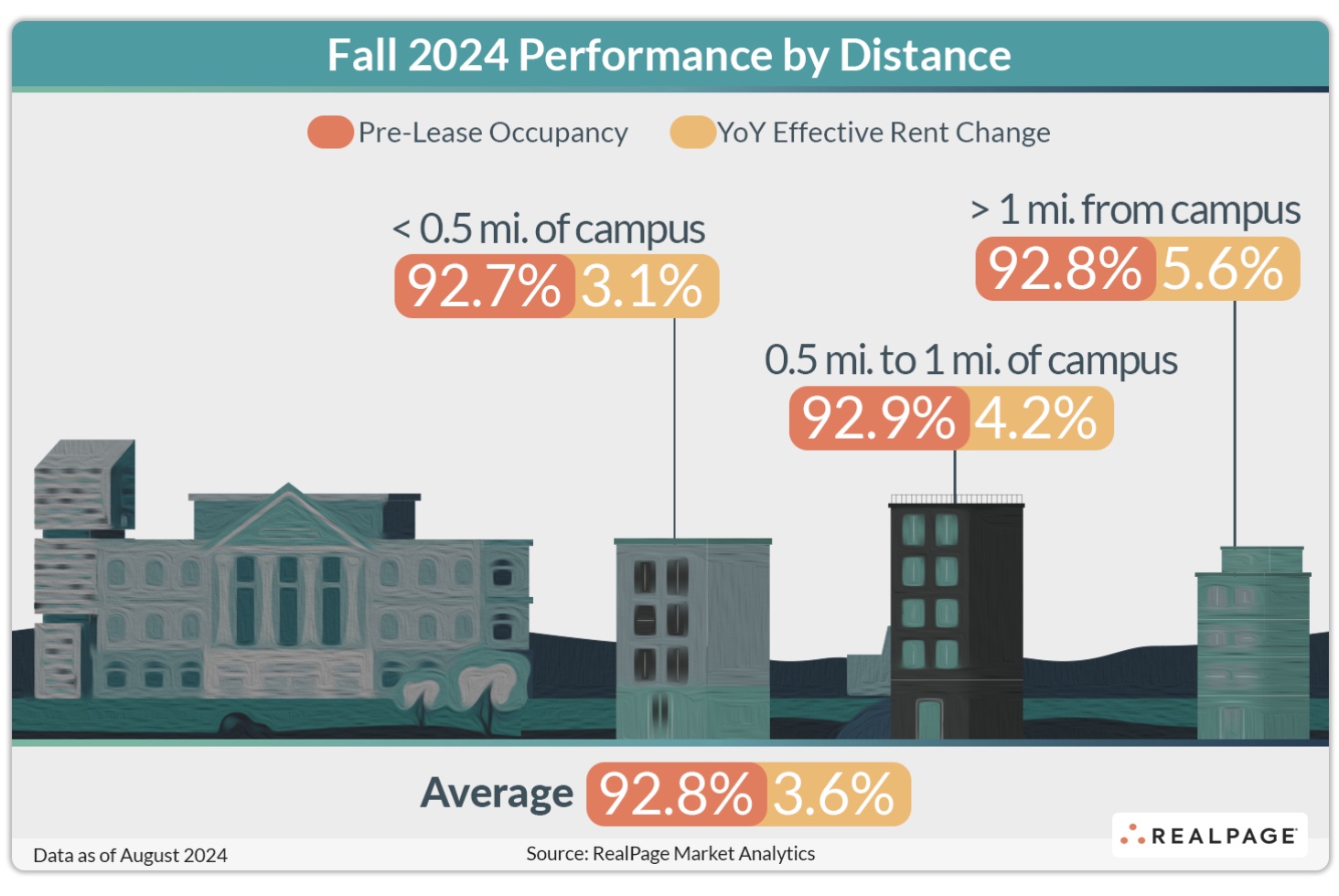

Occupancy rates also are tightly clustered across distances from campus. Properties within a half to one mile of campus reported the tightest pre-lease occupancy as of August at 92.9 percent. Properties furthest from campus were 92.8 percent occupied and those within a half mile of campus saw the lowest pre-lease occupancy of 92.7 percent as of August.

Rent growth and enrollment

Rent growth and enrollment

Fall 2024’s full-year rent growth trended well ahead of the long-term norm, but student housing rent growth has cooled quickly in recent months, likely driven by a combination of softening demand and slowing inflationary pressures.

Rent growth in Fall 2024 was about five percent, the second-highest figure on record, but has since moderated due to the increase in available housing options and the normalization of demand. Conventional housing rent growth has also started to show similar trends, influenced by inflation and supply pressures, said Whittaker.

Data reveals that 60 percent of campuses with positive growth have recorded a total enrollment growth of about a quarter of a million students, while 40 percent of campuses have recorded negative growth, with a total contraction of about 200,000 students.

The divide is due to the consolidation of students at bigger brand-name institutions.

Bunch emphasizes the importance of location in enrollment trends, noting that not all schools are experiencing enrollment declines. Institutional-grade universities have seen a more stable enrollment base compared to other schools and high population growth states also are not facing significant enrollment declines.

Supply trends

Though conventional multifamily housing deliveries recently reached a 40 to 50-year peak, student deliveries have dropped below previous cycle norms.

Bunch noted that 33,000 new beds have been delivered annually since Fall 2021, compared to 50,000 beds during the 2010 cycle and 26,000 new beds are expected to deliver in Fall 2025, marking a years-long low in the data set. The top five schools receiving the new supply in Fall 2025 are all brand-name state flagship schools.

Conventional multifamily starts have peaked and are now coming down. The pullback in starts for conventional housing will likely keep student housing supply compressed for at least a year or two, since many schools have reached a threshold of supply, and additional supply could tip the balance of performance, said Bunch.

RealPage’s 2024 pre-leasing end-of-season blog post is here.