Now is the time to buy multifamily, said Peter Standley, director of Marcus & Millichap’s multifamily division, while discussing the state of industry on October 7. He discussed the impact of new apartment supply on the U.S. market, differentiating between short-term and long-term effects and explained how market conditions favor multifamily investment.

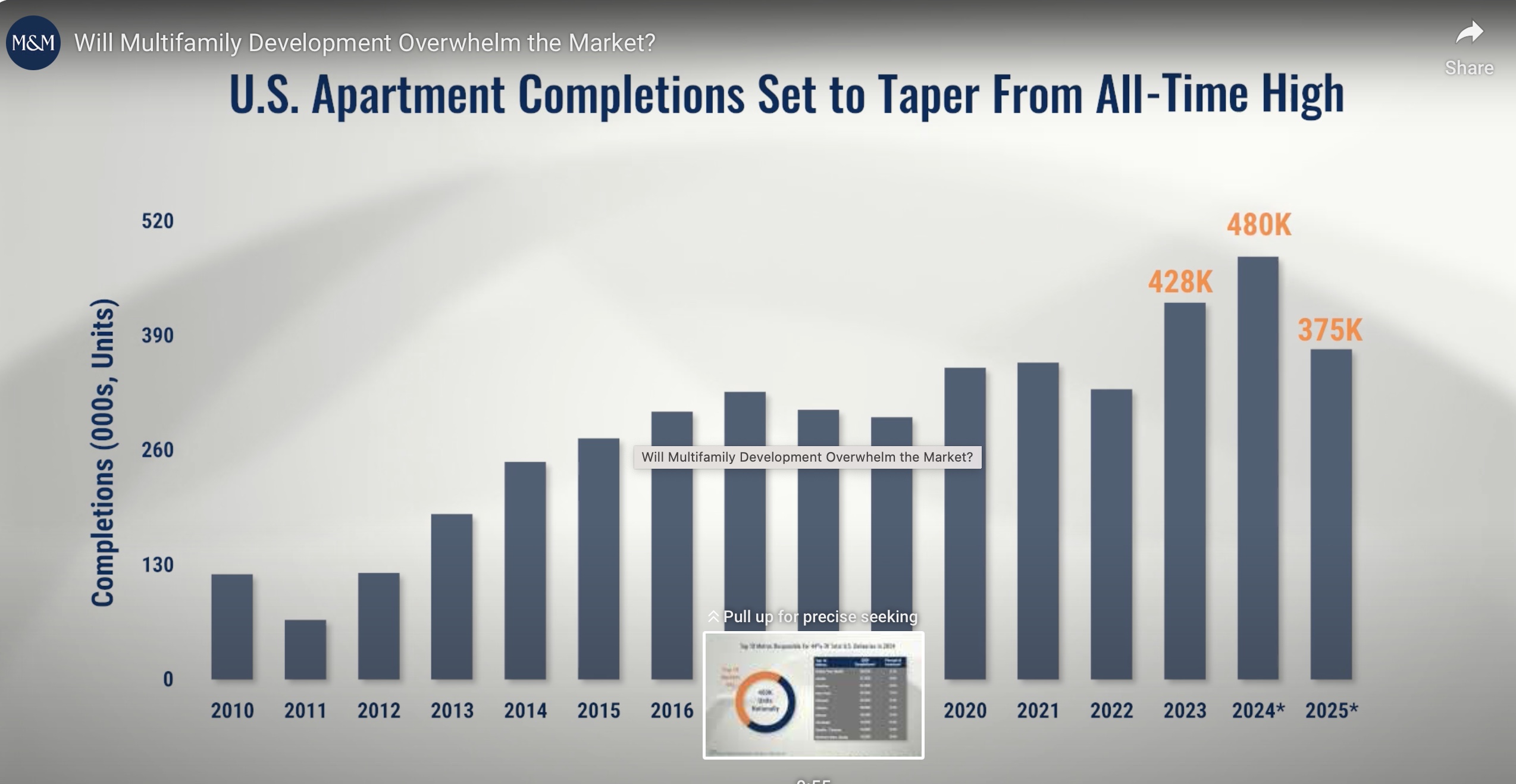

In the short term, there’s a current construction boom with a million units underway, but deliveries are already slowing, with 375,000 units projected for 2025, a decrease from the previous two years, he said. See chart below.

Moreover, the concentration of new units across the United States is very siloed. The top ten core markets in terms of new construction deliveries make up about 44 percent of all the nation’s new construction, he said.

Looking ahead long term, Standley projects there will be a gap in new deliveries from 2026 to 2027 due to reduced starts in 2024 and 2025, setting the stage for investment and expansion in the multifamily sector.

Carl Whittaker, RealPage chief economist, agrees that the construction pipeline is drying up at an alarming rate as the industry quickly approaches peak supply.

“Nearly three quarters of the units currently being developed are scheduled to deliver in the next 12 months. With fewer than 40,000 new units started in the third quarter of 2024 there’s a very real possibility that annualized deliveries come 2027 may not reach 200,000 units,” he said.

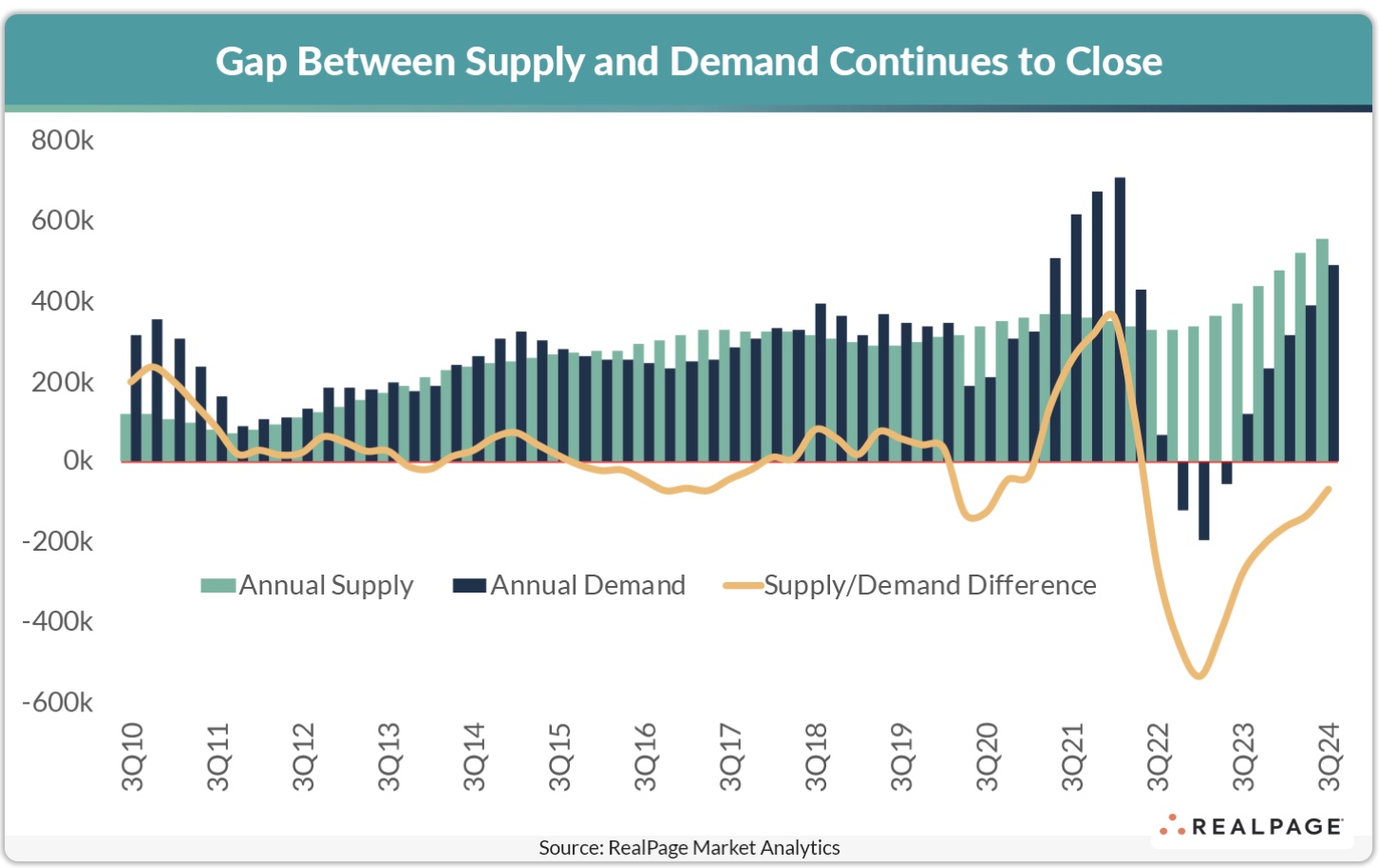

RealPage data also suggests the multifamily industry is on a path to recovery. Supply reached 557,842 units in the third quarter on an annual basis, a rate unseen since 1974, while occupancy nationwide in market-rate apartments was 94.4 percent in Q3, down a mere 10 basis points year-over-year, and monthly rent averaged $1,838 as of September.

While demand still fell below concurrent rates of new supply, the delta between the two was at the lowest point in two years. As of Q3 2024, the difference in annual supply and annual demand (488,773 units) registered just above 69,000 units, according to RealPage Analytics. See chart below.

More positive fundamentals: on a long term basis, cap rates are rising, debt costs are falling and market competition is decreasing, said Standley.

The bottom line? Now is the perfect opportunity to buy multifamily.