The producer price index (PPI) report from the Bureau of Labor Statistics (BLS) stated that construction materials prices were up 0.1 percent month-over-month in September on a seasonally adjusted basis. However, the change in construction materials prices for August and July were each revised 0.1 percentage point higher. August’s increase is now stated as 0.3 percent. The index of components and materials for construction was up 0.7 percent from its year-earlier level.

Overall prices for processed goods for intermediate demand were down 0.8 percent for the month. The volatile prices of processed fuels and lubricants fell 4.7 percent. The overall processed goods for intermediate demand index was 2.7 percent lower than its year-earlier level.

For reference, the changes in these indices compare with a 2.4 percent rise in the all-items consumer price index (CPI-U) for the 12 months ending in September.

Yield Pro compiled the BLS reported changes for our standard list of construction materials prices. These are prices of materials which directly impact the cost of constructing an apartment building. The first two right hand columns of the table provide the percent change in the price of the commodity from a year earlier (12 Mo PC Change) and the percent change in price from last month (1 Mo PC Change). If no price data is available for a given commodity, the change is listed as N/A.

The pre-COVID column lists the change in the current construction materials prices relative to the average of prices from December 2019 through February 2020, before the pandemic impacted the economy. This provides a longer-term view of construction materials price trends.

| Commodity | 12 Mo PC Change | 1 Mo PC Change | Pre-covid Change |

| Softwood lumber | (2.2) | 2.5 | 14.8 |

| Hardwood lumber | 1.8 | (0.2) | 30.4 |

| General millworks | 2.6 | 0.1 | 31.1 |

| Soft plywood products | (10.0) | 0.9 | 56.8 |

| Hot rolled steel bars, plates and structural shapes | (8.3) | (2.2) | 42.4 |

| Copper wire and cable | 9.5 | 0.3 | 40.6 |

| Power wire and cable | 3.3 | (1.3) | 131.3 |

| Builder’s hardware | (0.6) | 0.0 | 24.8 |

| Plumbing fixtures and fittings | 1.8 | 0.0 | 19.8 |

| Furnaces and heaters | 2.3 | 0.0 | 37.4 |

| Sheet metal products | 1.1 | (0.2) | 47.8 |

| Electrical Lighting fixtures | 1.5 | 0.0 | 19.9 |

| Nails | (8.8) | 0.4 | 18.9 |

| Major appliances | (1.0) | (2.1) | 21.0 |

| Flat glass | 7.3 | 2.9 | 38.0 |

| Ready mix concrete | 4.5 | 0.3 | 38.0 |

| Asphalt roofing and siding | 1.3 | 0.9 | 41.6 |

| Gypsum products | 4.7 | 0.0 | 47.7 |

| Mineral wool insulation | 8.0 | 1.2 | 51.2 |

| CPI-U (unadjusted) | 2.4 | 0.2 | 22.3 |

The prices used by the BLS in compiling the indexes are collected on the Tuesday of the week containing the 13th day of the month. In September that would have been September 10. In the October report, the data collection date will be October 15.

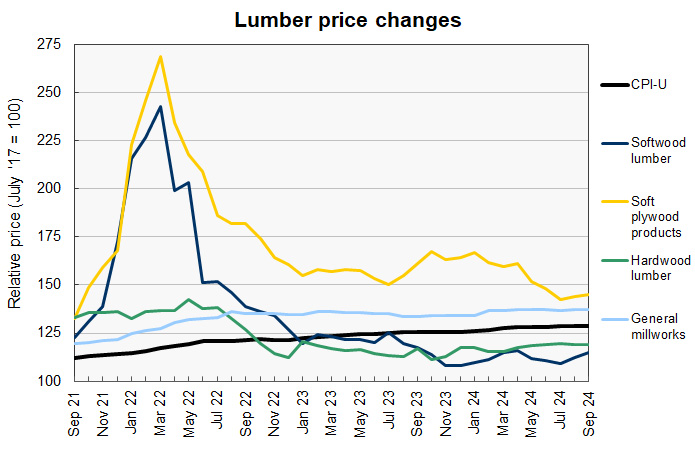

The first chart, below, shows the price index history for wood products over the past 37 months.

The price of softwood lumber climbed 2.5 percent this month, the second highest increase of the construction materials prices that we track. Given that it also moved significantly higher last month, the price bears watching to see if the rise is part of a trend or simply a response to the United States recently doubling tariffs on Canadian lumber.

After trending downward for all of 2024, the price of soft plywood products took another move higher this month, rising 0.9 percent. The price trend seems to be mirroring that of last year, when it climbed in late summer.

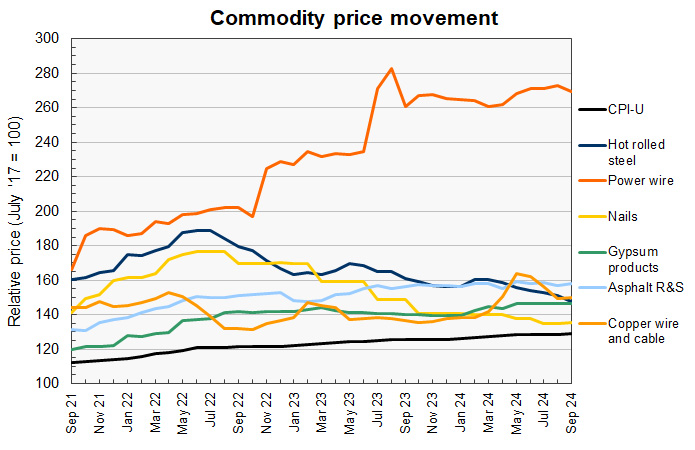

The next chart, below, shows the recent history of several other construction materials prices. These are relatively simple commodities whose prices are strongly driven by those of the materials of which they are comprised.

The prices indexes for both power wire and cable and for hot rolled steel bars moved lower this month. The decline in the hot rolled steel index continues a long-term trend while that for power wire is a rare step back from an even longer-term upward trend.

The price index for copper wire was reported to rebound this month, rising 0.3 percent on top of a 0.5 percent upward revision to last month’s index.

The price index for nails also rebounded slightly this month, rising 0.4 percent. This is a break from its two-year downward trend.

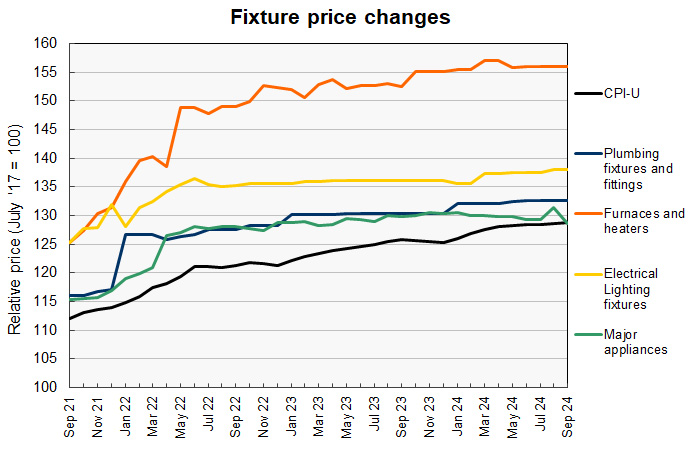

Price changes for several of the more finished goods from our sample are illustrated in the final chart, below.

The remarkable stability in certain construction materials prices continued this month with the price indexes for both plumbing fixtures and fittings and for furnaces and heaters each being quoted as being unchanged to a 6-digit figure for the last four months.

The price index for major appliances, which jumped last month, gave back the gain this month, leaving it lower than it was two months ago.

The price index for electrical lighting fixtures was reported to be unchanged this month, but last month’s index was revised lower by 0.65 percent, the largest downward adjustment of any of the construction material prices we track.

The full current BLS report can be found here.