The average age of homebuyers in the U.S. has risen by six years since July 2023—another sign that younger Americans are being priced out of the market due to escalating ownership costs.

The average age of homebuyers is now 56, up from 49 in 2023, according to the National Association of Realtors’ annual state-of-the-market report released in October. That’s a historic high, up from an average age in the low-to-mid 40s in the early 2010s.

The median age of first-time buyers also rose from 35 to 38, while the share of first timers dropped from 32 percent to 24 percent of all buyers for the year ending July 2024. That marks the lowest percentage since NAR started tracking the metric in 1981.

In my two decades in the mortgage business, I’ve never seen a more difficult time for millennials to purchase a home,” said Bob Driscoll, SVP and director of residential lending at Mass.-based bank Rockland Trust.

That’s largely due to rising homeownership costs, he said. The median U.S. home price is now $435,000, per NAR—up 39 percent since 2020—while the average 30-year fixed mortgage rate has more than doubled to over 6 percent in that time.

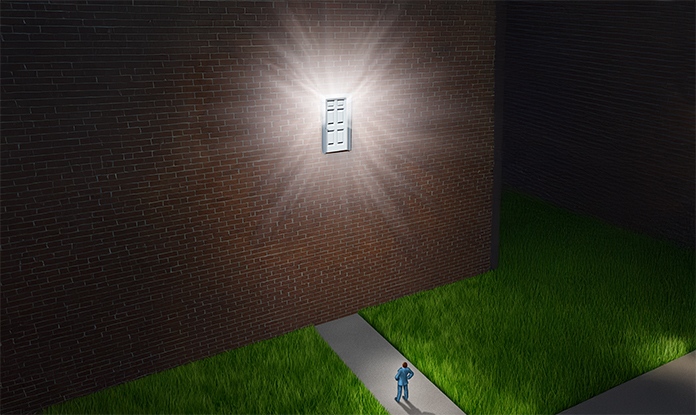

Younger homebuyers struggle

High homeownership costs are especially challenging for younger buyers, as many struggle to save for a down payment while juggling student loan debt, high rent prices and lower wages early in their careers. The biggest obstacle to homeownership for younger buyers is saving for a down payment, says Driscoll.

An 18 percent down payment—the median percentage buyers put down, according to NAR—on a $435,000 home comes to $78,300. That’s a significant expense, nearly matching the annual U.S. median household income of $80,610, per U.S. Census Bureau data.

Younger buyers who can afford down payments are still often outbid by older, wealthier buyers using equity from homes they already own. Without this advantage, younger buyers must “absorb the additional cost out of pocket,” said Driscoll.

Younger buyers are also competing with wealthier all-cash buyers, whose share of home purchases has increased from 20 to 26 percent in the past year, the study said.

Perhaps unsurprisingly, a quarter of first-time buyers have relied on a gift or loan from a relative or friend to afford a down payment, the data show.

“Homebuying for the younger generation is wildly unaffordable,” said Noah Damsky, a chartered financial analyst and principal at Marina Wealth Advisors.

“Saving for a down payment can be challenging without an outsized income, which is evident in the data.

And a median income only covers the bare necessities, which is why a higher income or existing wealth is critical to becoming a homeowner.”