The USA is preparing to swear in President-elect Donald J. Trump as its 47th president, or what some housing experts call the return of the nation’s builder-in-chief. Housing was a major focus of both candidates on the campaign trail and multifamily scored some ballot winners and losers in the election.

Pundits are busy predicting the effect of Trump’s victory on renters and rental housing providers, from higher mortgage rates if inflation continues, to relaxed and fewer restrictions on residential housing construction.

Analysts from Morningstar predict that the industry will benefit from increased tax incentives for homebuilders, which may result in more supply, if not offset by Trump’s tariffs on foreign goods entering the country.

“Tariffs have the potential to drive up construction costs, and possibly rents,” said Jay Parsons, Principal, Head of Investment Strategy & Research, at Madera Residential.

He also notes that a Trump administration, in conjunction with GOP control of the Senate, reduces risk of a national law pushing tax penalties on large single-family rental owners. VP Harris had endorsed legislation authored by Ohio Senate Democrat Sherrod Brown to push tax penalties on any owner of more than 50 single-family rental homes, but Brown lost re-election and Harris was defeated in her bid for the presidency.

As of this writing, the Republicans are favored to regain full control of Congress by retaining the House of Representatives.

Parsons also expects less expansion of the Low-Income Housing Tax Credit. He points out that in his first term in office, Trump focused on creating Opportunity Zones and pushing for budget cuts in HUD, both of which the President could revisit during his second term.

Some housing pundits believe that the large deportations of illegal immigrants that Trump has promised will remove a substantial chunk of the labor force, but Parsons thinks this is less likely.

A bigger question involves Fannie and Freddie, the two government-sponsored enterprises that back the bulk of residential mortgages in the nation. As the Wall Street Journal reported in September, Trump’s allies have been working on a plan to privatize the GSEs since they were placed under government control in 2008, in the wake of the financial crisis. Don’t expect this to happen overnight, if at all.

Ballot issues

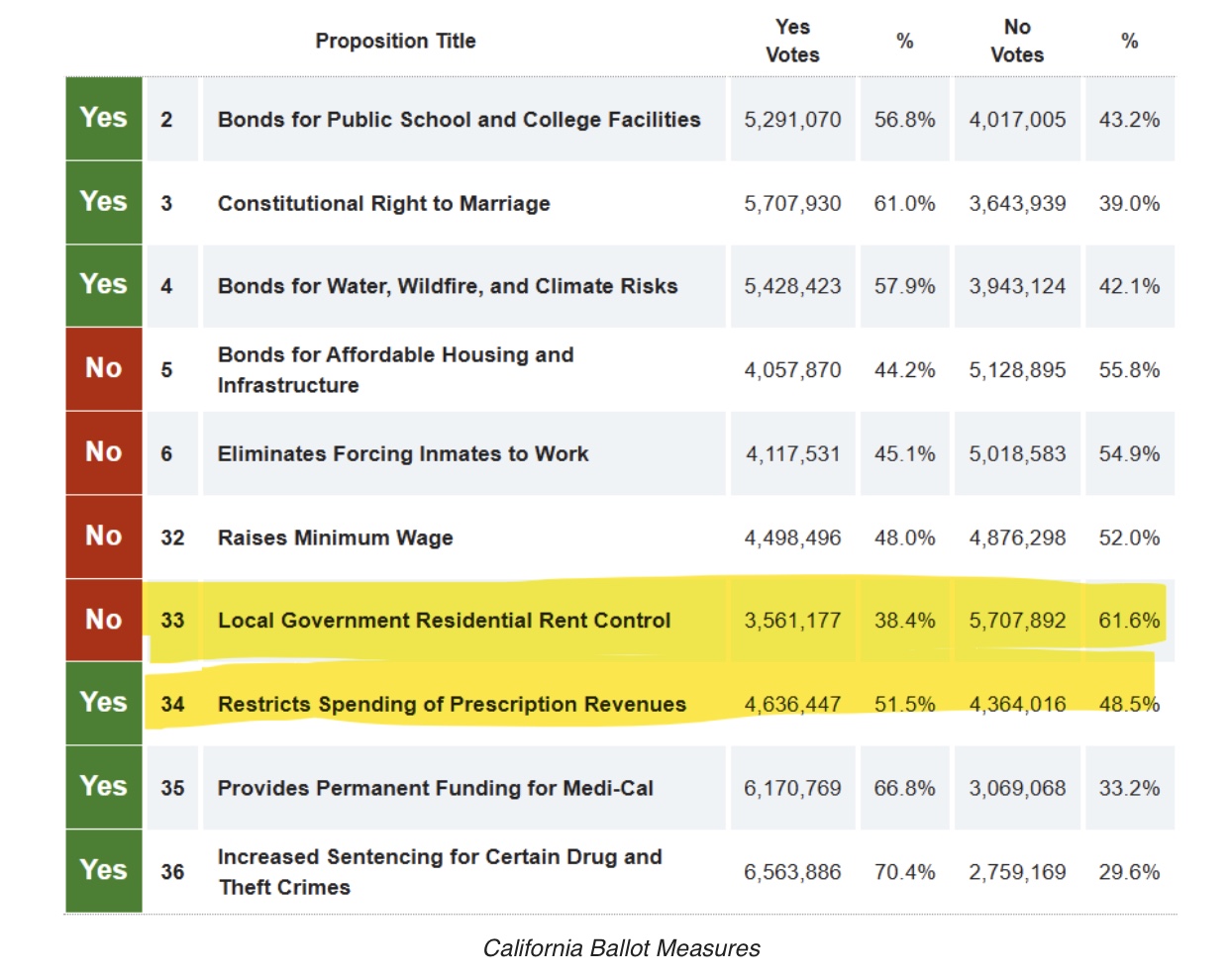

There was much more at stake for the rental housing market than just the presidential race. Both rent control and affordable housing expansion were on the ballot in several states. All votes are not yet tallied, but here are the projected winners and losers.

Despite a recent Redfin survey suggesting three-quarters of Americans favor rent control, Californians defeated for the third time in six years Prop 33, a ballot measure that would have legalized rent control expansion across the state.

They also are on track to pass Prop 34, a bill that requires healthcare funds to be spent solely on healthcare, thereby blocking the backer of Prop 33 from attempting a fourth ballot measure.

Parsons called the defeat of Prop 33 “a resounding, bipartisan beatdown, with more than 62 percent of California voters saying ‘no’.”

“Kudos to California voters for getting educated and voting on the side of science, history and common sense to properly protect renters,” he said.

Californians also voted down rent control expansion measures in the San Francisco suburban towns of Larkspur and San Anselmo that would have capped renewal rent hikes for eligible properties at 60 percent of CPI, which Parsons points out would be less than 1.5 percent today.

In addition, the Marin County town of Fairfax overturned a city law capping renewal rent increases at 75 percent of CPI.

Not all rent control measures were defeated. Also in California, which already allows rent control, but only for older properties and only on renewals, Berkeley passed Measure BB, reducing the renewal rent cap from seven percent to five percent. Parsons points out that other aspects in BB, like expanding rent control to newer properties, won’t go into effect because Prop 33 statewide didn’t pass.

Voters in Santa Ana, California, enshrined an existing law passed by the city council in 2021 capping renewal rent increases at 80 percent of CPI, or three percent, whichever is less. Measure CC now caps rent increases below two percent and prevents future city councils from unwinding the measures without another public ballot measure.

Finally, in Hoboken, New Jersey, voters shot down a ballot measure that would have allowed rents to reset to market when units turned, as long as the property owners paid a fee into an affordable housing fund. Instead, the voters chose to continue allowing vacancy control, a policy Parsons says has been widely discredited.

As for measures to boost the supply of affordable housing, California voters rejected Prop 5, which would have lowered the vote threshold needed to pass local bond measures to fund housing and public infrastructure from 66.67 percent to 55 percent.

Jay Parsons provided a chart of all measures on California’s ballot below, with a highlight on Props 33 and 34.

He covers all housing-related measures, including affordable housing, on the 2024 ballot here.