Yardi Matrix reported that the national average asking apartment rent was down $3 in October compared to the revised level of the month before at $1,748 per month. The national average year-over-year asking apartment rent growth was +0.9 percent in October, unchanged from the rate reported last month. The month-over-month rent growth rate was 0.2 percent.

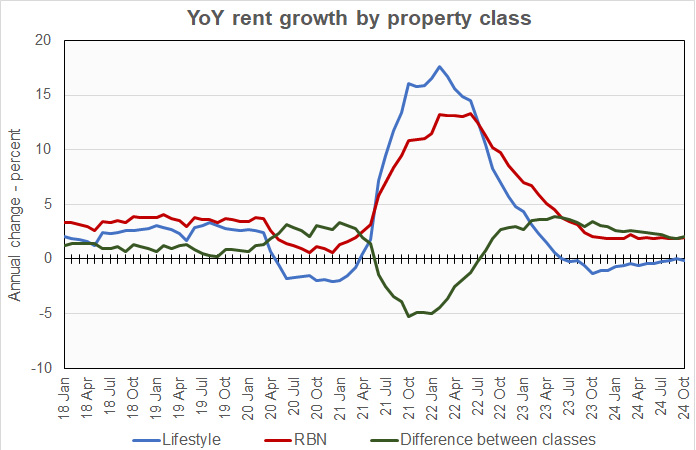

Rents in the “lifestyle” asset class, usually Class A properties, were down 0.1 percent year-over-year, while rents in “renter by necessity” (RBN) properties increased by 2.0 percent year-over-year. The lifestyle rent growth is down 0.1 percentage point from last month’s rate while the RBN rent growth is up 0.1 percentage point from last month’s rate. The chart, below, shows the history of the year-over-year rent growth rates for these two asset classes along with the difference between these rates.

Last month’s report showed that rents in the lifestyle class did not decline year-over-year for the first time in 14 months. However, that streak of non-losing months ended at 1 as lifestyle rents fell year-over-year in October. High levels of new supply are putting downward pressure on rents, and particularly on lifestyle rents, since that is where most of the new supply is being delivered.

Year-over-year rent growth for RBN properties has been remarkably steady for the last year, varying only between 1.9 percent and 2.2 percent. However, this rate is significantly lower than that seen in the pre-pandemic years of 2018 and 2019 when RBN year-over-year rent growth averaged nearly 3.5 percent in a lower-inflation rate environment.

Yardi Matrix reported that the U.S. average occupancy rate in June was down 10 basis points from the level in last month’s report at 94.7 percent. The occupancy rate was reported to be unchanged year-over-year.

New supply remains high

The discussion portion of the report focused on the pressure that the high levels of new supply is putting on rents. Yardi Matrix’s outlook for new supply is summarized in the following table.

| Year | Market rate units | Affordable units | SFR units |

| 2024 | 554,000 | 71,500 | 36,700 |

| 2025 | 508,000 | 74,000 | 29,500 |

| 2026 | 371,000 | 57,000 | 23,000 |

The new supply drop off in 2026 is forecast to lead to a rebound in rent growth in the 2026-2027 time frame. This conclusion is partially based on U.S. demographic trends that should see the renter population growing regardless of what happens with immigration.

Tabulating the data

Yardi Matrix reports on other key rental market metrics in addition to rent growth. These include the year-over-year job growth rate based on the 6 month moving average and the completions over the prior 12 months as a percentage of existing stock. The 10 metros with the largest annual apartment rent increases are listed in the table below, along with the other data.

| City | YoY rent | YoY rent last month |

YoY jobs (6 mo moving avg) |

Completions as % of stock |

| New York | 5.3 | 5.4 | 1.5 | 1.4 |

| Detroit | 3.7 | 3.0 | 0.2 | 1.0 |

| Kansas City | 3.7 | 4.2 | 1.4 | 2.1 |

| Washington DC | 3.2 | 3.1 | 0.6 | 2.0 |

| Columbus | 3.1 | 2.8 | 0.7 | 3.4 |

| Indianapolis | 3.0 | 3.3 | 2.2 | 2.5 |

| Chicago | 2.9 | 2.4 | 0.1 | 1.5 |

| New Jersey | 2.9 | 2.8 | 1.6 | 3.0 |

| Boston | 2.8 | 3.4 | 0.7 | 2.5 |

| Philadelphia | 2.2 | 1.9 | 1.6 | 2.0 |

The major metros with the smallest year-over-year apartment rent growth as determined by Yardi Matrix are listed in the next table, below, along with the other data as in the table above.

| City | YoY rent | YoY rent last month |

YoY jobs (6 mo moving avg) |

Completions as % of stock |

| Austin | (5.5) | (4.9) | 1.7 | 7.6 |

| Raleigh | (3.1) | (3.1) | 2.4 | 6.1 |

| Phoenix | (2.4) | (2.4) | 2.3 | 4.5 |

| Atlanta | (2.3) | (2.0) | 1.2 | 3.3 |

| Orlando | (2.2) | (1.8) | 1.6 | 4.7 |

| Tampa | (2.0) | (2.3) | 1.8 | 3.6 |

| Charlotte | (1.9) | (2.1) | 1.6 | 5.4 |

| Dallas | (1.5) | (1.7) | 1.5 | 3.2 |

| Nashville | (1.5) | (2.0) | 0.7 | 6.2 |

| Denver | (1.0) | (0.3) | 0.3 | 4.6 |

The top metros for month-over month rent growth in October were Detroit, Kansas City, New Jersey and New York. Only New York was in the top 4 in last month’s report. The trailing metros this month were Denver, Austin, Raleigh and Orlando. Only Denver was in the bottom 4 in last month’s report.

Single-family rentals rent decline accelerates

Yardi Matrix also reported that single-family rental (SFR) rents fell $8 in October from the revised level of the month before to $2,164 per month. The year-over-year SFR rent growth rate fell 0.3 percentage points from the level reported last month to 0.3 percent.

Yardi Matrix reported on the top 34 markets for built-to-rent single-family rentals, 18 of which saw rents grow year-over-year in October. The leading markets for year-over-year rent growth were Kansas City, Detroit, Raleigh, and Chicago. None of them saw year-over-year rent growth as high as 5 percent.

The markets with the lowest year-over-year rent growth were Miami, San Antonio, Phoenix and Pensacola.

The national occupancy rate for single-family rentals in September fell 0.1 percentage point from the revised level of the month before to 95.1 percent.

This month, 12 of the 34 metros tracked saw year-over-year occupancy increases. The metros with the largest year-over-year occupancy increases were Pensacola, Nashville, Salt Lake City and Atlanta. The metros with the greatest occupancy declines were Jacksonville, Indianapolis, Greenville and Dallas.

The complete Yardi Matrix report provides information on some of the smaller multifamily housing markets and more information on the differences in results between lifestyle and RBN properties. It can be found here.