CoreLogic reported that their single-family rent index (SFRI) for September rose 2.0 percent from its year-earlier level. This is down 0.4 percentage points from last month’s reported year-over-year rent growth rate and is down from the 2.6 percent annual rent growth rate reported in September 2023.

Adjusted vs. nominal

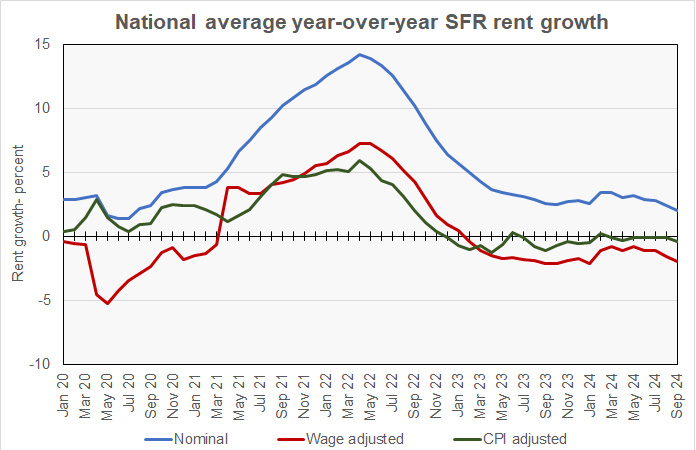

The history of the overall SFR rent growth rate since January 2020 is shown in the first chart, below. The chart shows both the nominal year-over-year single-family rent growth rate and also the wage-adjusted and CPI-adjusted rates. The wage-adjusted rate is the year-over-year nominal rate less the year-over-year rate of wage growth as measured by the seasonally-adjusted average hourly earnings of production and non-supervisory employees. The CPI-adjusted rate is the year-over-year nominal rate less the year-over-year rate of growth in the consumer price index (CPI-U).

The chart shows that nominal SFR year-over-year rent growth rate has been trending lower over the last 6 months. Over that period, the overall rate of inflation has been falling at nearly the same rate while nominal wage growth has remained steady at nearly 4 percent.

For reference, Yardi Matrix found that single-family rent growth in September was 0.6 percent year-over-year as rents fell $3 for the month. However, Yardi Matrix focuses on properties of 50 or more units while CoreLogic takes a broader look at the single-family rental market, since small holdings represent a majority of the market.

Ranking the metros

CoreLogic reports the year-over-year rate of growth in the SFRI for a select group of 20 metropolitan areas. Detroit moved into the top spot with year-over-year rent growth of 5.2 percent, which is actually down 0.2 percentage points from Detroit’s reported rate for last month. Seattle dropped to the number 2 spot with rent growth of 5.0 percent. New York City trailed Seattle with a rent growth of 4.9 percent. Chicago returned to the top 5 after a one-month absence with rent growth of 4.4 percent. Washington D.C. rounded out the top 5 with rent growth coming in at 5.3 percent.

The number of metros which saw their rents decline rose from 1 to 4 this month. Austin saw rents decline 2.9 percent year-over-year. San Diego rents declined 0.7 percent. Rents in both Orlando and Dallas declined 0.2 percent. Phoenix rents were again unchanged year-over-year.

CoreLogic is a data and analytics company. It calculates the SFRI using “a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service.” The CoreLogic report is available here.