In the 2024 race between Vice President Kamala Harris and former President Donald Trump for the U.S. presidency, housing is a major issue for the first time since the 1990s.

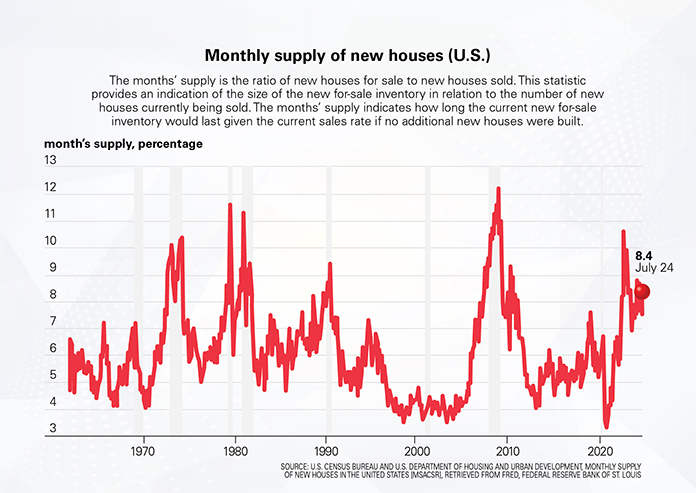

One thing is certain, the next president will have to address the nation’s housing affordability crisis, even though, in the past, neither party’s policies have been effective in increasing housing supply or lowering housing prices.

“It’s great to see both presidential candidates talking about housing and the need for more of it,” said Jay Parsons, head of investment strategy at Madera Residential, “There’s a lot of other issues that the candidates and other stakeholders can disagree on, but there are a few they agree on.”

Both candidates acknowledge there is not enough housing to meet demand. They also align on the need to cut regulatory barriers to new housing development and both talk about opening up federal lands for development as a possible solution.

Parsons said, “I don’t know how big of a needle mover (opening federal lands) really is because there’s a lot of complexity, and some of that land is not going to be in locations where we need a lot of housing, but everything helps.”

From there, their platforms take very different approaches. Harris takes aim at the housing crisis with demand-side incentives and more federal relief, while Trump is focused on increasing supply through removing regulatory impediments at local and state levels and by deporting illegal immigrants to free up housing. One of the slogans chanted at his Tucson rally on Sept 12 was “make housing affordable again.”

Differences on energy

Perhaps the greatest contrast between the two platforms is the candidates’ stance on fossil fuels, climate change and energy production. The subjects came up often during the debate on September 11.

Harris has agreed with President Biden, who a couple of years ago signed into law the most aggressive climate mandate in U.S. history, that climate change is a “very real” existential threat, while Trump calls climate change a “hoax” and withdrew the U.S. from the Paris Climate Accords during his term as president.

Harris has vowed to transition away from oil and natural gas, touting alternative energy sources like wind, yet more recently embraced fossil fuel production, while Trump has pledged to reverse Biden’s green agenda policies and “drill, baby, drill.”

During the recent presidential debate, Trump pointed to Harris’ previous opposition to fracking, a position she seems to have changed, much to the chagrin of environmentalists.

“Trump is focused on reducing the cost of energy and that ties into natural gas, which has a big impact on housing,” Edward Pinto, senior fellow and director of the housing center at the American Enterprise Institute (AEI), said in an interview with Yield Pro magazine in early September.

“Natural gas is the least expensive way to heat water and to heat a home and the Biden/Harris administration has done a lot to raise the cost of natural gas appliances and shift things over to electric.

“President Trump talks about reducing regulations. I don’t know which precise regulations he’s talking about. But one that came to my attention yesterday is that HUD has implemented by rule the 2021 International Building Code energy standard that home builders say could increase the price of a new home by up to $31,000. And it only applies to FHA- and USDA-financed homes, basically your large group of entry level buyers,” he said.

The rule took effect on May 28, but has yet to work its way through pricing.

“I can only imagine it’s impact on energy costs associated with new construction for entry level homes,” said Pinto.

The National Association of Home Builders (NAHB) called the policy a blow to housing affordability that will act as a deterrent to new construction at a time when the nation desperately needs to boost its housing supply to lower shelter inflation costs.

The National Association of Home Builders (NAHB) called the policy a blow to housing affordability that will act as a deterrent to new construction at a time when the nation desperately needs to boost its housing supply to lower shelter inflation costs.

Pinto said, “The Biden/Harris administration is clearly trying to phase out natural gas, but natural gas was actually very popular with the Green Movement up until it became inexpensive.”

According to the U.S. Energy Information Administration, the price of natural gas has fallen and stayed low following a spike in 2022 that coincided with Russia’s invasion of Ukraine, while electricity prices have risen by approximately 20 percent since late 2020.

Subsidies and supply

Harris proposes a $25,000 subsidy for first-time homebuyers who have made timely rent payments for two consecutive years and a $10,000 tax credit.

Some economists are skeptical these policies will increase housing supply or address high interest rates that make buying a home unaffordable for many. While the subsidy would generate demand for homeownership, it ignores the underlying issue that there’s just not enough housing, they said.

“I think $25,000 in cash is still quite impactful, even if home prices go up as a result. It definitely can be a needle mover for some first-time homebuyers,” said Parsons.

Real estate coach and author Tim Harris thinks increased demand fueled by down-payment assistance could lead to higher home prices in markets with limited housing stock. “It could also increase rents as some potential buyers without the benefit of the subsidy are priced out of the market, opting to rent instead,” he said.

The National Housing Conference (NHC), a coalition of affordable housing leaders, disagrees, writing on their website that as long as the subsidy is well distributed, it is unlikely to inflate housing prices.

“First time homebuyers make up only one-third of the market today, and that figure will decrease significantly as interest rates fall. Targeted down-payment assistance, therefore, is not likely to have an inflationary impact on housing prices, especially if it is limited to first-generation homebuyers who earn less than 140 percent of the area median income,” wrote David M. Dworkin for NHC.

Mark Zandi, chief economist for Moody Analytics, also thinks Harris’ homebuyer subsidy could work, but only if it follows an increase in supply. “You’ve got to put the horse before the cart. It’s a matter of timing,” he said.

The pros and cons of tax credits

Harris wants to give incentives to homebuilders to spur development of three million new starter homes during the next four years. She plans to subsidize development in part by expanding the Low-Income Housing Tax Credit (LIHTC) program, the primary means by which affordable housing gets built in this country.

The National Association of Home Builders (NAHB) has voiced its support, stating, “A tax credit to help builders construct more entry-level housing and expanding and strengthening the LIHTC program will help builders to construct badly needed new homes and apartments,” but agrees with other housing experts that any demand incentive needs to address local market conditions and be widely available because of nation’s roughly 1.5 million housing unit shortfall.

NAHB’s own 10-point plan focuses on removing regulations and other impediments for builders as a means of easing affordability challenges.

The expansion of the LIHTC program is a bi-partisan proposal, one that AEI’s Pinto thinks is full of the same challenges inherent in many other subsidy programs.

“Studies show that nearly all LIHTC developments displace other housing that could have been built by the market without subsidies,” he said.

Pinto estimates that the average new LIHTC housing unit costs around $450,000, with nearly half the funds allocated for renovation and preservation of existing units, rather than new ones.

Trump has promised to protect single-family zoning, stating at a recent rally, “There will be no low-income housing developments right next to your house,” even as he promised to ease environmental and permitting rules to lower housing costs.

Pinto weighed in, “I’ve talked with a lot of NIMBY’s and they have one legitimate gripe—that when the federal government subsidizes housing, it creates problems in neighborhoods. They don’t keep them up and that’s a problem when we’re talking about lifetime density.

“What people fear is what happens when the government brings in subsidized housing to a single-family neighborhood. Trump was speaking about government-subsidized housing, which I am not in favor of. And I’m not in favor of LIHTC, but I am in favor of what is called light touch density and making legal the highest and best use of the land in single-family neighborhoods, which is generally townhomes built by the private sector,” he said.

A housing pundit in an online forum summarized what he sees as the difference between the candidates’ platforms. “A lot of proposals coming from the Republican side are geared toward longer term sustainable housing recovery, such as giving incentives to developers to start building homes again, not because they are getting subsidies from the government, but because they are able to make more profit.

“One candidate’s plan is the government using money as a cudgel hypothetically and the other is lowering the barriers to entry for new developers and builders, and ultimately buyers, to buy homes,” he said.

But no matter who wins the election, any plan will need the approval of Congress before it can be implemented. And, because zoning, permitting, environmental reviews, impact fees and building codes are all mostly set at the state or local level, the federal government has very little sway over land use regulations that impact housing production.

Acknowledging this, Trump wants to auction off tracts of federal land to homebuilders while removing restrictive regulations that make development difficult.

During a campaign rally in Asheville, N.C., on August 14, he compared his plan for federal lands to the Opportunity Zone program he signed into law in 2017 as part of the Tax Cuts and Jobs Act, explaining that like those projects, the federal tracts will “have low taxes, low regulations to stimulate rapid economic growth and maximum affordability.”

Critics have noted that in many cases the new jobs necessary to make Opportunity Zones successful were lacking. If elected this year, Trump will have to address that issue.

Tim Harris thinks Trump’s plan to increase supply by making development cheaper and easier could potentially lower prices, but rapid deregulation could lead to speculative development, which could increase home prices in the short term as investors buy up available land and properties.

As part of his Tax Cuts and Jobs Act, Trump lowered taxes across the board and could again seek to lower corporate taxes to stimulate housing activity. He has proposed lowering the corporate tax to 15 percent from the current federal rate of 21 percent and wants to eliminate taxes on tips and Social Security benefits.

Among the potential positive ripple effects could be a rise in investment activity, more construction and supply and lower home prices, say analysts.

Harris on the other hand could follow Biden’s budget proposal to raise the corporate tax rate to 28 percent, a 33 percent increase.

She has accused Trump of giving tax breaks only to the wealthy, but an analysis by the Tax Policy Center, a left-of-center Washington think tank, found that 80.4 percent of taxpayers received tax cuts across the income spectrum.

Disgraced policy

Harris also plans to repurpose certain federal lands for new housing developments and streamline permitting processes and reviews through a $40 billion federal “Innovation Fund” that would “empower local governments to fund local solutions.”

But she also vows to “take on corporate landlords and cap unfair rent increases” and ban the use of certain software programs that help landlords determine optimal rent prices.

She endorsed the Stop Predatory Investing Act introduced last year by Ohio Senator Sherrod Brown that would deny interest and depreciation deductions to landlords that own and rent more than 50 single-family homes.

Harris recently announced her support for President Biden’s proposal to limit annual rent increases to five percent for two years for landlords who own 50 or more units if they want to continue receiving tax breaks available to rental property owners. The policy would affect more than half the rental properties in U.S.

Both right and left leaning economists agree that capping the amount of rent landlords can charge stifles development of much-needed new housing.

Rent caps might appear to help existing renters in the short term, but, in the long run decrease affordability, fuel gentrification and create negative spillovers into the surrounding neighborhood while hurting the very low- to modest-means folks they are meant to help, say housing experts at the Brookings Institute.

A comprehensive study of rent control found that landlords are more likely to let rent-capped units fall into disrepair because of a lack of needed funds for upkeep.

Another study from the Journal of Housing Economics found that rent control can also influence the market value of real estate properties, which is calculated as the sum of expected future earnings, discounted over time, making properties less attractive to prospective buyers.

Homebuilders say a Biden/Harris rent cap could ultimately curtail new housing construction.

Misguided scapegoating

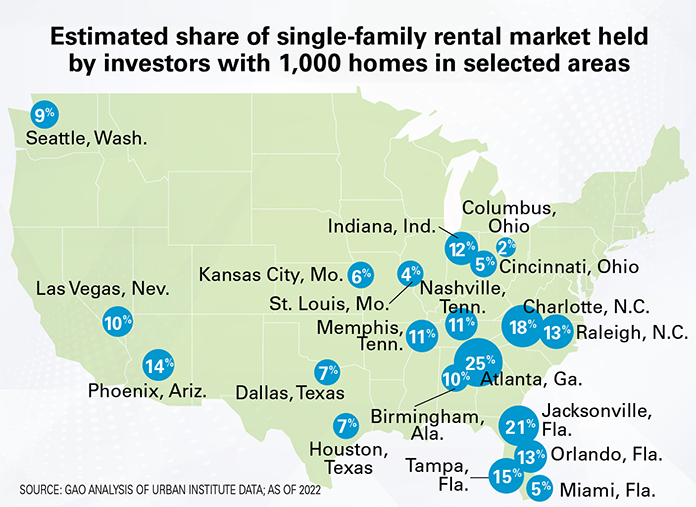

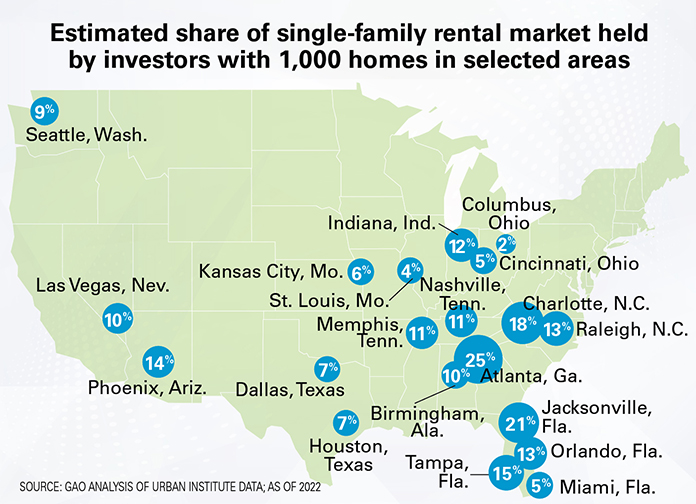

While Trump hasn’t joined the scapegoating of institutional landlords, his V.P. pick, J.D. Vance, has been a critic of institutional investors purchasing and then renting homes, arguing, like Harris, that they deprive ordinary Americans of the opportunity to be homeowners.

Sharon Wilson Geno, president of the National Multifamily Housing Council has pushed back on blaming landlords and rent-setting algorithms for the rise in housing costs. The reason for high prices, explains Wilson Geno, is there are not enough houses to meet demand.

Blaming investors for the price rise and dearth of housing supply is a misdiagnosis that threatens to exacerbate the crisis while ignoring the root causes, explained Joel Griffith, Research Fellow in the Thomas A. Roe Institute for economic policy studies at The Heritage Foundation.

The actual culprits are federal mortgage subsidies, interest rate manipulation, central bank MBS purchases (which nearly doubled during the pandemic years), rising construction costs, and local land-use restrictions, he said.

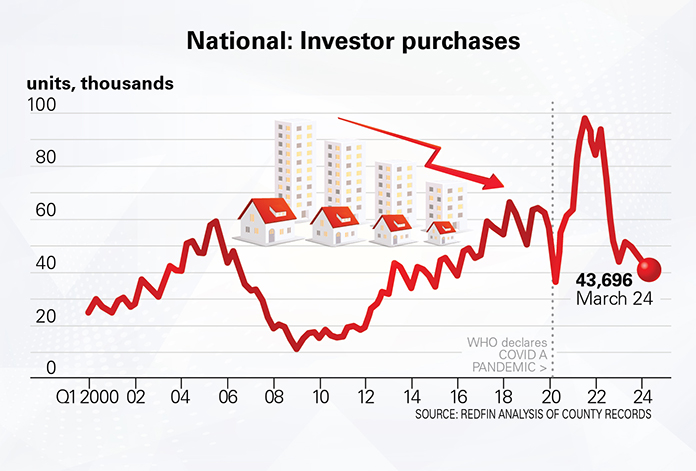

The rise in investor purchases was an effect of these Federal Reserve policies, rather than a leading cause of the price surge.

Large investors joined in the frenzied buying spree of near-zero interest rates that pushed existing home sales from barely four million annually in May 2020 to 6.5 million five months later, but even at the peak of the frenzy, institutional investors accounted for less than three percent of the overall purchase market.

The Urban Institute estimates that institutional investors made up only 0.74 percent of single-family home purchases in 2021, which means other buyers purchased 99.26 percent.

As the Fed increased interest rates, institutional investors significantly slowed acquisitions. Their share of the single-family purchase market has since cratered to the longer-run average of 0.4 percent after rocketing to 2.5 percent during the heart of the cheap money frenzy, according to analysis by John Burns Research.

Harris has doubled down on her support for the U.S. Justice Department’s (DOJ) attack on institutional landlords who use certain rent-setting software.

Wilson Geno said the attacks by the DOJ are based on perceptions that feed a particular narrative, one that ultimately hurts renters, while ignoring facts. She notes that using rental data to determine pricing is a well-accepted practice in rental housing and has been used by the federal government through the U.S. Department of Urban Development (HUD) to determine fair market value in the distribution of Section 8 vouchers. HUD relies on data and analysis from some of the software companies now alleged to have engaged in anticompetitive activities, she said.

Despite the differences in the candidate’s platforms and what he calls “gimmicky talking points on the campaign trail,” Madera Residential’s Parsons emphasizes the positive.

“It’s really good to see housing supply as a major topic of national discussion. These issues have been lingering for a while, and to see them now being discussed at the highest levels is an encouraging step in the right direction. We need housing—for-sale homes, rental homes, low-income rental homes, moderate-income housing and market-rate, so-called luxury apartments. Housing should not be an either/or discussion. We need to focus on things that move the needle,” he said.