Multifamily originations in 2025 are expected to surpass last year’s volume, thanks to stabilizing, although higher, interest rates, an expensive for-sale market and the nation’s extreme shortage of housing, according to Freddie Mac’s newly released 2025 Multifamily Outlook report.

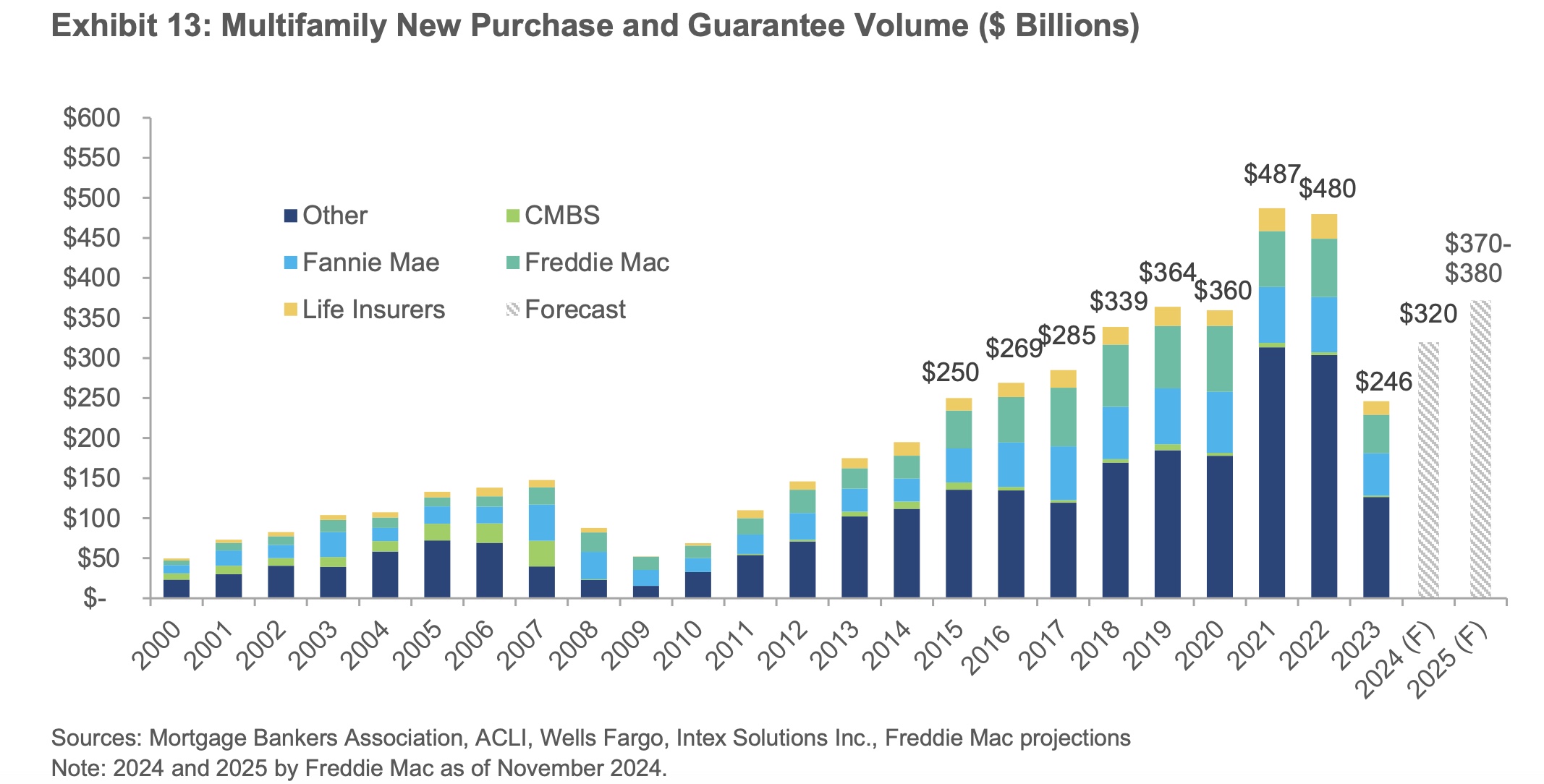

Freddie expects multifamily origination volumes to reach between $370 billion and $380 billion in 2025, compared to 2024 volumes, which are projected to total $320 billion once all fourth quarter data is tallied. Although origination volume should increase from 2024, it’s still falls short of the $816 billion of originations recorded in 2022 and the $891 billion record high originations set in 2021.

In 2023 and much of 2024, high and volatile interest rates, rising cap rates, lower asset values and slowing property performance subdued the transaction market, notes Freddie. Transaction volume in 2023 was $246 billion, a little more than half of the 2022 total of $480 billion, according to the Mortgage Bankers Association (MBA).

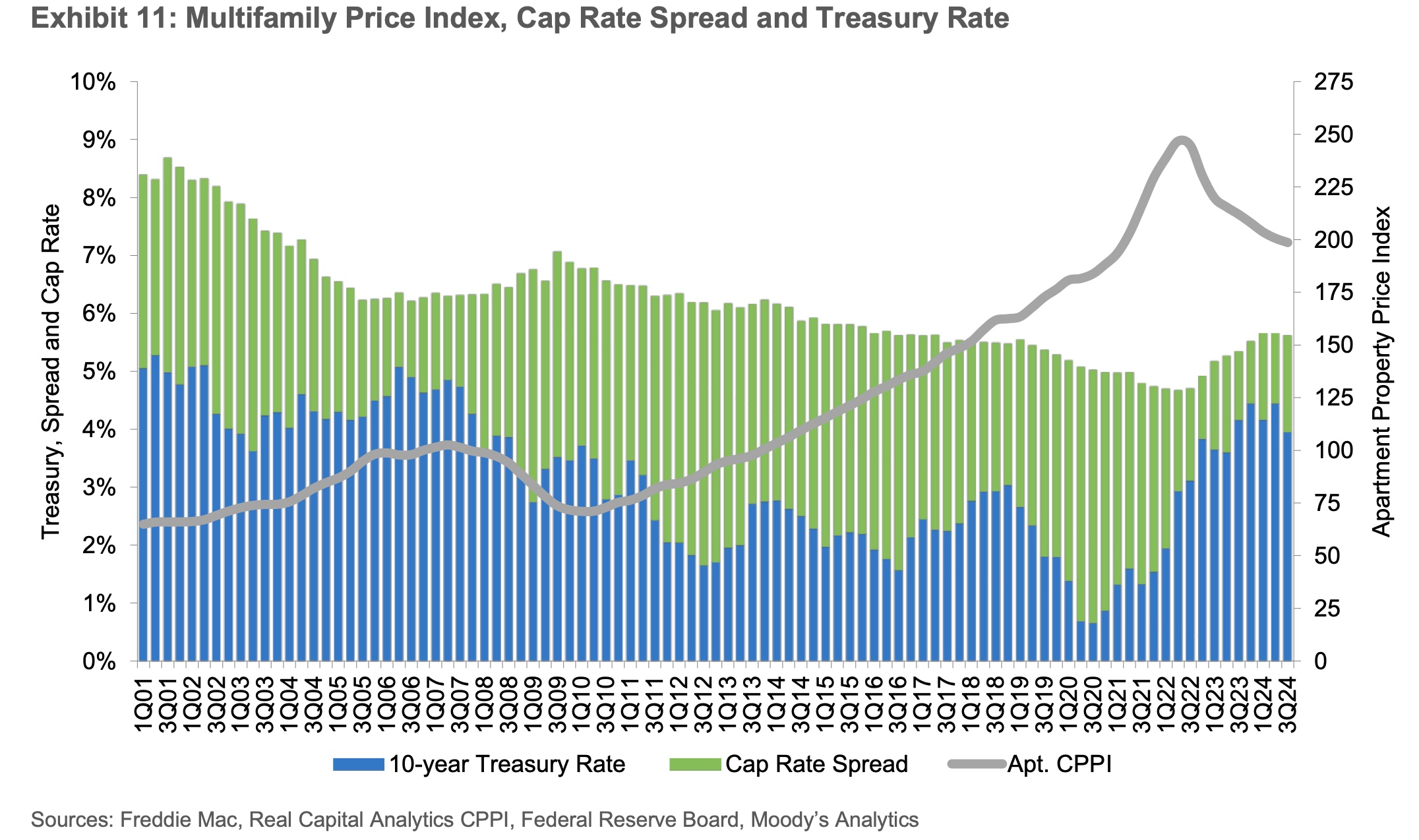

The 10-year Treasury yield, which typically determines coupons on long-term loans, averaged 3.95 percent in Q3 2024, indicating a cap rate spread of about 170 basis points (bps), up compared with late 2023 when it was just above 100 bps, but well below the historic average of about 300 bps going back to 2000, reports Freddie.

The 10-year increased to 4.28 percent in Q4 2024 and indicated that cap rate spread compressed again at roughly 120 bps, assuming cap rates are unchanged. Some market participants think multifamily values may have bottomed, although hard data is difficult to gather, said Freddie.

Since peaking in mid-2022, property prices have been declining and are down nearly 20 percent over that period, per RCA, due to higher cap rates and moderating property performance. However, the rate of price declines has been flattening, falling by just -1.4 percent and -1 percent, respectively, during Q2 and Q3 2024, but still up nearly 10 percent nationally since the pandemic started.

Cap rates generally move in tandem with interest rates because, in theory, rising rates lead to higher cap rates, which in turn lower property values.

Despite elevated interest rates and volatility, cap rates were relatively stable for the first nine months of 2024, operating within a 10-bps range of 5.6 percent to 5.7 percent, according to data from Real Capital Analytics (RCA). As of Q3 2024, they increased about 30 bps to 5.6 percent, although cap rate data generally lags the actual market.

Transaction volume continued to rise in 2024 as interest rate volatility slowed but experienced large swings even after the Fed began lowering rates last September. And since the Fed in December projected fewer cuts this year, Freddie notes that transactions that made financial sense at yesterday’s interest rate may not today.

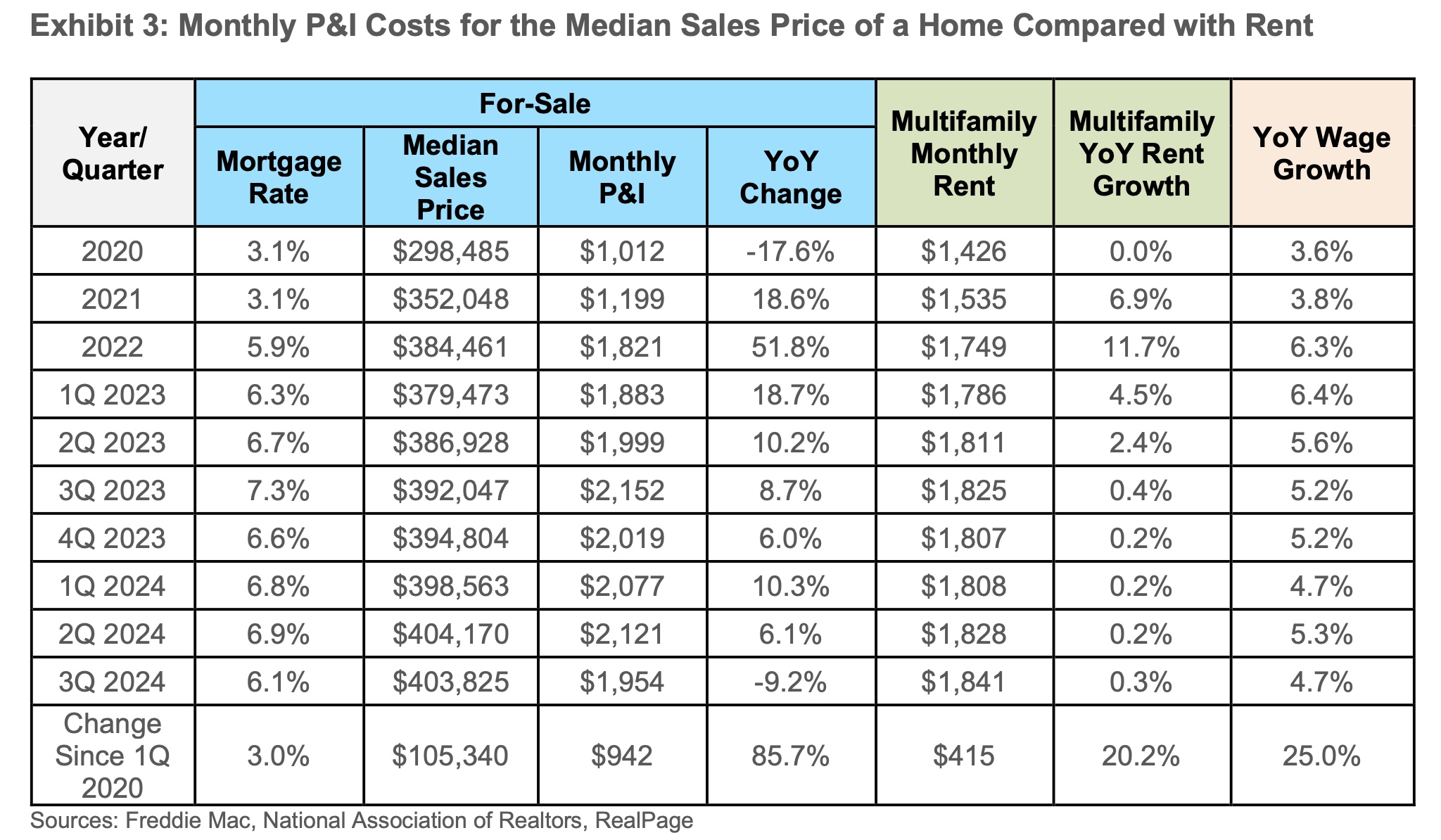

Freddie still expects multifamily originations to increase as the lack of affordable single-family homes drives first-time homebuyers into the rental pool. Many are unable to come up with rising home prices, insurance, property taxes and down payments. A Bankrate study in April 2024 found that renting is cheaper than buying in all major U.S. cities.

As of the Q3 2024, the monthly cost to finance a home has gone up $942 since Q1 2020, while monthly rental rates have increased by $415 in the same period. Freddie expects multifamily rents to climb by 2.2 percent, up from the 0.3 percent annual rent growth as of Q3 2024, compared with 11.7 percent and 6.9 percent in 2022 and 2021, respectively.

While Freddie expects 2025 volume to total between $370 billion to $380 billion, the MBA forecasts volume of $390 billion for the year (shown in Freddie’s Exhibit 13) due to the backlog of multifamily transactions sidelined while rates were elevated, loans that can no longer reasonably extend and need to refinance, as well as property price and cap rate stabilization.

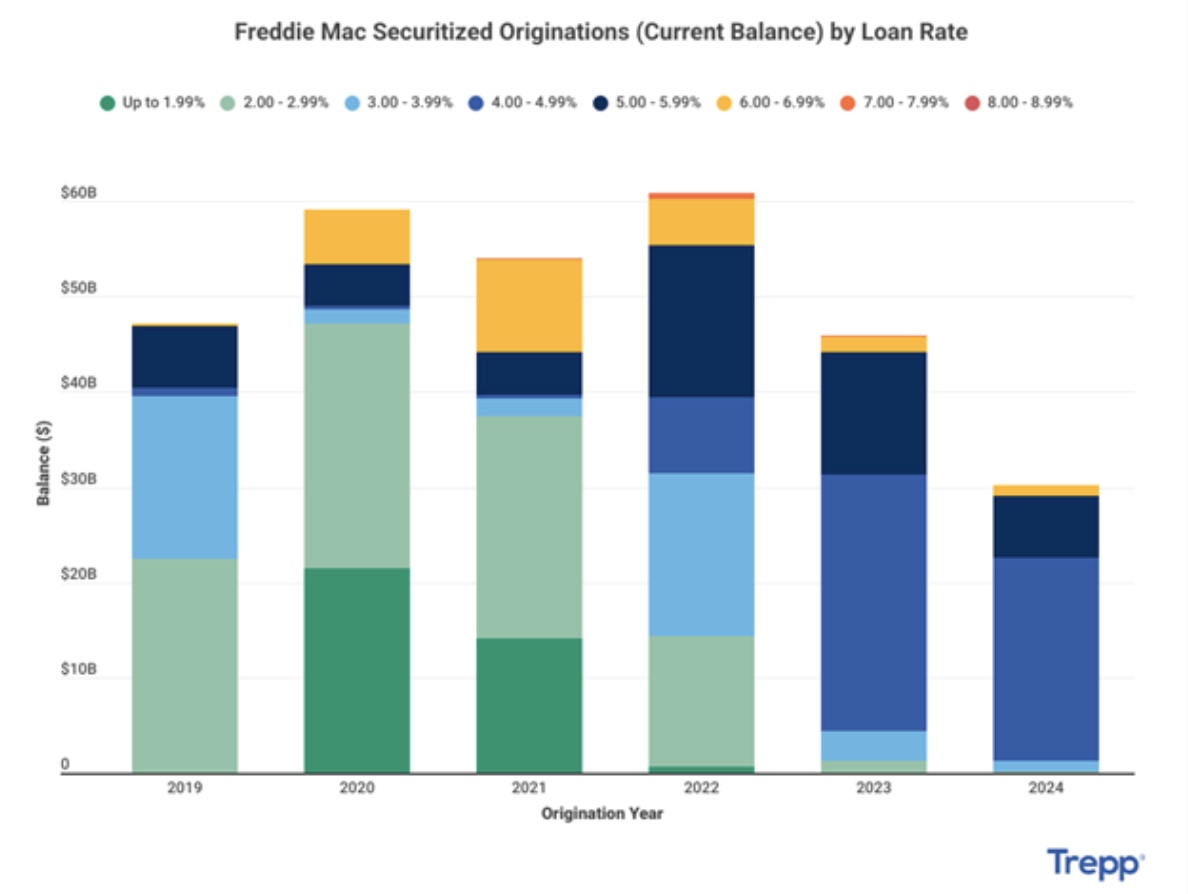

A portion of Freddie Mac multifamily loan originations are securitized by the Government-Sponsored Enterprise agencies (GSE), which offer private capital as a lending source for agency-profile borrowers.

Trepp, which offers advanced analytics for CMBS and CRE loans, breaks out the current outstanding balance of securitized Freddie loans by their year of origination and the current loan rate in the graph below.

Over the past five years, 83.8 percent of originations have an interest rate of less than 5 percent, compared with 51.73 percent of originations in 2022; 9.44 percent in 2023; and 4.05 percent in 2024. More striking is that 79.67 percent of 2020 originations bear an interest rate of less than four percent, compared with just 2.75 percent in 2023 and 0.52 percent in 2024.

After back to back years of decreases in 2023 and 2024, the volume of securitized agency originations is uncertain, but there is little reason to suspect that the loan rate mix in 2025 will look much different than last year, said Trepp.