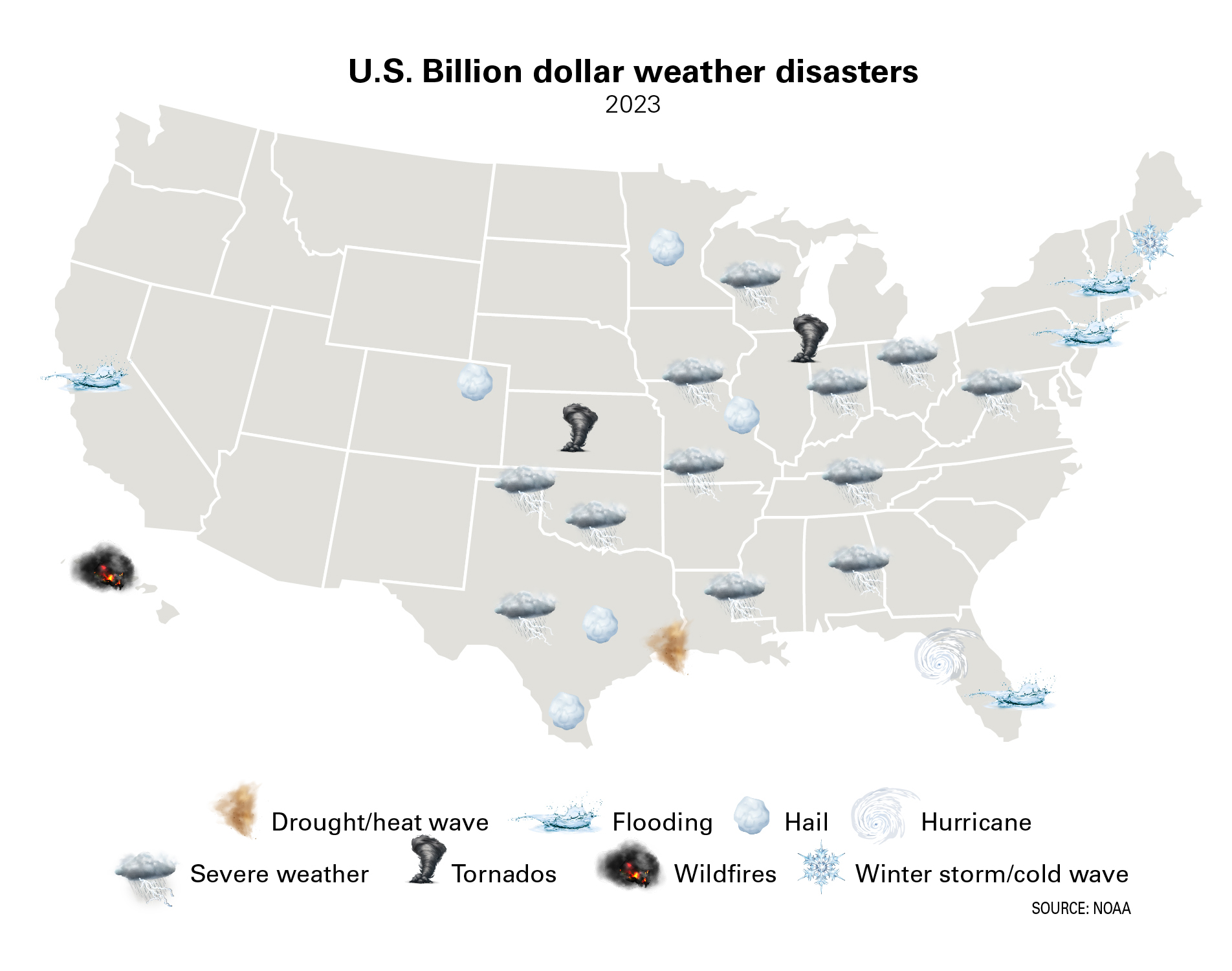

Several hurricanes and tropical storms tore wide paths of mayhem and destruction through the Southeast and Mid-Atlantic United States this year. Just one of these disasters, Hurricane Helene, caused more than $87 billion in damage. Hurricane Milton caused more than $85 billion.

As this magazine goes to press in November 2024, the Atlantic hurricane season has already produced 17 named storms including five hurricanes. This will be the first year since 2019 to include two or more Category Five hurricanes, with sustained winds of at least 158 miles per hour.

Damage from these storms and other emergencies like wildfires are likely to cause even more chaos in the market for property insurance—and even higher costs for apartment managers. Multifamily pros had just begun to hope the cost of insurance might stop rising so quickly in 2024 after years of relentless increases.

Damage from these storms and other emergencies like wildfires are likely to cause even more chaos in the market for property insurance—and even higher costs for apartment managers. Multifamily pros had just begun to hope the cost of insurance might stop rising so quickly in 2024 after years of relentless increases.

“The market had reached a level of stability, coming from a challenging market from 2021 to 2023,” said Rafael Rivera, managing director of operational risk at Greystar.

Now rates are likely to rise again in 2025, once insurance companies add up the claims for damage from hurricanes this year.

Insurance costs rose relentlessly

The cost of insurance had been growing quickly for apartment properties since 2017. The most extreme increases in costs came during the period of rapid price inflation after the coronavirus pandemic.

“The cost has increased more than 150 percent in the last five years,” said Peter Standley, director of Marcus & Millichap’s Multifamily Division, working in the firm’s offices in Indianapolis. “Inflation and storms have taken the cost of insurance to a whole new level.”

The insurance bill for each apartment property varies widely depending on the particular risks it faces, the cost to repair or replace damaged buildings and the property’s history of insurance claims. As a rough average, a property that paid roughly $200 unit per year for its package of insurance coverage in 2019 now has to pay more than $650 per unit, said Standley.

In 2023, the cost of insurance increased by 26.2 percent on average for apartment properties, according to the 2023 I/E IQ benchmarks, from the National Apartment Association (NAA) in collaboration with the Institute of Real Estate Management (IREM) and the Building Owners and Management Association (BOMA). The benchmarks included operating and expenses information for over 900,000 multifamily units in more than 4,000 properties spanning 110 metro markets. The increase in insurance costs in 2023 was more than twice the increase in 2022, which had itself seemed large at the time.

The cost of insurance is still relatively small compared to other costs. It averaged just 8 percent of the operating expenses at apartment properties in 2023, according to NAA. But the relentless increases in insurance costs are still hurting the plans of apartment investors who operate on tight margins. Rising costs also impact financing activities as lenders become increasingly risk averse.

Why is this happening?

The crippling storms of 2023 contributed directly to the rising cost of insurance. Global natural disasters caused $380 billion in economic losses—only 31 percent of which were covered by insurance, according to Aon’s 2024 Climate and Catastrophe Insight Report.

“The year 2023 was the worst year on record in terms of severe storms going back to 1980s,” said M&M’s Standley.

The rising cost of construction also contributed directly to the increasing cost of property insurance as damaged buildings became more expensive to fix. “The cost of building has gone up exponentially,” said Standley. For example, the producer price input for materials used in new multifamily construction rose 15.5 percent in 2021, according to the Bureau of Labor Statistics. Labor costs also rose sharply.

Other kinds of insurance are also becoming more costly for apartment properties—not just policies that cover fires and floods.

In states like California, where litigation is relatively easy, many landlords also face the risk of liability from tenant lawsuits. Many property owners have been sued over problems like cracks in sidewalks that can lead to trips and falls. Among M&M’s clients in California, roughly half are dealing with a lawsuit from a tenant or tenant advocacy group.

“These have the potential to be million-dollar payouts,” said Standley.

In California, defendants are also responsible for the cost of plaintiffs’ legal fees in cases the plaintiff wins. “There are now dozens of ‘habitability lawsuits’ filed every day where multifamily property owners and their insurers are forced to settle rather than risk being on the hook to pay the plaintiff’s legal fees,” according to The Counselors of Real Estate’s October report identifying the Top Ten Issues Affecting Real Estate in 2025.

Insurance companies have struggled to pay all these claims. Many have failed or dramatically reduced their business. For example, State Farm General Insurance Company no longer offers commercial apartment policies in California, impacting roughly 42,000 policies, according to NAA. “A number of other insurance carriers just left the state in California,” said Standley.

After Hurricane Ian struck Florida in September 2022, United Property & Casualty Insurance Company, a significant regional insurance carrier, became insolvent. At least 15 other Florida insurance carriers have become insolvent since 2020.

Until recently, insurance companies could diffuse their risks by selling some of that risk on the international re-insurance markets. Investors like hedge funds or large, foreign insurance companies like Lloyd’s of London or Zurich would access property insurance markets in the U.S. by committing to pay a share of any claims from the covered properties in exchange for receiving some of the income from premiums.

These re-insurance firms have “experienced significant losses, raised their costs and have restricted the type and size of business that they will provide coverage for,” said Matt Sullivan, chief operating officer, The Michaels Organization, based in Camden, New Jersey.

Some apartment companies have negotiated agreements with their insurance companies to cover some of the cost of repairing or replacing damaged or destroyed properties themselves in exchange for lower premiums. “Our firm has assumed higher deductibles (retained more risk), changed the structure of our insurance coverage tower to meet underwriting appetite and gain more efficient pricing,” said Sullivan.

In the past three years, nearly two-thirds (61 percent) of owners and managers of apartment properties had to increase the deductibles of the insurance plans to keep the cost of those plans affordable, according to the National Multifamily Housing Council’s (NMHC’s) 2023 State of Multifamily Risk Survey and Report, a study of 160 apartment owners and managers with more than a million units under management. More than half (57 percent) said that their insurance carriers had added new policy limitations to reduce their exposure. And nearly a third (34 percent) reported that their insurance carriers limited or reduced coverage amounts.

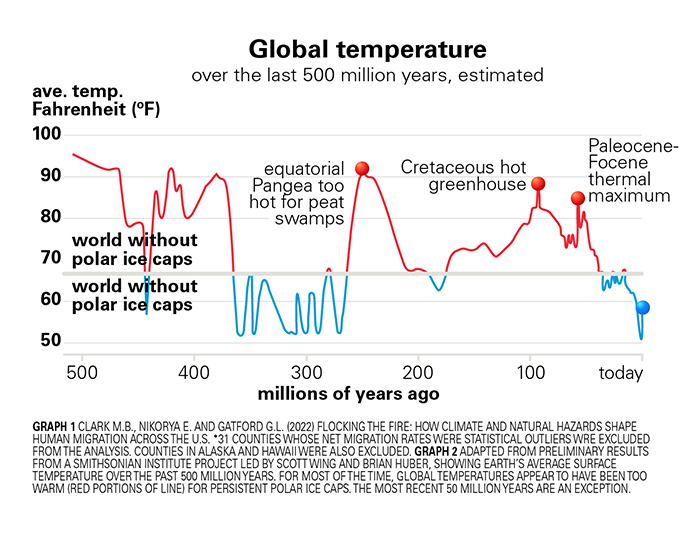

This cycle of expensive claims, rising costs and shrinking coverage for property insurance has happened before.

“The insurance market ebbs and flows,” said Standley. “The market will get really tough, and then everyone raises their prices.” In the past, healthy competition has eventually returned to the insurance markets, usually after a period where there are no natural disasters, and the losses are minimal.

Apartment managers dodge rising costs

Apartment managers can avoid some increasing insurance costs is by avoiding insurance claims.

For apartment properties with no claim history, the cost of insurance generally increases 15 percent to 30 percent year-over-year with no other changes to the coverage. But at apartment properties with a history of insurance claims, even if the claims were due to tenant actions outside of the landlord’s control, premiums can more than triple in price, according to Marc Gordon, principal, co-president, and chief financial officer for Investors Management Group (IMG), based in Los Angeles.

“Claims filed at a property affect the premiums for the next renewal—potentially for the next five years,” says Gordon.

To avoid that punitive increase in costs, IMG generally does not file an insurance claim unless it is for at least $100,000—even if their insurance policy allows for a $25,000 deductible.

“We’d often expect future premiums to rise by more than our out-of-pocket costs,” said Gordon. “In some cases, we are strategically increasing our deductibles to reduce the costs of premiums, especially because we aren’t filing for the smaller claims.”

Apartment managers have found another way to keep properties from getting a history of insurance claims: they try to avoid damage to their properties from occurring in the first place.

“We are also implementing a host of preventive control measures such as limiting the use of grills to help mitigate the risk of a loss,” said Gordon.

Other apartment managers carefully assess their properties to make them more resilient to the risks they face. In areas where wind is a hazard, they remove trees that could fall and damage buildings. In area threatened by flood, they locate expensive appliances like HVAC systems on higher ground.

“We continue to improve our focus on loss mitigation throughout both our owned and managed portfolios,” said Greystar’s Rivera.

Insurance companies also consider these efforts. “An owner can be rewarded for thoughtful loss prevention with better rates,” said Gordon.

Owners of apartment properties should also make sure insurance companies don’t overcharge them based on inflated estimates of how much it would cost to replace the properties if they were destroyed by disaster. Many insurance companies estimate replacement costs based on a baseline for properties of a certain type.

“If you like do some legwork, your replacement costs may be cheaper,” said M&M’s Standley. For example, the insurance company might estimate a section wall might cost $300 per foot to replace. But a property owner might be able to show the item could really be replaced for $250 per foot. “There may be a case to save some money.”

“Owners need to work with insurance brokers to make sure underwriters have accurate, up-to-date information on a property and replacement costs so that they can then plug into their underwriting models to accurately assess valuations,” said Robert Griswold, president of Griswold Real Estate Management, based in San Diego.

A careful assessment may also show opportunities to prevent losses.

“We’ve had a property before where we graded areas of the property,” said Aaron Phipps, senior vice president and chief financial officer for Lawson, based in Norfolk, Va. “We’ve worked with municipalities to make sure you know storm drains are cleared to make sure that the water flow is going the direction it’s supposed to go.”

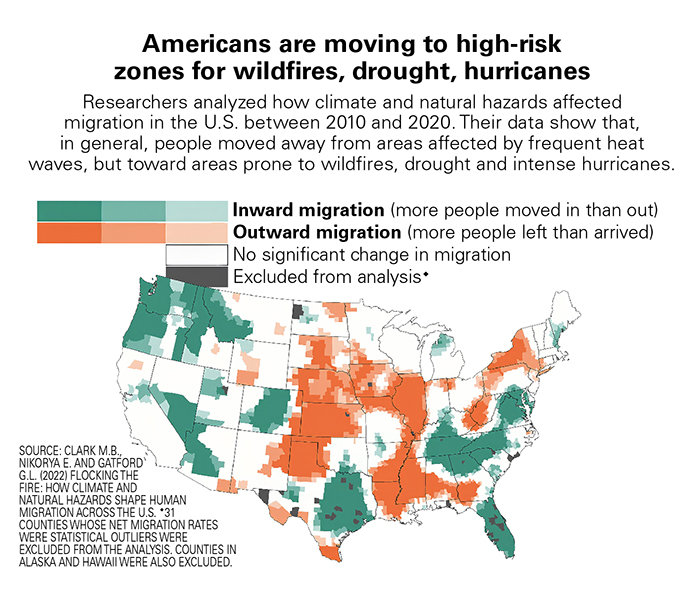

Some apartment investors are also deciding what properties to buy—and which ones to sell—based on insurance costs and the risk of natural disasters.

“We decided a few years ago to exit the Florida market because of risk of rising insurance costs,” said IMG’s Gordon. “The value proposition did not support operating in some Florida coastal locations. We didn’t want to be in a market where there is an extremely high risk each year that the property will be flooded or subject to material damage. Other apartment investors satisfy themselves with diversifying their portfolios of properties.

“Make sure you spread your risk, just like the insurance companies do,” said Standley.

“Make sure you spread your risk, just like the insurance companies do,” said Standley.

If an investor has a portfolio of apartment properties located in coastal markets in Florida, all those properties could be damaged or destroyed in a single brutal season of hurricanes. Simply selling a property located on the coast and buying a new property a little inland on slightly higher ground could add some helpful diversification to a portfolio, experts say. “You don’t need to make any drastic changes, but diversification across your portfolio in terms of vintage and location will help spread your risk,” said Standley.

Apartment investors can also diversify their portfolios by owning apartment properties that were built using different types of construction.

“If you own stick frame, maybe you’re buying something that’s completely cinder block,” said Standley. This strategy reduces both the risk of loss for the property owner and the cost of insuring against that loss. “Cinder block is a lot cheaper to insure than stick frame. With stick frame you can lose everything.”