Intergra Realty Resources (IRR) recently released its annual Viewpoint report for 2025. The report discusses the state of the US economy and presents an update on the operating performance data for four commercial property classes. This article focuses on the data for the multifamily property class.

The report provides IRR’s estimates for basic performance metrics for Class A and B properties in urban and suburban areas in each of four regions of the country and how those metrics have changed over the past year.

Assessing the economy

IRR notes that many economists predicted that the U.S. economy would experience a recession as the Federal Reserve raised interest rates after 2022. However, the economy has avoided that fate, and the report suggests that it will continue to do so. While the report predicts that GDP growth will to continue to slow, dropping to an annualized rate of about 1.5 percent in Q2 2026 according to Moody’s Analytics, the growth rate is predicted to pick up after that point. The report credits the U.S. consumer with keeping growth positive by continuing to spend.

The report observed that employment growth slowed in 2024 from 2023’s rate but has remained strong. However, they note that most of the recent growth has occurred in just 3 industries: healthcare, government and leisure and hospitality. They also note that the response rate to the BLS surveys upon which the employment data is based has fallen in recent years. This may make the data more volatile and less reliable.

The report quotes the October 2024 PCE inflation index coming in at 2.3 percent year-over-year, with the core PCE index at 2.8 percent. These readings are still above the Fed’s 2.0 percent target, but the report notes that recent wage growth has outpaced inflation, easing the burden on consumers.

With inflation remaining above the Fed’s target, the report does not look for interest rates to decline rapidly. It quotes a Moody’s Analytics projection that has the effective Fed Funds rate remaining above 4 percent until the fall of this year and not dropping to 3 percent until the end of 2026.

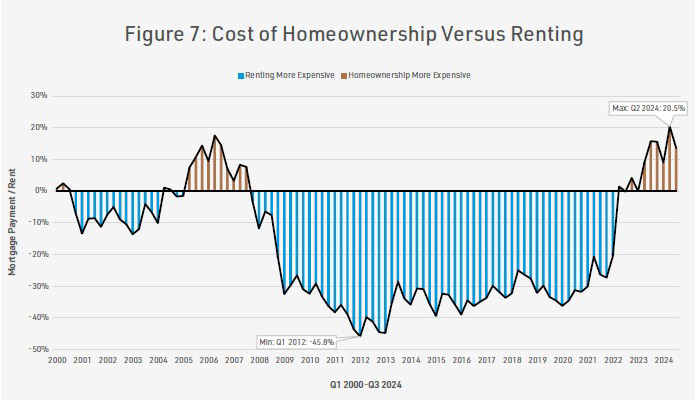

The report provides data showing that the cost of owning a home was significantly less than the cost of renting from 2007 to 2022. However, recently the cost of renting has been much less than the cost of owning a home. In February 2024, the differential in favor of renting reached 20.5 percent. This is the highest it has been in IRR’s dataset, which goes back to 2000.

Multifamily cap rates rise, but more slowly

In last year’s IRR Viewpoint Report, IRR found that cap rates rose year-over-year for every property grouping (Class A or B, urban or suburban) for every region of the country in Q3 2024. This year, the Central region was an exception to this trend. There, cap rates declined for both Class A and Class B properties in both urban and suburban markets. The decline was as high as 23 basis points for suburban Class B properties and as little as 1 basis point for urban Class A properties.

The national average cap rate increase was about 10 basis points, down from the 59 basis point rise seen in the 2024 Viewpoint report. Nationally, Class A properties had cap rates averaging 5.65 percent while Class B properties had cap rates averaging 6.27 percent.

Cap rates for urban properties were slightly lower than those of suburban properties except in the Central region. The highest cap rate in the country was for suburban Class B property in the East region at 6.75 percent. The lowest cap rate was for urban Class A property in the West at 5.12 percent.

The report defined the commercial property business cycle as going through the following phases: expansion > hypersupply > recession > recovery > expansion. Of the 57 cities covered, the report stated that 18, are in the hypersupply stage due to the high level of new supply arriving. Eleven metros are in the recession phase. Thirteen metros are in the recovery phase while 15 metros are in the expansion phase. This is a much more even distribution than in last year’s report, in which by far the largest number of metros was in the hypersuppy phase.

Rent growth is slow but outlook is positive

IRR’s national average rent growth for Class A properties was 0.27 percent. Rent growth for Class B properties was 0.12 percent. The low rate of rent growth was driven by the high level of new supply which arrived over the last two years. As new supply ebbs and demand remains strong due to both strong job growth and the high cost of owning, IRR expects annual rent growth to return to its long term trend of 2 to 3 percent annual growth.

IRR data indicated that Class A properties in the East region had the highest rate of rent growth at 1.3 percent. Class B properties in the West region had the lowest rate of rent growth at -0.2 percent.

The absolute level of rents was highest for Class A properties in the West region at $2546. Rents were lowest for Class B properties in the Central region at $984.

The national average vacancy rate for Class A properties was reported to rise 109 basis points year-over-year to 6.90 percent. The national vacancy rate for Class B properties rose 44 basis points to 4.87 percent.

IRR found that all regional vacancy rates for both Class A and Class B properties rose year-over-year. The vacancy rate rose between 18 basis points for Class B properties in the Central region and 159 basis points for Class A properties in the South.

Class A properties in the South region had the highest vacancy rate at 7.48 percent. Class B properties in the Central region had the lowest vacancy rate at 3.62 percent. Vacancy rates for Class B properties were significantly lower than those for Class A properties in all regions of the country.

The report also discusses office, retail and industrial commercial property markets. It is available here. Registration is required in order to access the report.