Apartment market conditions declined in the National Multifamily Housing Council’s (NMHC’s) most recent Quarterly Survey of Apartment Market Conditions. All four indices – Market Tightness (40), Sales Volume (41), Equity Financing (48) and Debt Financing (32) – came in below the breakeven level (50), signaling less favorable conditions this quarter.

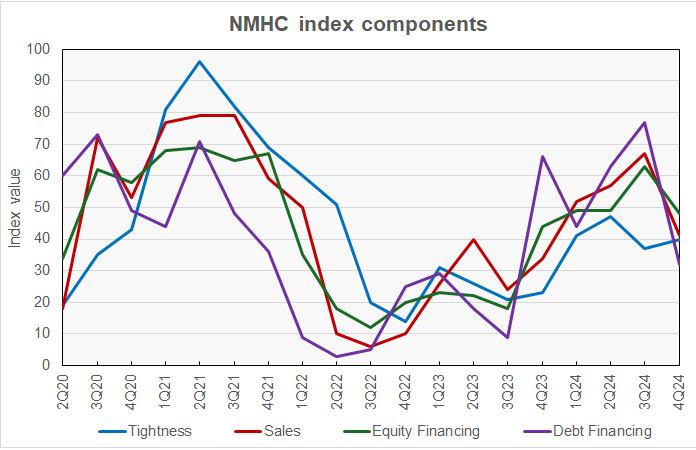

While the tightness index had been in negative territory in last quarter’s report, the other three components of the index had been in positive territory. However, they dropped sharply in this quarter’s survey. The history of changes to the components of NMHC’s index are illustrated in the chart, below.

“Census data show that more apartments were delivered in 2024 than in any other year since 1974,” noted NMHC’s Economist and Senior Director of Research, Chris Bruen. “This surge in new supply continues to put downward pressure on rent growth and occupancy, especially in sunbelt markets.”

“Federal Reserve officials, meanwhile, signaled in December that they are expecting short-term interest rates to remain higher for longer in their effort to combat inflation, now projecting a median of just two rate cuts in 2025. The 10-Year Treasury yield, as a result, rose 58 basis points between October and January, leading to a higher cost of both debt and equity capital in the apartment market and lower deal flow.”

- The Market Tightness Index came in at 40 this quarter – below the breakeven level of 50 – indicating looser market conditions for the tenth consecutive quarter. Slightly over half (52 percent) of respondents thought market conditions were unchanged relative to three months ago, while a third of respondents thought conditions have become looser. Fourteen percent of respondents reported tighter market conditions than three months prior. This index had been at 37 last quarter, so it was the only sub-index that showed improvement.

- The Sales Volume Index reading of 41 reflects decreasing deal flow over the past three months. This is down sharply from last quarter’s reading of 67 and marks the first pullback after three straight quarters of increasing deal flow. While 48 percent of respondents thought sales volume went unchanged over the past three months, 34 percent (up from 10 percent) thought sales volume was lower than in October, while just 16 percent (down from 43 percent) of respondents thought volume was higher.

- The Equity Financing Index came in at a reading of 48, reversing again after last quarter’s survey brought the index value to 63. That was the first time it was above 50 since January 2022. In the current survey, 60 percent of respondents thought the availability of equity financing went unchanged over the last three months. Eighteen percent of respondents thought equity was less available (up from 6 percent in October), while 14 percent thought equity was more available (down from 32 percent in October).

- The Debt Financing Index also came in well below the breakeven level of 50 – indicating less favorable conditions for debt financing compared to three months ago – with a reading of 32. This was down sharply from a reading of 77 in October. Only 14 percent of respondents this quarter felt now was a better time to borrow than three months ago, while 49 percent thought borrowing conditions were worse. A third of respondents reported unchanged debt financing conditions, up from 25 percent last quarter.

The full survey results are available here.