Confidence has returned to a small segment of the multifamily arena forecasting an end to the supply glut that has stymied both development and acquisitions over the past several years. Apartment REITs and a few private developers are ramping up their pipelines in response to what they see as slowing starts over the next few years, while the broader apartment development landscape remains constrained.

This was the focus of a LinkedIn page discussion launched by rental housing economist Jay Parsons on February 18 after listening to the REIT’s Q4 2024 earnings calls.

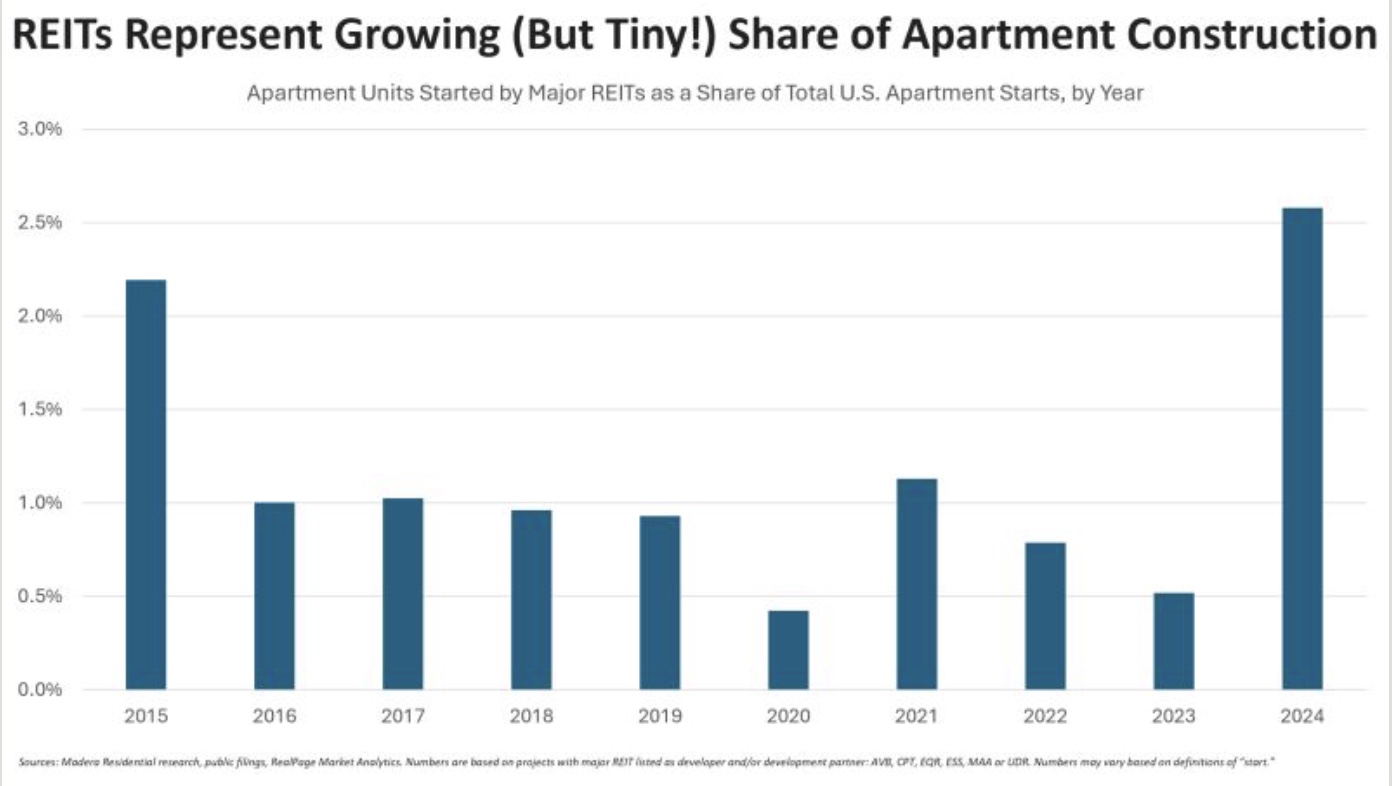

Some of the big six apartment REITs are starting projects now to take advantage of the low supplied environment expected in 2026-27, he said, with the caveat that their activity represents only a tiny sliver of the nation’s overall apartment construction.

The dearth of available equity financing and difficulty finding projects that pencil out has most apartment developers on the sidelines. Some private developers able to self-fund their projects are moving ahead with development, but even they are having difficulty getting traditional projects out of the ground.

Greystar, for instance, broke ground last September with retail partner ECHO Realty on the mixed-use Ophelia with 231 apartments in Pittsburg, Pa., slated for completion in early 2026. Mill Creek Residential started the podium-style Modera Nations with 396 units located three miles west of Downtown Nashville.

But the bottom line is that new REIT development activity and these few starts by privates reflect their unique position and are not a leading indicator for a broader resurgence in starts, said Parsons.

Collectively as a group, the apartment REITs tripled their starts from 2023 to 2024, but that activity wouldn’t even have cracked the most recent National Multi Housing Council Top 25 developers list based on 2023 starts, he said.

REIT starts in 2024 represented only 2.6 percent of all units started nationally, and marked a 10-year high, up notably from 0.5 percent in 2023. See chart below.

Parsons explained how REIT apartment construction differs from more fragmented single-family homebuilders and the strategies of merchant apartment builders, the latter of which raise equity from investors with the goal of paying them back plus some when they sell after lease-up.

REITs and certain peers on the private side possess an advantage because they can self-fund project equity and borrow at comparatively attractive rates. Their lower cost of capital and typical long-term, build-to-hold strategy gives them more flexibility than most merchant builders that aim to sell a project as soon as construction is complete.

If REITs start as many projects as planned this year, their share of starts nationally will increase again, Parsons said, providing commentary from REIT Q4 2024 calls.

Avalon Bay (AVB) said its most recent $1.6 billion in project starts are timed to a projected slowdown in starts in the overall industry and, “will face less competition when they lease up in roughly two years’ time. By the end of this year, we expect to have $3.5 billion under construction, which is 50 percent higher than where we are today,” said AVB president and CEO Benjamin Schall. AVB is looking for low- to mid-six percent returns for investment in new development.

Mid America (MAA), focusing primarily on the Sun Belt, broke ground on five projects totaling 2,300 units last year—a “record level” for them, and expects to start three to four more this year. MAA CFA Brad Hill said, “Development is one of the best uses of capital that we have today.”

Essex announced it was breaking ground on its first new development in more than five years. Camden plans up to $675 million in new starts this year, focusing on suburban projects, while UDR, could start two to three projects. Of the big REITs, only Equity Residential said they have no new starts currently planned, said Parsons.