The economic projections released by the Federal Open Market Committee (FOMC) after this week’s meeting indicate that they expect the interest rate trajectory to be the same as they projected with the last release in December.

The FOMC meets 8 times per year but only releases an economic forecast at 4 of the meetings. The Fed forecast presents estimates for economic metrics for December of each year through 2027 and a “longer run” forecast which reflects their view of the equilibrium state of the economy. The consensus Fed forecast is developed by combining the forecasts of 19 economists. Each of the economists assumes that the Fed will follow “appropriate” monetary policy during the term of the forecast, although their individual ideas of what that policy is may vary.

Interest rates higher for longer

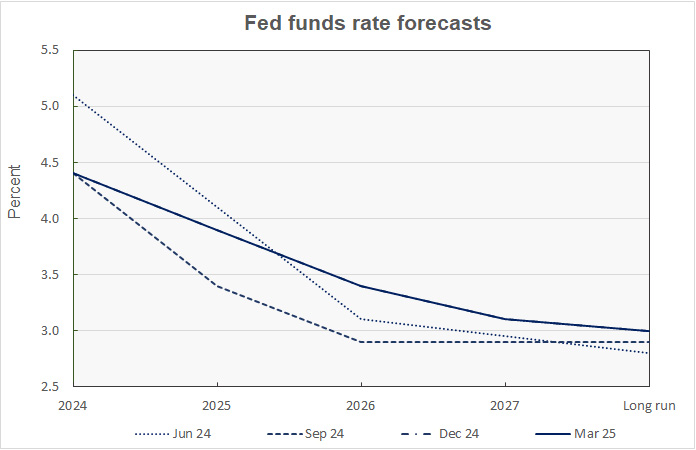

As expected, the Fed left interest rates unchanged at their recent meeting with a target range of 4.25 percent to 4.5 percent. Their year-end 2025 projection is for a Fed Funds rates of 3.9 percent, effectively a range of 3.75 to 4.0 percent. This implies two ¼ point rate cuts this year. Their projection calls for two more ¼ point rate cuts in 2026, with a year-end target rate of 3.4 percent. The year-end target for 2027 is 3.1 percent. The projection for the long-run (equilibrium) interest rate was left unchanged at 3.0 percent.

A history of the forecasts for the Federal Funds rate is given in the first chart, below.

Inflation: higher for longer

The Federal Reserve’s preferred inflation measure is based on the Personal Consumption Expenditures (PCE) survey, rather than the more familiar Consumer Price Index (CPI).

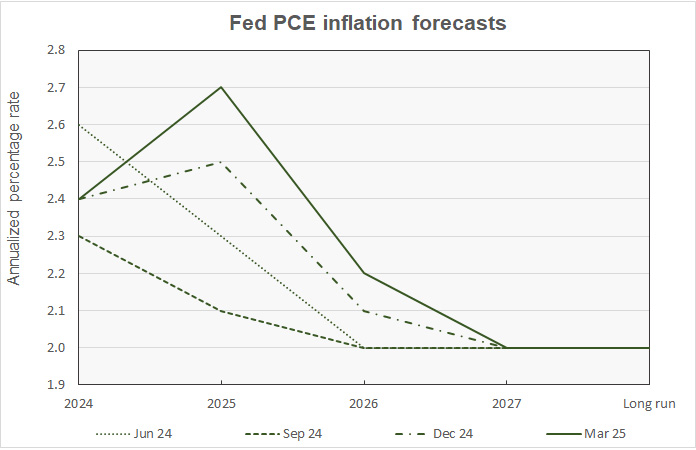

While the Fed expressed a relatively optimistic outlook on inflation in their last pre-election projection released last September, the two projections they have released since then have shown an increasingly gloomy view of where inflation is heading.

The September projection had year-end 2025 inflation at only 2.1 percent, just above the Fed’s 2.0 percent target. However, this projected rate was raised to 2.5 percent in December and to 2.7 percent in the current (March) projection. Similarly, the year-end 2026 projection has been raised from 2.0 percent to 2.1 percent to the current 2.2 percent. Inflation is not expected to reach the Fed’s 2.0 percent target until 2027.

Recent PCE inflation forecasts are shown in the next chart.

GDP growth lower in near term

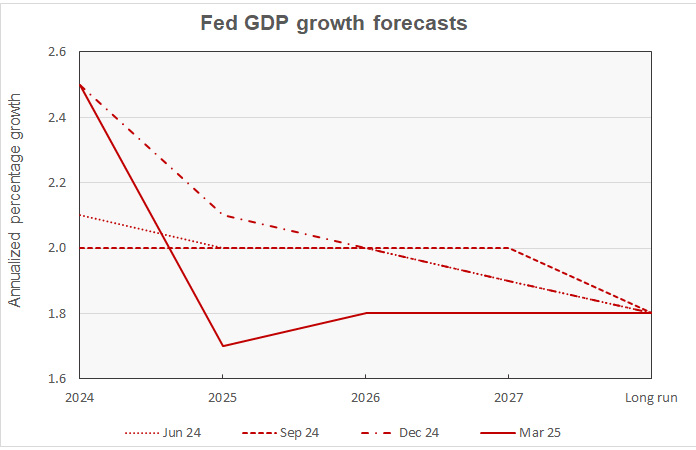

The largest change to the Fed’s GDP growth forecast was a 0.4 percentage point drop in the expected growth rate in 2025. The projected GDP growth for the year was lowered from 2.1 percent to 1.7 percent.

In addition, the GDP growth projections for 2026 and 2027 were lowered to only 1.8 percent. This is the Fed’s long-run (equilibrium) GDP growth projection. The Fed evidently thinks that the economy will not get a bounce as it emerges from its near-term slowdown.

Recent Fed GDP forecasts are illustrated in the next chart, below.

Unemployment higher in 2025

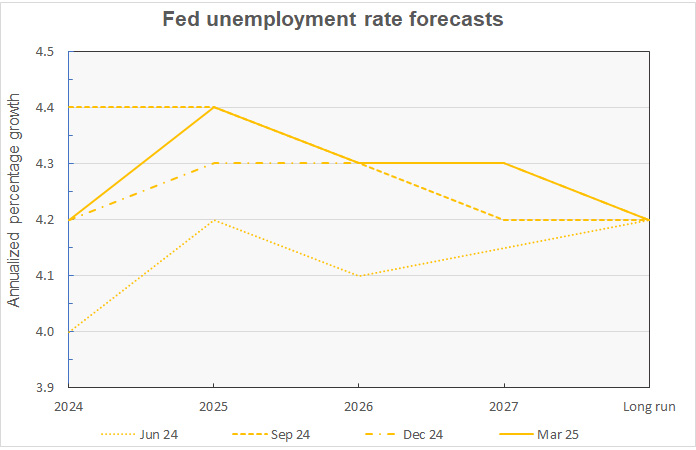

The Fed has raised its year-end 2025 projection for the unemployment rate 0.1 percentage point to 4.4 percent. The most recent unemployment rate figure from the Bureau of Labor Statistics was only 4.1 percent, so the Fed believes that the rate will rise this year. Unemployment rate projections for the rest of the forecast horizon were left unchanged from December’s report.

The Fed has a dual mandate to keep unemployment and inflation both low. Their current projection calls for higher inflation in the near-term, suggesting that interest rates should be raised. The projection also calls for higher unemployment, suggesting that interest rates should be lowered. Therefore, it is not surprising that interest rates have been left unchanged.

The history of the Fed’s recent unemployment rate forecasts is shown in the next chart.

The next updates to the Federal Reserve’s forecasts for the economy will come after the June 2025 FOMC meeting which concludes June 18.