Rental housing economist Jay Parsons is known for challenging conspiracy narratives about the multifamily industry. This week, on his LinkedIn page, he debunks monopoly myths that claim large corporate landlords dominate the rental market, driving up rents and negatively impacting community stability and tenant well-being.

The reality is quite the opposite, he said. The rental housing sector remains highly fragmented. Unlike industries dominated by a handful of major corporations, rental real estate is spread across a vast number of independent owners, from small landlords with just a few units to institutional investors managing larger apartment complexes.

Even the largest players in multifamily real estate own only a small fraction of the overall housing stock. Compared to industries like tech, banking, and retail—where a few corporations control significant market share—rental housing remains highly decentralized. This fragmentation, Parsons argues, keeps multifamily an accessible and attractive investment for smaller players.

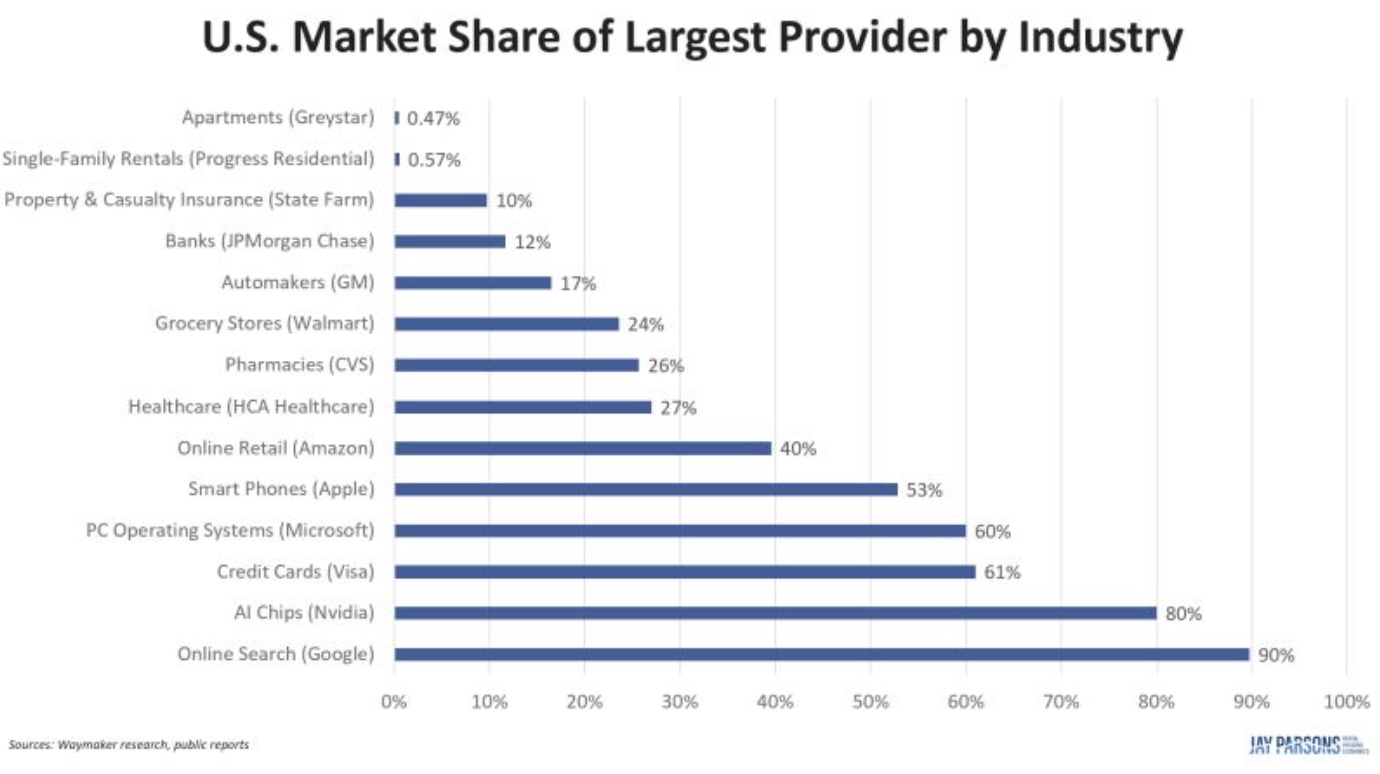

To illustrate his point, Parsons shared a chart comparing market share statistics across various industries:

• Greystar, the largest U.S. multifamily investor, owns just 0.47 percent of the nation’s apartment units.

• Progress Residential, the leading single-family rental (SFR) investor, owns only 0.57 percent of single-family rental properties.

Now, compare those figures to other industries:

• Google controls 90 percent of the online search market.

• Visa holds 61 percent of U.S. credit card transactions.

• Apple commands 53 percent of the U.S. smartphone market.

• Amazon dominates 40 percent of online retail.

• HCA Healthcare owns 27 percent of the healthcare provider network.

• CVS controls 26 percent of U.S. pharmacies.

• Walmart holds 24 percent of the U.S. grocery market.

• GM produces 17 percent of American-owned vehicles.

• JPMorgan Chase has 12 percent of the banking market.

• State Farm has 10 percent of the property/casualty insurance sector.

“By comparison, even the biggest apartment and SFR owners are rounding errors,” Parsons said. “Being the largest in the market doesn’t make them dominant players by any means.”

He acknowledged that some argue SFR investors hold more influence in specific metro areas such as Atlanta, but explains that the argument is misleading. While Progress Residential has a larger presence in Atlanta than nationally, its market share there is still just 4.5 percent, according to JBREC data.

“So, even in a market like Atlanta, Progress’ presence is far smaller than what we see with dominant players in other industries,” Parsons said, dismissing the monopoly claims.

He went on to applaud the decentralized nature of U.S. rental housing. “I love this about the rental industry—it’s so fragmented, so diversified, and still relatively easy for new players to enter. There are likely tens of thousands of rental property owners, each with their own unique strategies and focus areas. Is there any major industry as fragmented as rental housing? Maybe restaurants.”

One commenter on Parsons’ post agreed, writing, “Rental real estate remains one of the last truly fragmented industries, which is exactly why there’s so much opportunity for strategic investors to carve out a niche.”