Two surveys published this month, one national from the National Multifamily Housing Council (NMHC) and the other regional from the Federal Reserve Bank of Minneapolis, highlight how the rising cost of insurance continues to challenge multifamily operations.

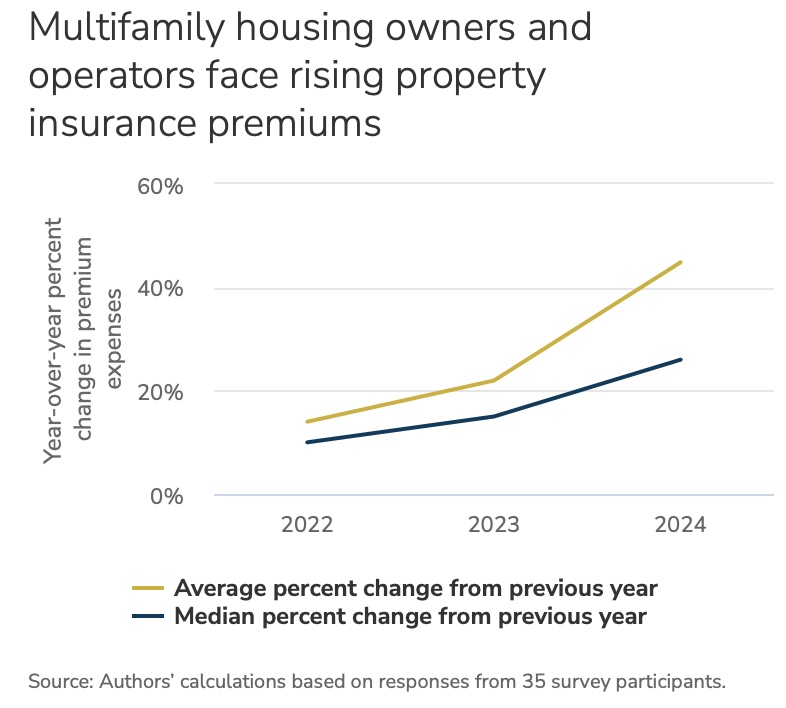

The Minneapolis Fed found that, on average, over 50 percent of the overall operating expense inflation for multifamily housing owners since 2020 can be attributed to increases in property insurance premiums. The figure below shows average and median year-over-year increases.

From 2021 to 2022, respondents reported an average annual premium increase of 14 percent, followed by 22 percent from 2022 to 2023, and a staggering 45 percent from 2023 to 2024. By 2024, property insurance premiums were, on average, double those in 2021, far outpacing increases in the Consumer Price Index over the same period.

From 2021 to 2022, respondents reported an average annual premium increase of 14 percent, followed by 22 percent from 2022 to 2023, and a staggering 45 percent from 2023 to 2024. By 2024, property insurance premiums were, on average, double those in 2021, far outpacing increases in the Consumer Price Index over the same period.

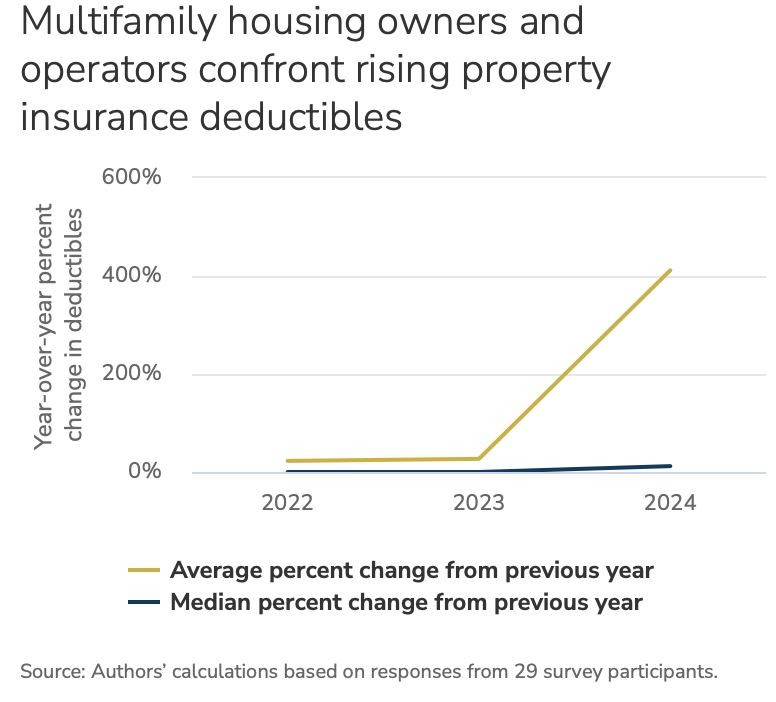

This next figure shows the year-over-year increases in deductibles.

Similarly, the 2024 NMHC State of Multifamily Risk Survey found that insurance costs continue to rise, further exacerbating the already serious affordability housing crisis in the U.S. While insurance rates remain significantly elevated compared to historical norms, the report indicates that the last year brought some stabilization to the property insurance market, marking the first decline in rates since 2017 after 27 consecutive quarters of growth. However, liability lines continue to face challenges, with rising litigation costs and restrictive underwriting practices driving up premiums.

Similarly, the 2024 NMHC State of Multifamily Risk Survey found that insurance costs continue to rise, further exacerbating the already serious affordability housing crisis in the U.S. While insurance rates remain significantly elevated compared to historical norms, the report indicates that the last year brought some stabilization to the property insurance market, marking the first decline in rates since 2017 after 27 consecutive quarters of growth. However, liability lines continue to face challenges, with rising litigation costs and restrictive underwriting practices driving up premiums.

“High insurance costs, interest rates, and construction and material costs make the development and operation of rental housing a financial challenge,” said Sharon Wilson Géno, NMHC President. “A more stable insurance market will help keep costs in check, which, in turn, will improve housing affordability and potentially lower rental housing costs for residents.”

The findings from the Minneapolis Fed survey underscore the financial strain on multifamily housing owners, with respondents noting that rising property insurance costs are forcing them to choose between increasing deductibles or reducing coverage to mitigate higher costs, leaving them vulnerable in the event of property damage.

Moreover, survey respondents are frustrated with the increasing number of coverage exclusions, indicating that fewer causes of damage are eligible for reimbursement. One respondent said there are “so many that a new policy is like a book. You nearly need an attorney to read it to see if you actually have any coverage.”

Insurers most often tied premium increases to weather risks, claims histories, and buildings’ physical characteristics, explanations that survey respondents generally found unsatisfying. “Something is not right,” commented a respondent with zero claims and a 200-percent premium increase.

Rising insurance costs have particularly dire implications for affordable housing providers. Nearly two-thirds of survey respondents operate multifamily affordable to lower-income households. They have less flexibility to raise rents to cover increasing insurance costs and often face stricter limits on rent increases due to funding requirements.

As one affordable housing provider stated, “When insurance and other operating expenses are growing at a much faster rate, it doesn’t take long before properties cannot cover their operating expenses.” The financial strain poses a significant threat to the continued maintenance and development of affordable housing options.

The findings from both surveys underscore the urgent need for stakeholders in the multifamily housing sector to address the rising costs of insurance. Without meaningful intervention, the financial viability of multifamily properties, particularly those serving low- and moderate-income communities, remains at risk.