The multifamily investment outlook remains bullish, but the floodgates will not burst open with deal flow this year. That is the takeaway from the National Multifamily Housing Council’s (NMHC) annual conference, according to RealPage market analyst Carl Whitaker.

Short-term uncertainty, which is almost all about interest rates, not fundamentals, is matched if not topped by conviction in a positive mid- and long-term outlook, said rental housing economist Jay Parsons, basing his comment on his own takeaway from the meeting.

“Most investors believe supply has peaked, rents bottomed, demand robust, and there are greener pastures ahead,” he said.

Key to planning moves in the multifamily industry is understanding local dynamics. So which markets are piquing investors’ interest and why?

Phoenix, Dallas-Fort Worth, and Atlanta are seeing a surge in job growth with companies relocating their headquarters and operations from high-cost, high-tax states to these pro-business environments, suggests data from the Bureau of Labor Statistics. Pittsburgh, Cleveland, and Minneapolis, where universities, hospitals, and healthcare facilities are expanding, are also seeing strong job growth.

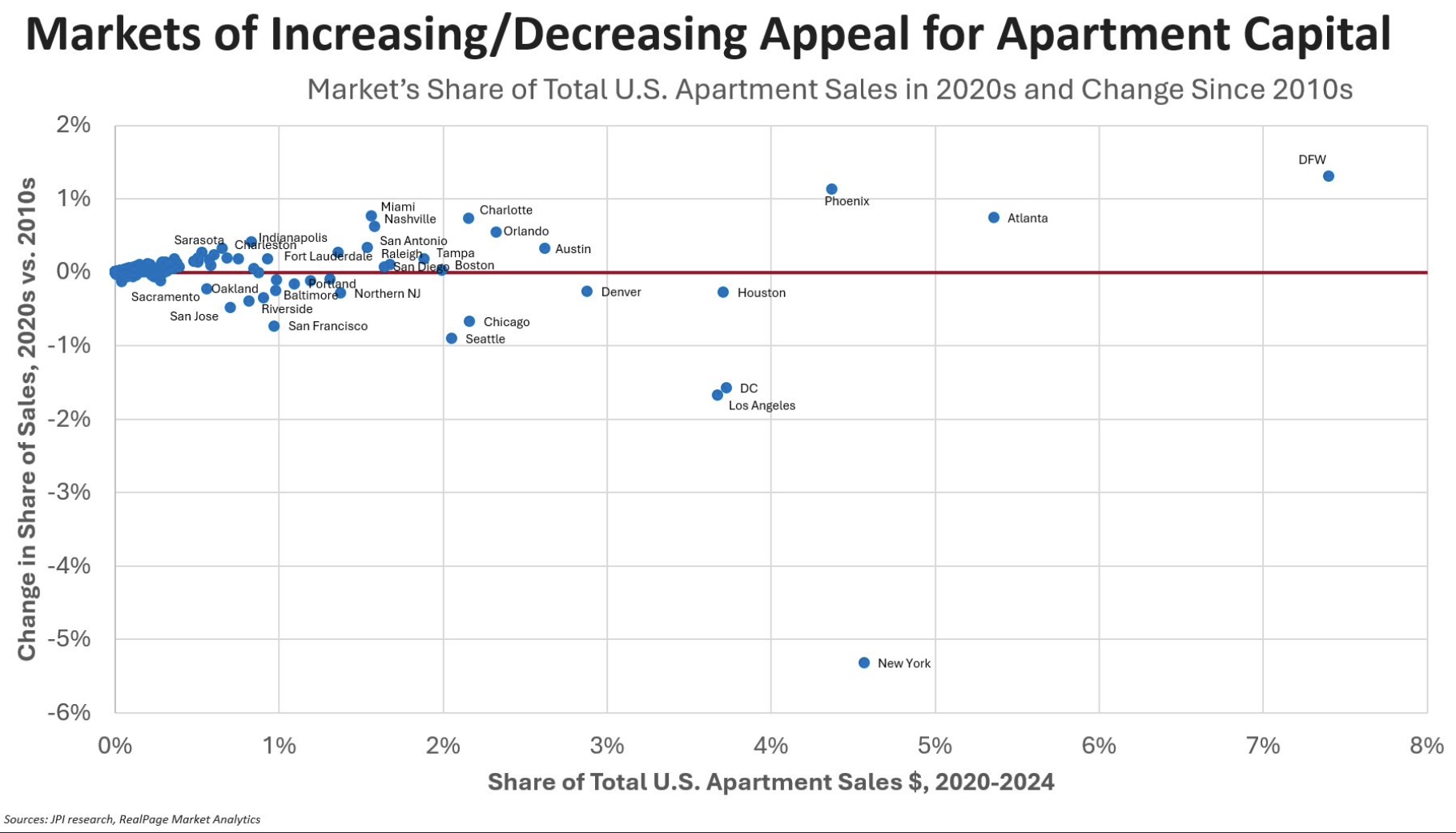

Parsons provided a chart on his LinkedIn page that looks at each market’s share of total U.S. apartment sales so far from 2020 to 2024 and then shows how much market share has changed versus the 2010s decade.

The results suggest that major gateway markets are losing market share, including Los Angeles and New York, the latter of which is still the number three market for sales.

Among metros losing sizable market share, DC is a surprise, said Parsons. Along with Seattle, San Francisco, Chicago and San Jose, DC was down at least 0.5 percentage points per thousands (ppts), despite its appeal to investors of all sizes. Other lesser surprise losses in sales volume were Northern New Jersey, Houston, Denver, Orange County and Long Island.

Houston and Denver were the biggest surprises given that their regional peers moved upward. Boston, whose market share held steady at two percent is the exception to the shrinking-share-in-gateway-markets rule, said Parsons.

Almost the entire Sunbelt was the big winner, with Dallas/Ft. Worth leading the pack with a gain of 1.3 ppts, representing 7.4 percent of all national apartment sales this decade. Phoenix, Miami, Atlanta, Charlotte, Nashville, Orlando and Indianapolis were close behind.

A number of apartment REITs are focusing investment strategies on the Sunbelt this year, drawn by easing rents and a steady influx of new residents looking for a lower cost of living, job opportunities, and a favorable climate. This influx to major Sunbelt metros outside of California is predicted to push vacancy rates down to or even below historical averages over the next five years, according Marcus & Millichap.

Meanwhile, NMHC predicts that some of today’s least vacant markets like Los Angeles, Orange, and San Diego will see out-migration intensified by the California wildfires, high property prices and cost of living, and declining job growth.

Parson’s chart shows Charleston is the top tertiary market for apartment sales over the last five years. Meanwhile, Indianapolis and Kansas City are both attracting institutional players.

While the industry may optimistic that a resurgence in deal flow is coming, Parsons said he got the feeling at NMHC that, “everyone wants to be a net buyer, but at prices that don’t exist and for assets that aren’t on the market, at least not at any scale.”

What will finally loose the deal flow spigot? Falling or stabilizing interest rates; motivated sellers; lenders pushing some exits; and/or rebounding rents and improving NOIs, said Parsons.