A new report from CBRE states that cap rates for core multifamily assets moved lower in Q1, continuing a trend that began in Q1 2024. Both buyer and seller sentiment improved, according to the report.

Feeling good

CBRE’s surveyed buyer and seller sentiment, asking if respondents felt positive, neutral or negative about buying or selling multifamily property. It found that sentiment for buyers of core multifamily property in Q1 2025 was very positive and was significantly more positive than it had been one quarter earlier. Fully 65 percent of buyers reported positive sentiment in Q1 against less than 5 percent who reported negative sentiment. Positive buyer sentiment rose 21 percentage points from the previous quarter.

Sentiment among sellers of core multifamily property also became more positive in the quarter, but not as dramatically. Whereas negative sentiment outweighed positive sentiment by about 16 percentage points in Q4, in Q1 positive sentiment outweighed negative sentiment by about 10 percentage points. However, in both quarters by far the majority of sellers reported neutral sentiment.

Cap rates are falling, but slowly

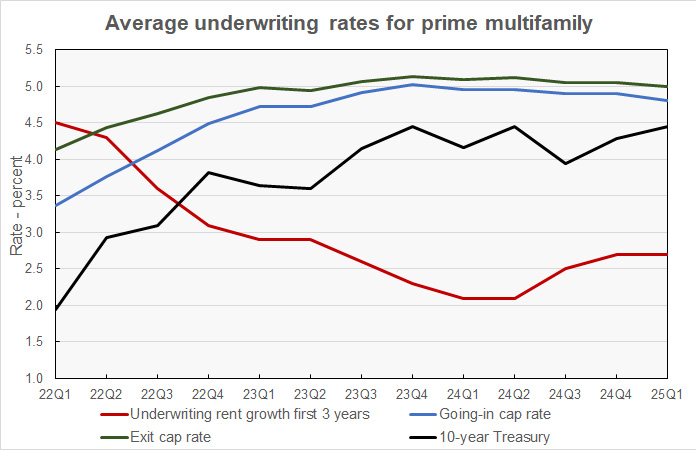

The chart, below, shows the recent history of the survey results for assumptions about the average annual rent growth expected for the first three years after a property is purchased, the going-in cap rate, the exit cap rate and the 10-year Treasury rate.

The chart shows that cap rates used in underwriting assumptions rose rapidly in 2022 as interest rates climbed. Cap rates peaked in Q4 2023 as the 10-year Treasury rate also reached its highest level. Since then, cap rates have been falling, if slowly, while Treasuries have shown no clear direction. The going-in cap rate in Q1 was 4.81 percent, down 4.2 percent from its peak. The average 10-year Treasury rate in Q1 was 4.45 percent, matching its 2023 high.

The average underwriting rent growth rate is up from its low of 2.1 percent, which it reached in Q1 2024. It has been 2.7 percent for the last two quarters. Achieving this rent growth rate would require a return to pre-pandemic rates of growth. According to Apartment List, year-over-year rent growth has been negative since May of 2023, so the market is still far from normal.

Markets vary

The submarket with the lowest cap rates was Boston, with a going-in range of 4.25 – 4.50 percent and an exit rate range of 4.50 – 4.75 percent for core multifamily properties. The submarket with the highest going-in rates was Chicago, with a going-in cap rate range of 5.50 to 5.75 percent and an exit rate range of 5.00 – 5.25 percent.

The average going-in cap rate for the 19 metros covered in the report was 4.83 percent, while the average exit cap rate was 5.01 percent for core multifamily property.

The full CBRE report also quotes rates for the value-add market segment. It can be found here.