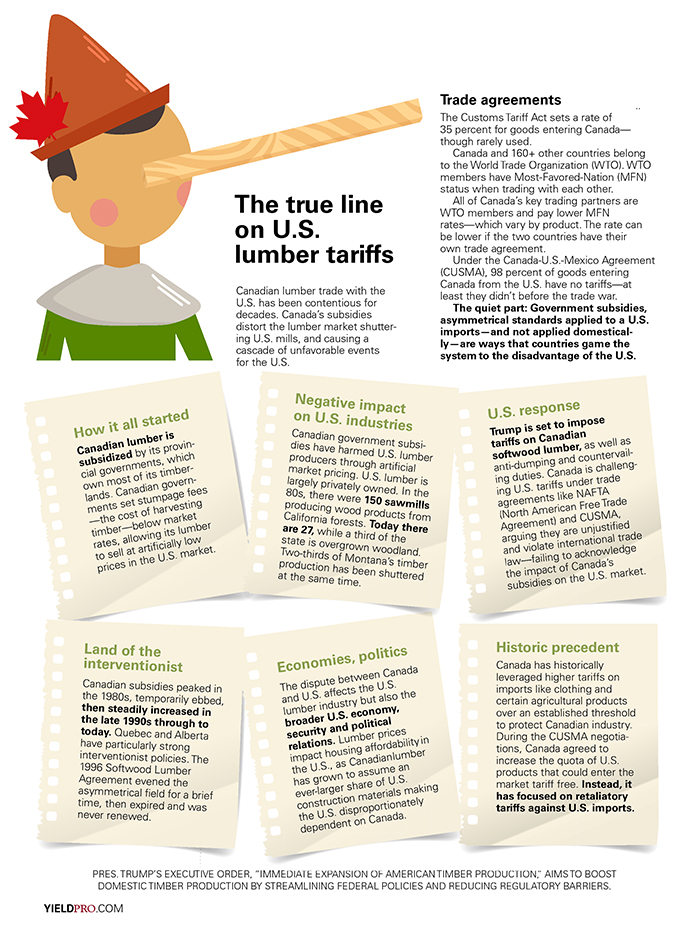

Canadian lumber trade with the U.S. has been contentious for decades. Canada’s subsidies distort the lumber market shuttering U.S. mills, and causing a cascade of unfavorable events for the U.S.

Trade agreements

The Customs Tariff Act sets a rate of 35 percent for goods entering Canada—though rarely used.

Canada and 160+ other countries belong to the World Trade Organization (WTO). WTO members have Most-Favored-Nation (MFN) status when trading with each other.

All of Canada’s key trading partners are WTO members and pay lower MFN rates—which vary by product. The rate can be lower if the two countries have their own trade agreement.

Under the Canada-U.S.-Mexico Agreement (CUSMA), 98 percent of goods entering Canada from the U.S. have no tariffs—at least they didn’t before the trade war.

The quiet part: Government subsidies, asymmetrical standards applied to a U.S. imports—and not applied domestically—are ways that countries game the system to the disadvantage of the U.S.

How it all started

Canadian lumber is subsidized by its provincial governments, which own most of its timberlands. Canadian governments set stumpage fees—the cost of harvesting timber—below market rates, allowing its lumber to sell at artificially low prices in the U.S. market.

Negative impact on U.S. industries

Canadian government subsidies have harmed U.S. lumber producers through artificial market pricing. U.S. lumber is largely privately owned. In the 80s, there were 150 sawmills producing wood products from California forests. Today there are 27, while a third of the state is overgrown woodland. Two-thirds of Montana’s timber production has been shuttered at the same time.

U.S. response

Trump is set to impose tariffs on Canadian softwood lumber, as well as anti-dumping and countervailing duties. Canada is challenging U.S. tariffs under trade agreements like NAFTA (North American Free Trade Agreement) and CUSMA, arguing they are unjustified and violate international trade law—failing to acknowledge the impact of Canada’s subsidies on the U.S. market.

Land of the interventionist

Canadian subsidies peaked in the 1980s, temporarily ebbed, then steadily increased in the late 1990s through to today. Quebec and Alberta have particularly strong interventionist policies. The 1996 Softwood Lumber Agreement evened the asymmetrical field for a brief time, then expired and was never renewed.

Economies, politics

The dispute between Canada and U.S. affects the U.S. lumber industry but also the broader U.S. economy, security and political relations. Lumber prices impact housing affordability in the U.S., as Canadian lumber has grown to assume an ever-larger share of U.S. construction materials making the U.S. disproportionately dependent on Canada.

Historic precedent

Canada has historically leveraged higher tariffs on imports like clothing and certain agricultural products over an established threshold to protect Canadian industry. During the CUSMA negotiations, Canada agreed to increase the quota of U.S. products that could enter the market tariff free. Instead, it has focused on retaliatory tariffs against U.S. imports.

President Trump’s Executive Order, “Immediate Expansion of American Timber Production,” aims to boost domestic timber production by streamlining federal policies and reducing regulatory barriers.

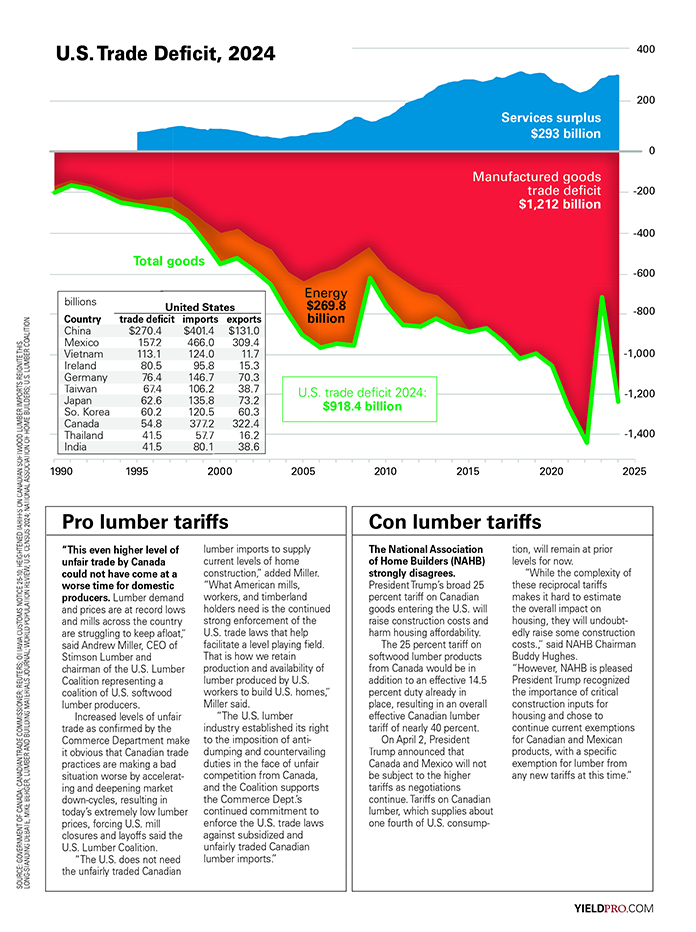

U.S. Trade Deficit, 2024

Services surplus $293 billion

Manufactured goods trade deficit $1,212 billion

Energy $269.8 billion

U.S. trade deficit 2024: $918.4 billion

in billions United States

Country trade deficit imports exports

China $270.4 $401.4 $131.0

Mexico 157.2 466.0 309.4

Vietnam 113.1 124.0 11.7

Ireland 80.5 95.8 15.3

Germany 76.4 146.7 70.3

Taiwan 67.4 106.2 38.7

Japan 62.6 135.8 73.2

So. Korea 60.2 120.5 60.3

Canada 54.8 377.2 322.4

Thailand 41.5 57.7 16.2

India 41.5 80.1 38.6

Pro lumber tariffs

“This even higher level of unfair trade by Canada could not have come at a worse time for domestic producers. Lumber demand and prices are at record lows and mills across the country are struggling to keep afloat,” said Andrew Miller, CEO of Stimson Lumber and chairman of the U.S. Lumber Coalition representing a coalition of U.S. softwood lumber producers.

Increased levels of unfair trade as confirmed by the Commerce Department make it obvious that Canadian trade practices are making a bad situation worse by accelerating and deepening market down-cycles, resulting in today’s extremely low lumber prices, forcing U.S. mill closures and layoffs said the U.S. Lumber Coalition.

“The U.S. does not need the unfairly traded Canadian lumber imports to supply current levels of home construction,” added Miller. “What American mills, workers, and timberland holders need is the continued strong enforcement of the U.S. trade laws that help facilitate a level playing field. That is how we retain production and availability of lumber produced by U.S. workers to build U.S. homes,” Miller said.

“The U.S. lumber industry established its right to the imposition of anti-dumping and countervailing duties in the face of unfair competition from Canada, and the Coalition supports the Commerce Dept.’s continued commitment to enforce the U.S. trade laws against subsidized and unfairly traded Canadian lumber imports.”

Con lumber tariffs

The National Association of Home Builders (NAHB) strongly disagrees. President Trump’s broad 25 percent tariff on Canadian goods entering the U.S. will raise construction costs and harm housing affordability.

The 25 percent tariff on softwood lumber products from Canada would be in addition to an effective 14.5 percent duty already in place, resulting in an overall effective Canadian lumber tariff of nearly 40 percent.

On April 2, President Trump announced that Canada and Mexico will not be subject to the higher tariffs as negotiations continue. Tariffs on Canadian lumber, which supplies about one fourth of U.S. consumption, will remain at prior levels for now.

“While the complexity of these reciprocal tariffs makes it hard to estimate the overall impact on housing, they will undoubtedly raise some construction costs.,” said NAHB Chairman Buddy Hughes.

“However, NAHB is pleased President Trump recognized the importance of critical construction inputs for housing and chose to continue current exemptions for Canadian and Mexican products, with a specific exemption for lumber from any new tariffs at this time.”

Source: Government of Canada; Canadian Trade Commissioner; Reuters; Ottawa Customs Notice 25-10; Heightened tariffs on Canadian softwood lumber imports reignite this long-standing debate, Mike Berger, Lumber and Building Materials Journal; World Population Review; U.S. Census 2024; National Association of Home Builders; U.S. Lumber Coalition