The National Association of Home Builders (NAHB) quarterly survey of multifamily builders showed a slight decline in confidence in the market for new multifamily housing. The survey provides 3 measures of sentiment, the Multifamily Production Index (MPI), the Multifamily Occupancy Index (MOI) and a survey on whether conditions are perceived to be getting better or worse. The first two measures declined slightly while the third improved.

Setting the scale

The MPI and MOI measure builder and developer sentiment about current production conditions and occupancy respectively in the apartment and condo market. The indexes are reported on a scale of 0 to 100, so that a number below 50 indicates that more respondents report conditions are poor than report conditions are good.

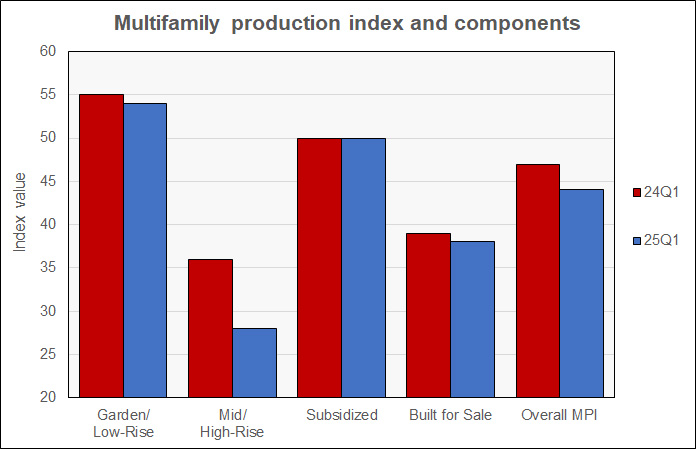

The MPI looks at four market segments, garden/low-rise, mid/high-rise and subsidized rental properties and built-for-sale multifamily (or condominium) properties. The overall MPI declined 3 points year-over year to a reading of 44. The component measuring garden/low-rise dropped 1 point to 54, the component measuring mid/high-rise units fell 8 points to 28, the component measuring subsidized units was unchanged at 50 and the component measuring built-for-sale dropped 1-point to 38. The MPI results are summarized in the following chart:

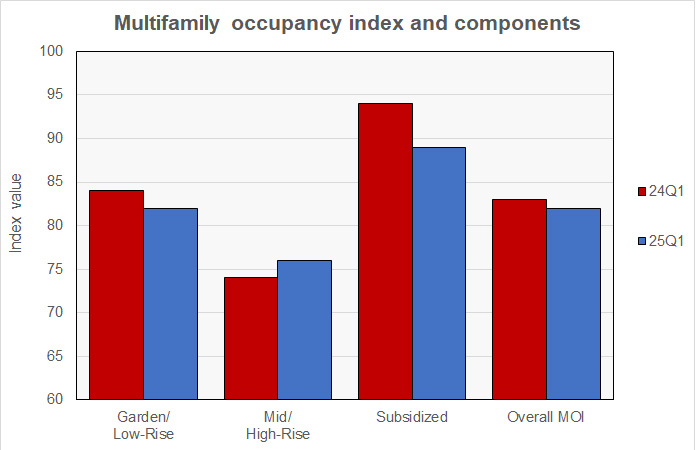

The MOI looks at the same 3 built-for-rent market segments as the MPI, but it does not survey the condominium market. The overall MOI declined 1 point year-over-year to a reading of 82, still a very positive reading. The three component indexes remained in positive territory (above 50) despite 2 of them experiencing declines. The component measuring garden/low-rise units fell 2 points to 82, the component measuring mid/high-rise units rose 2 points to 76 and the component measuring subsidized units fell 5 points to 89. The MOI results are summarized in the following chart:

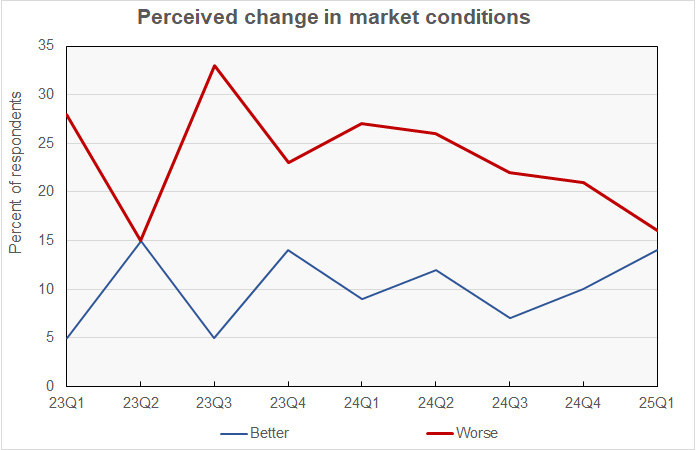

The results were more positive for the survey on whether respondents thought that conditions were improving or getting worse. The portion of respondents who perceived conditions as improving rose 5 points year-over-year to 15 percent. The portion of respondents who perceived conditions as getting worse fell 11 points year-over-year to 16 percent. The history of the responses to this question are shown in the last chart, below. It shows that the differential between those who believe things are getting better and those who believe that conditions are getting worse is the most favorable it has been since Q2 2023.

Reflecting on the survey results, NAHB Chief Economist Robert Dietz said, “The MPI of 44 is consistent with NAHB’s forecast for a modest decline in the rate of multifamily production for the remainder of 2025, followed by a modest recovery in 2026. Like remodelers and single-family builders, multifamily developers are being affected by rising costs and economic policy uncertainty. In NAHB’s first quarter multifamily survey, more than half of the developers reported that their suppliers have increased prices due to announced, enacted or anticipated tariffs.”

The NAHB survey is available here.