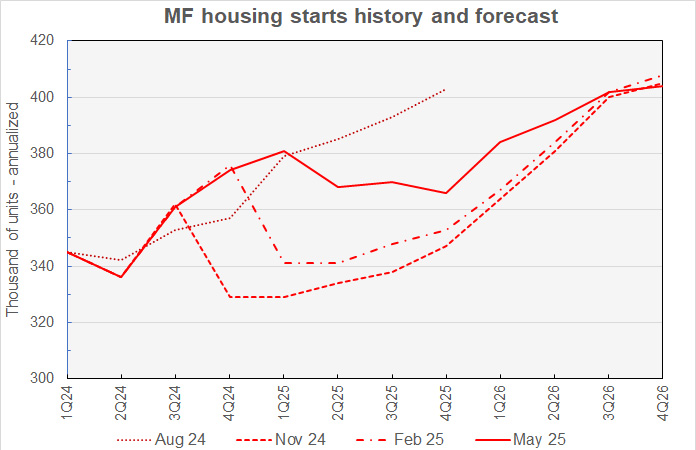

Revisions to Fannie Mae’s housing forecast in May call for more multifamily starts across the entire forecast horizon than in last month’s forecast. Fannie Mae is now predicting 371,000 starts in 2025 with 396,000 starts in 2026.

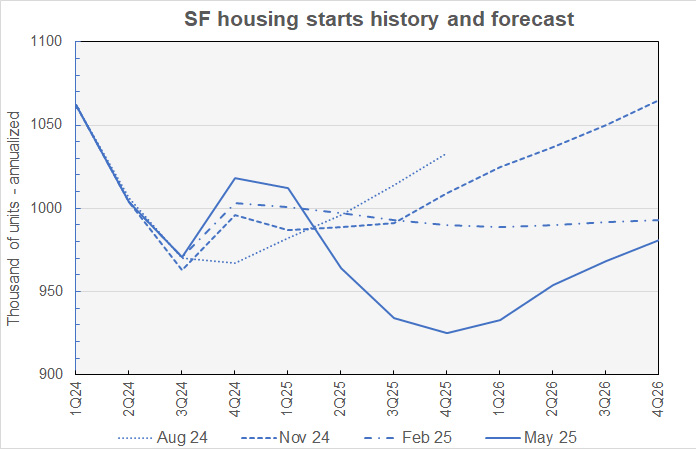

By contrast, the forecast for single-family housing starts was revised slightly lower for every quarter of 2025 but raised slightly for the last 3 quarters of 2026.

Interest rates nearly unchanged from last forecast

Fannie Mae’s forecasters kept their prediction for the course of the Fed Funds rate unchanged from that in last month’s forecast. They still predict the Fed Funds rate to fall from its current level of 4.3 percent to an average of 3.9 percent in Q4 2025 and to an average of 3.1 percent in Q4 2026.

This month’s forecast for the 10-year Treasury rate had only one small revision. The forecasters lowered their predicted interest rate in Q4 2025 by 0.1 percentage point to 4.2 percent. They still expect the rate to average 4.3 percent in both 2025 and 2026.

Multifamily starts forecast higher

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

The August 2024 forecast had the most positive outlook for multifamily starts in 2025 of any of Fannie Mae’s forecasts. Fannie’s forecasters’ predictions for starts in 2025 then dropped until they reached their low point in their January forecast. Recently, the forecasters’ predictions for multifamily starts in 2025 have been increasing.

Revisions to Fannie Mae’s multifamily housing starts forecasts were all to the upside again this month but with larger upgrades to the quarterly forecasts for 2025 than for 2026.

The Q1 2025 forecast was revised higher again this month. It has been raised by a total of 61,000 annualized units since the January forecast. The largest revision made this month was for 20,000 additional annualized units in Q3 2026. This revision pushed the low point in multifamily starts from Q3 to Q4 2025 and raised the lowest starts by quarter from 350,000 annualized units to 366,000 units.

For reference, the most recent new residential construction report from the Census Bureau has multifamily starts running at a seasonally-adjusted annualized rate of 381,000 units in Q1 2025. Multifamily starts ran at an annualized rate of 434,000 units in the first month of Q2, based on preliminary estimates.

Looking at yearly forecasts, the predicted number of multifamily starts for 2025 was revised higher by 12,000 units to 371,000 units. The forecast for multifamily starts in 2026 was revised higher by 6,000 units to 396,000 units.

Single-family starts forecast slightly lower

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

The single-family starts quarterly forecasts for 2025 were revised higher by between 3,000 and 7,000 annualized units. The forecasts for single-family starts in the last 3 quarters of 2026 were revised lower by 3,000 or 4,000 annualized units each. These revisions are an order of magnitude smaller than those made last month.

The low point for single-family starts going forward is again predicted to be Q4 2025, but at 925,000 annualized units. Starts are forecast to rise from that point. Single-family starts are predicted to reach an annualized rate of 981,000 units in Q4 2026, up 4,000 units from the level predicted last month.

Looking at full-year predictions, Fannie Mae now expects 5,000 fewer single-family starts in 2025 than forecast last month at 959,000 units. Fannie Mae now expects 3,000 more single-family starts in 2026 than forecast last month at 959,000 units.

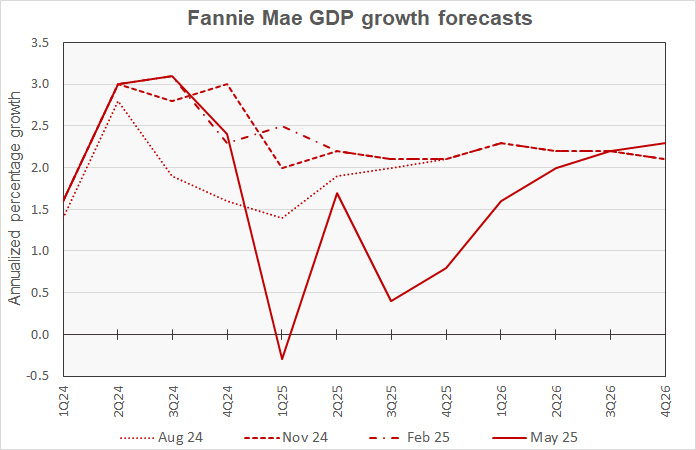

GDP growth for Q2 2025 revised sharply higher

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

Oddly, the largest revisions made to the quarterly GDP growth forecasts were made to the closest quarters. The forecast for Q1 2025 was revised lower by 0.6 percentage points to match the advance estimate of -0.3 percent growth from the Bureau of Economic Analysis. The forecast for Q2 was revised 0.9 percentage points higher to +1.7 percent. The Q3 2025 forecast was revised higher by 0.5 percentage points but no other quarter’s forecast was revised by more than 0.3 percentage points.

Fannie Mae’s forecasters now expect year-over-year GDP growth to be 0.7 percent in 2025, up 0.2 percentage points from the rate predicted last month. They expect 2.0 percent growth in 2026, up 0.1 percentage points from their last prediction.

For reference, the May 16 release of the GDP Now estimate from the Atlanta Fed indicates that Q2 2025 GDP growth is currently running at 2.4 percent. However, we are only halfway through the quarter and incoming data may change this estimate.

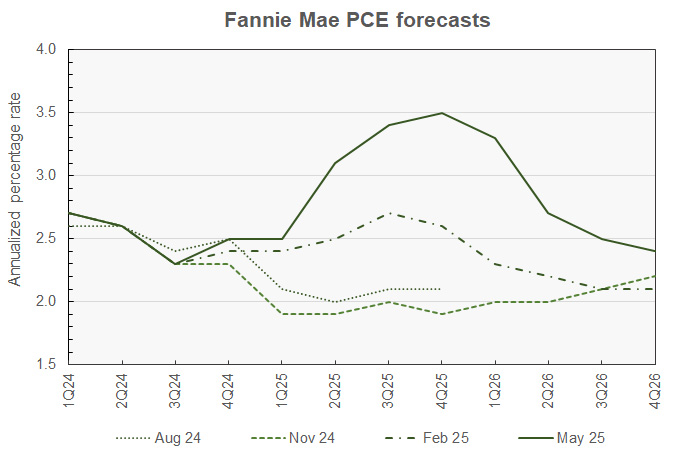

PCE Inflation forecast changes mixed

The next chart, below, shows Fannie Mae’s current forecast for the chained personal consumption expenditures (PCE) inflation rate, along with three other recent forecasts.

Fannie Mae’s forecasters have been raising their inflation forecasts for 2025 higher ever since their November 2024 forecast. They did so again this month, increasing their estimated rate of inflation by 0.1 percentage point in each quarter of the year. However, they also revised their predicted rate of inflation lower by 0.1 to 0.2 percentage points in each quarter of 2026.

Fannie Mae now expects year-over-year PCE inflation of 3.5 percent in 2025, falling to 2.4 percent in 2026.

Employment growth forecast higher

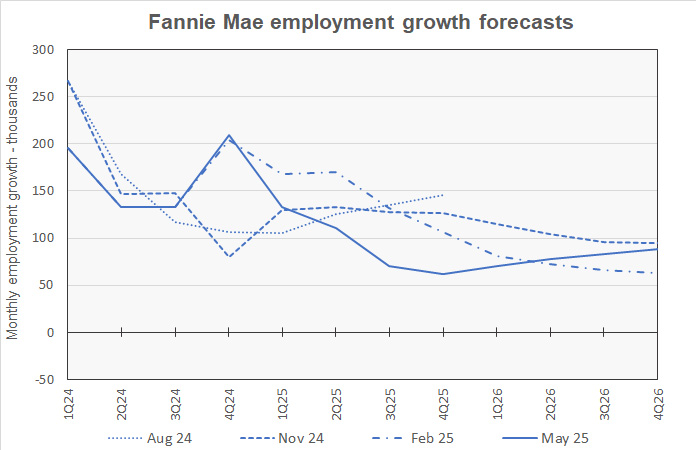

The next chart, below, shows Fannie Mae’s current forecast for employment growth, along with three earlier forecasts. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth. By contrast, the unemployment rate depends on employment but also on the labor force participation rate. Either rising employment or falling labor force participation can drive the unemployment rate lower, but only the former would contribute to economic growth.

Note that the population estimates upon which the employment data is quoted was updated in January, so the figures from earlier forecasts may not be directly comparable to those from current forecasts.

The forecasters revised their estimates for employment growth in Q1 2025 lower by 19,000 jobs per month to 133,000 jobs per month. This matches the figure derived from the business survey in the May Employment Situation Report from the Bureau of Labor Statistics.

The forecasters revised their predictions for employment growth higher through the rest of the forecast horizon. Revisions ranged from an additional 74,000 employees per month in Q4 2025 to an additional 3,000 employees per month in Q3 2026. While the predicted rates of employment growth are significantly lower than those we have seen recently, they are now predicting no quarters with net job losses over the next 2 years, an improvement from last month’s forecast.

Employment growth in 2025 is now expected to be 1,100,000 jobs, up by 300,000 jobs. The employment growth forecast for 2026 calls for the economy to add 1,000,000 jobs, up by 400,000 jobs from last month’s estimate.

The Fannie Mae May forecast can be found here. There are links on that page to the detailed forecasts and to the monthly summary.