Redfin’s rent report for April says that the national median asking apartment rent rose 0.9 percent for the month to reach a level of $1,625. However, the median rent growth was -1.0 percent year-over-year.

Varying results

Unlike rent reports from Apartment List and Yardi Matrix which report their measures of apartment rent month-by-month, Redfin reports rents on a trailing 3-month average basis. This method of reporting will tend to smooth out the noise in the data, but it may be less quick to show sudden variations in the underlying data trends.

Redfin’s report focuses on the 50 largest metros in the country. However, Redfin only had sufficient rent data on 44 of these metros in order to confidently quote rent growth results.

A summary of the April results from these three sources is contained in the following table:

| Source | Median rent | MoM rent growth |

YoY rent growth |

| Redfin | $1,625 | +0.9% | -1.0% |

| Yardi Matrix | $1,736 | -0.1% | +0.9% |

| Apartment List | $1,392 | +0.5% | -0.3% |

As mentioned, Redfin focuses on the 50 largest metro areas defined by the Census Bureau. Yardi Matrix tracks results from 136 metro areas, but they may divide large Census Bureau metro areas into two. Apartment List has reports on 202 metro areas and attempts to model rents from the entire universe of rental properties, not just those that are professionally managed. The differences in the market segments covered and how the data is processed may explain the differences in results.

Looking long term

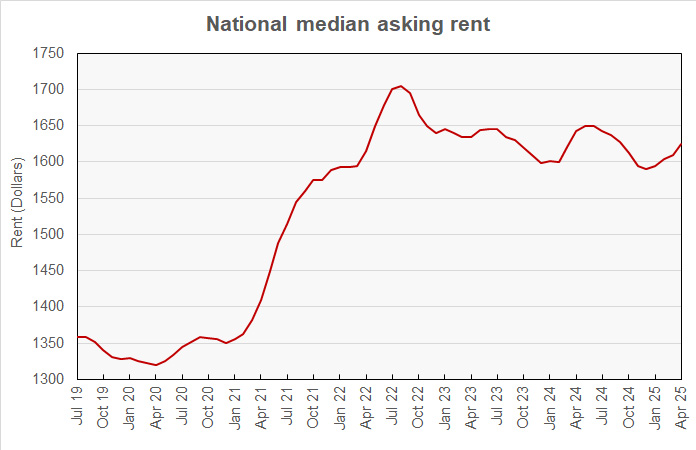

The history of the national median apartment rent as measured by Redfin is shown in the chart, below. It shows that rents have been trending upward since January but that the pace of their rise is trailing that of last year. In 2024, cumulative rent growth from January to April was 2.62 percent while it is only 1.88 percent this year.

Leaders and trailers

The first table shows the 10 metros with the highest rate of year-over-year rent growth. Cities in the Midwest and Northeast continue to lead in rent growth.

| Metro | Median asking rent | MoM percent change | YoY percent change |

| Cincinnati | $1,450 | 0.6 | 8.7 |

| Pittsburgh | $1,499 | 1.6 | 7.5 |

| Baltimore | $1,615 | 0.5 | 5.9 |

| Birmingham | $1,418 | 2.2 | 5.8 |

| Washington DC | $2,090 | 1.6 | 5.2 |

| Chicago | $1,772 | 1.1 | 3.3 |

| Tampa | $1,803 | 0.7 | 2.6 |

| Boston | $2,834 | 1.9 | 2.3 |

| Buffalo | $1,310 | 0.4 | 2.3 |

| Providence | $2,185 | 0.7 | 2.2 |

The second table shows the metros with the lowest rate of year-over-year rent growth. Austin, continues to lead the list. While sunbelt cities with high deliveries are well represented on this list, there are also some northern cities.

| Metro | Median asking rent | MoM percent change | YoY percent change |

| Austin | $1,399 | (1.5) | (9.6) |

| Minneapolis | $1,530 | 0.1 | (7.3) |

| Portland | $1,795 | 1.8 | (5.3) |

| Raleigh | $1,450 | 1.5 | (5.2) |

| San Diego | $2,719 | 1.6 | (5.2) |

| Jacksonville | $1,490 | 1.0 | (3.6) |

| Salt Lake City | $1,552 | 2.2 | (3.5) |

| New York | $2,845 | 0.2 | (3.4) |

| Phoenix | $1,483 | 0.6 | (3.3) |

| Orlando | $1,745 | 0.3 | (3.2) |

The full report from Redfin also discusses rent growth history by number of bedrooms in the apartment and by the square footage of the apartment. It is available here.