Something’s shifting in the rental market and it’s good news for operators. Despite more apartments coming online, surging rent renewals are keeping the rental market very competitive.

In May 2025, apartment lease renewals showed unexpected resilience, pointing to a shift in renter behavior shaped by economic concerns, affordability pressures, and a cooling rent-growth environment. Despite record-high vacancy rates and slowing rent hikes, renters are choosing to stay put — and that decision is reshaping the dynamics of the multihousing market.

Historically, about half of renters in large urban markets move out when their leases expire. But that churn has slowed significantly. Some of the nation’s largest landlords now report turnover rates of just 30 percent. In other words, 70 percent of tenants are staying put — a major shift that reflects a confluence of forces making relocation less appealing and lease renewals more attractive.

One of the strongest indicators of this trend is the data. RealPage Analytics reported a lease renewal rate of 52.3 percent in May 2025, while RentCafe’s figures show renewal rates at 63.1 percent at the beginning of the year, up from 61.5 percent a year earlier. These numbers suggest a steady rise in lease renewals, even as rent growth itself is tapering off. Renewal rent growth has decelerated for 10 straight months, landing at 6.5 percent in May — still an increase, but far from the rapid hikes of recent years.

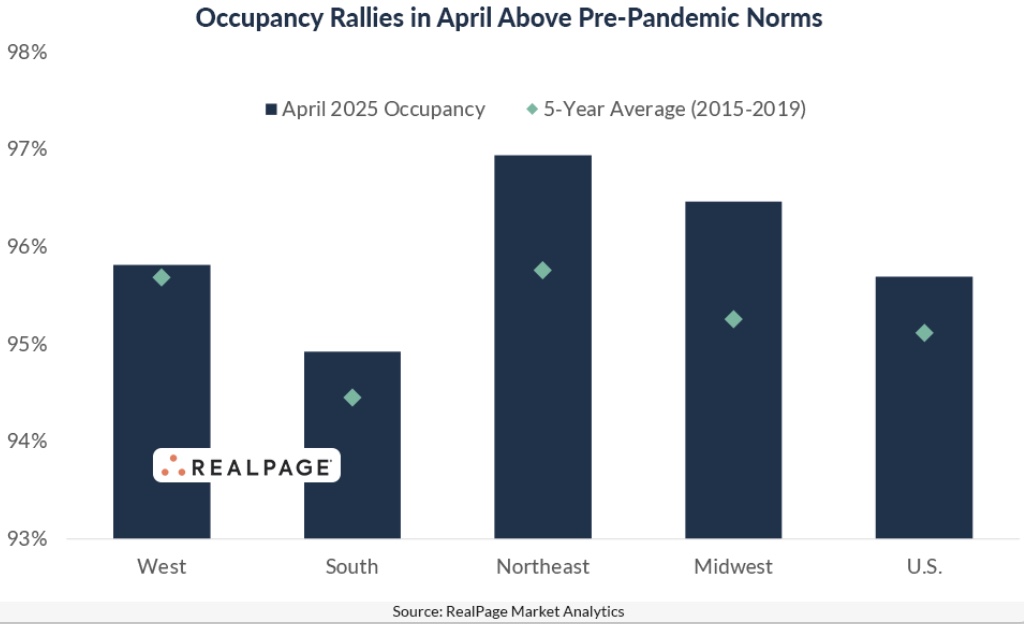

In a strong start to the prime leasing season, U.S. apartment occupancy surged in April. Occupancy rose 40 basis points month-over-month to reach 95.7 percent, marking the strongest April boost since 2010, according to RealPage Market Analytics. This uptick suggests that operators are working aggressively to fill vacant units amid heightened competition and shifting economic signals. Although some major markets remain below historical occupancy norms, the national figure now sits above long-term averages, signaling solid demand as peak leasing season begins.

So why are renters staying? A few key reasons stand out. First is the high cost of moving. Between rising moving expenses and the logistical stress, many renters are opting for stability. More significantly, the for-sale housing market remains largely out of reach. Home prices, borrowing costs, and a persistent premium to own versus rent, especially in fast-growing Sun Belt cities, are keeping renters in place.

The constant drumbeat of economic uncertainty in media reports may also be influencing renter behavior. A recent CNBC report noted that fear about the economy is making renters hesitant to make big changes. This sentiment was echoed by Keith Oden, Camden’s Executive Vice Chairman, who observed that some residents may be choosing to renew in the hope that clarity will come “somewhere down the road.”

Camden, a major Sun Belt REIT, posted a 3.3 percent increase in renewal rates and near-record-low resident turnover. Move-outs for home purchases were only 10.4 percent, a remarkably low figure that underscores how few renters are transitioning into ownership.

REITs across the board are experiencing similar patterns. Their May 2025 earnings calls highlighted how renewal strength is being driven by demand stability, limited new supply, and rental affordability. In Camden’s markets, rent increases have been more than offset by wage growth, which has outpaced rent growth by over 300 basis points for 28 consecutive months. As Camden CEO Ric Campo noted, “The premium to own versus rent continues to be at historically high levels, making apartment homes more affordable.”

Despite a national year-over-year rent decline of 0.3 percent and elevated vacancy rates of 7 percent as of the end of April, lease renewal strength suggests that renters are valuing familiarity, financial caution, and relative affordability over the risks and costs of moving.

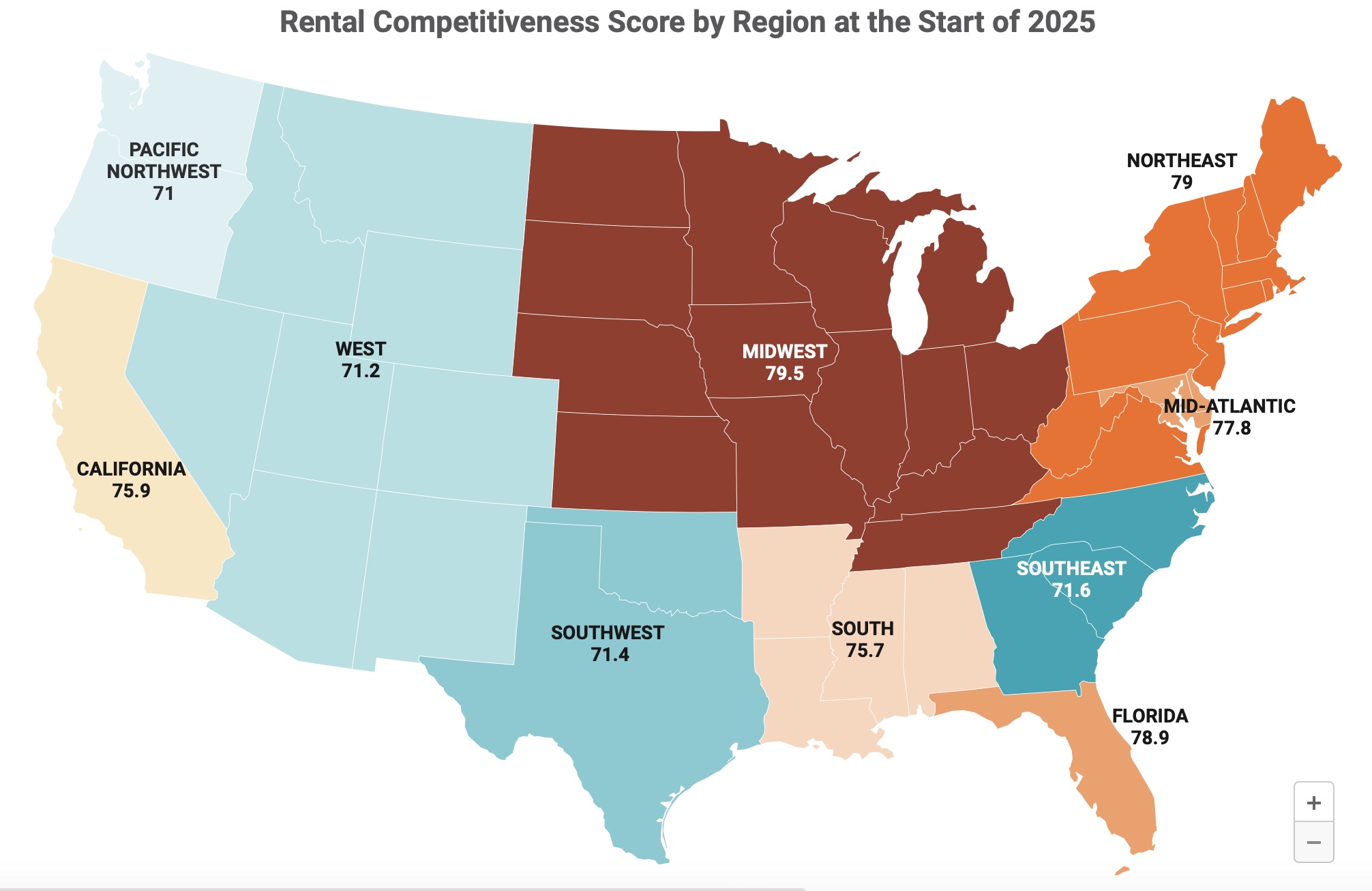

New in 2025, data from RentCafe shows that renters with longer initial lease terms are more likely to renew for extended periods. In tight markets like the Northeast, where options are limited, renters stay over three years on average, pushing occupancy to nearly 95 percent and renewal rates to 70 percent. In contrast, in more flexible markets like the South, average stays are closer to two years, with about 66 percent of renters renewing.

As the economy continues to evolve through the year, this renter stickiness could be a key stabilizing force in an otherwise unsettled housing market.