President Donald Trump is demonstrating his commitment to decentralizing housing aid. On May 2, 2025, he released his Fiscal Year 2026 “skinny budget,” outlining the administration’s broad spending goals. While presidential budget proposals are non-binding and primarily symbolic—especially in a first year—they signal intent and serve as a starting point for congressional negotiations. This year, passing any budget will require bipartisan support in a divided Senate.

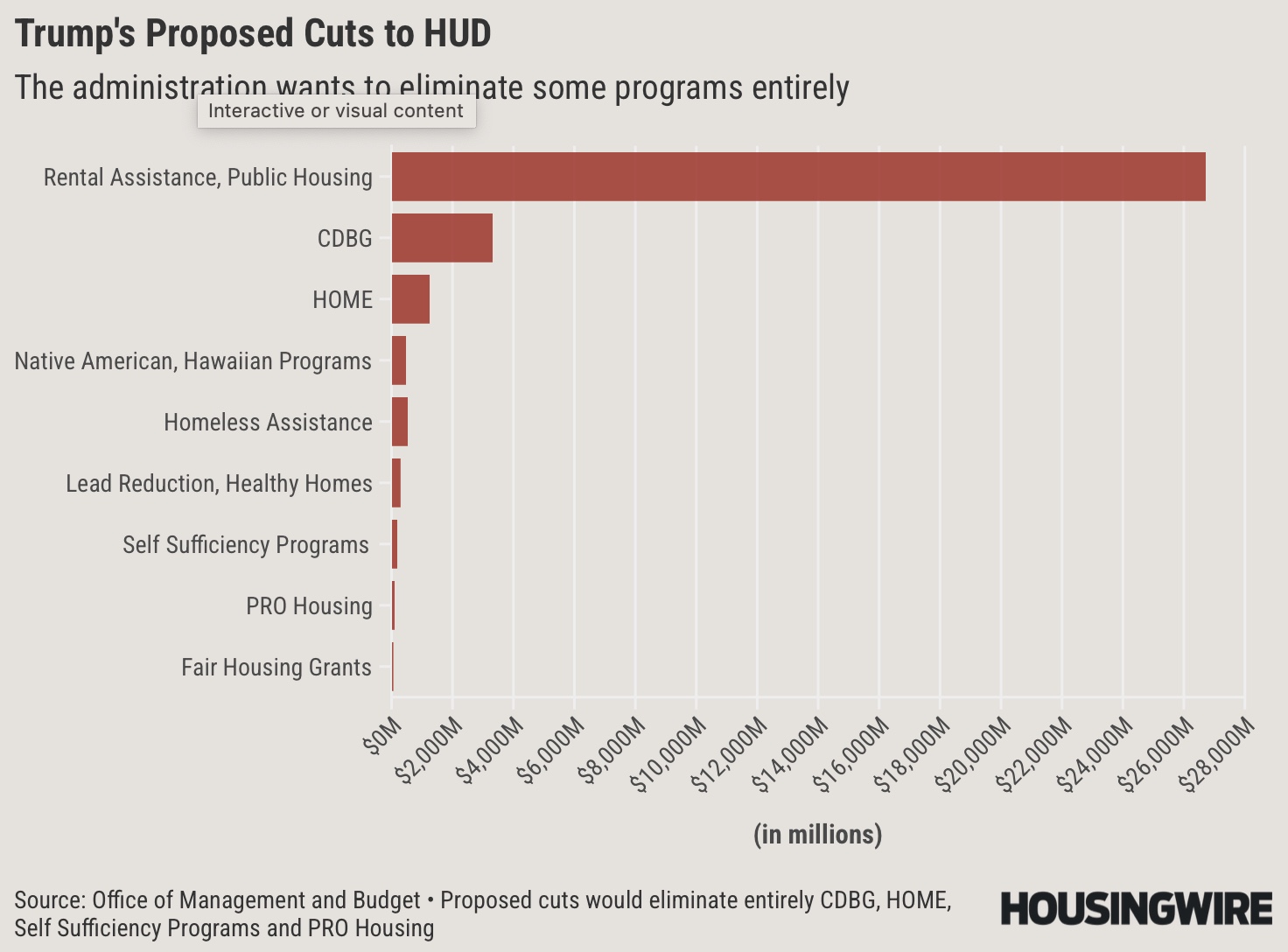

The budget proposes sweeping changes to federal housing aid policy, particularly through deep cuts to the Department of Housing and Urban Development (HUD), which would face a $33 billion (43 percent) reduction from FY 2025 levels. These cuts are part of a larger $1.7 trillion in FY 2026 spending, which includes a 23 percent decrease in non-defense discretionary funding—amounting to $163 billion in reductions. Key rental assistance programs, such as Section 8 Housing Choice Vouchers and Project-Based Rental Assistance, would see a $26.7 billion cut.

The budget also proposes a two-year cap on rental aid for able-bodied adults and seeks to decentralize housing assistance by converting federal programs into state-run block grants. Programs like the Community Development Block Grant (CDBG), the HOME Investment Partnerships Program, and the Pathways to Removing Obstacles Housing (PRO Housing) would be eliminated, despite their alignment with initiatives like the YIMBY movement, which promotes increased housing supply.

Other cuts include $532 million from homeless assistance, $296 million from lead hazard mitigation and healthy homes, and $196 million from self-sufficiency programs. However, the U.S. Department of Agriculture’s Rental Assistance program would receive a $74 million increase. Overall, non-defense agencies face funding reductions of at least 15 percent, with exceptions for Health and Human Services, Transportation, Veterans Affairs, and the Social Security Administration. Below is a list from Housing Wire of programs that could be on the chopping block.

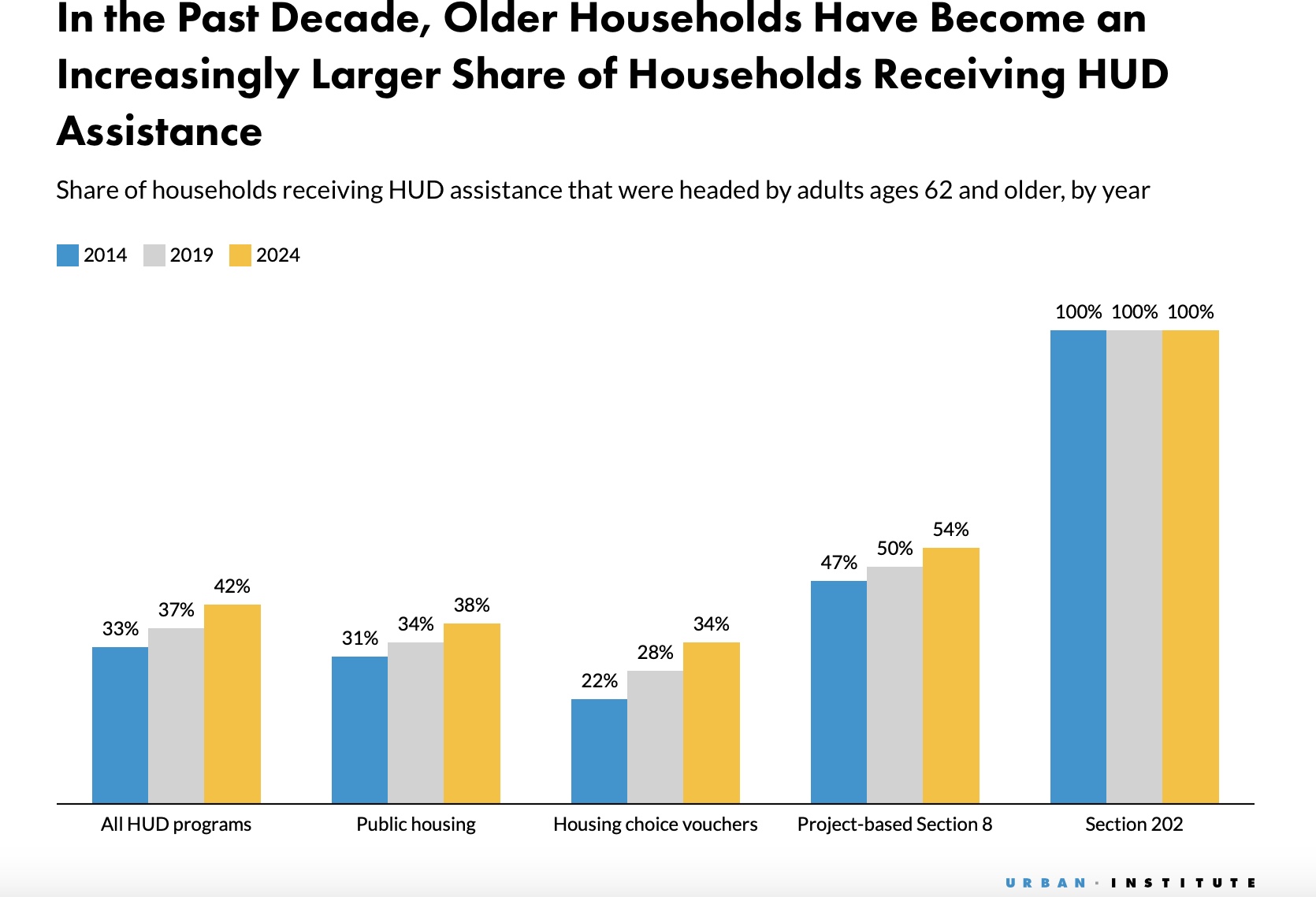

Multifamily real estate investors—especially those involved in affordable housing—are paying close attention. According to the Urban Institute, cuts to federal rental assistance programs have historically led to increased tenant nonpayment, landlord instability, and rising vacancy rates in subsidized housing markets. Though the Urban Institute says it’s not yet clear how the cuts will affect specific housing assistance programs, they will likely make it more difficult to administer housing programs effectively, especially for the elderly.

In cities like New York, where 633,000 people recently applied for just 200,000 Section 8 waitlist spots, the gap between demand and supply remains vast. Nationwide, only 25 percent of eligible households currently receive vouchers.

The proposed decentralization also raises concerns about inconsistency and added complexity. HUD currently provides national standards, but state-run systems may differ widely in rules, application processes, and inspection requirements. Since block grants are capped and don’t adjust for demand or inflation, assistance could run out even as needs increase, especially in high-cost areas, according to the Center on Budget and Policy Priorities.

Still, the new structure could present opportunities. States with well-run housing programs and incentives could attract investor interest. For example, Virginia’s governor is already preparing for changes, while cities like New York and San Francisco are pledging major investments or filing lawsuits in response to the proposed federal cuts. New York’s “City of Yes” initiative promises $1 billion for housing expansion.

Despite the administration’s vision to replace what it calls “dysfunctional rental assistance programs” with state-driven solutions, similar proposals in Trump’s first term failed to pass. Many of the programs he sought to cut received increases instead. David Dworkin, CEO of the National Housing Conference, called the latest proposal “dead on arrival” and warned it could lead to a homelessness crisis and financial collapse for landlords dependent on subsidies.

The National Apartment Association (NAA), while monitoring the budget process, continues to support the Section 8 program and urges Congress to pursue reforms rather than cuts. It backs the bipartisan Choice in Affordable Housing Act, which seeks to streamline Section 8, reduce bureaucracy, and improve outcomes for renters and landlords alike.

In summary, while the FY 2026 budget proposal is unlikely to pass unchanged, it reflects a broader push to reduce federal involvement in housing aid and rely more heavily on states and the private sector. For investors, tenants, and advocates, staying informed and proactive will be critical as the housing landscape continues to shift, notes NAA.